Banks and financials should lead dividend growth in the UK this year while miners hinder progress, according to a new report from AJ Bell.

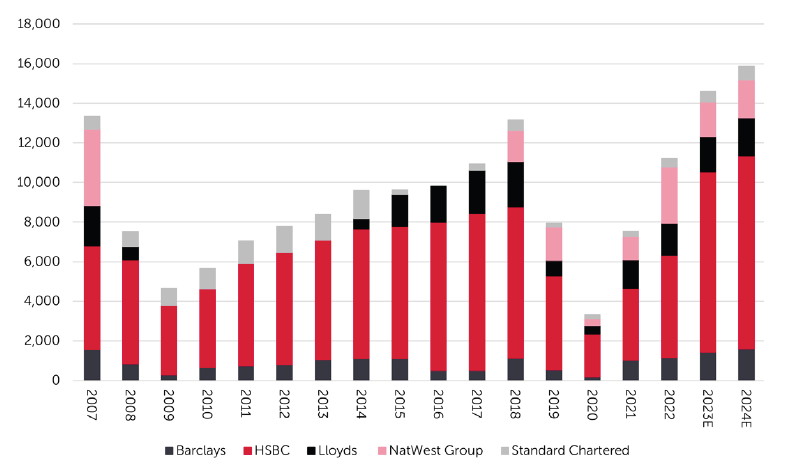

It said that the £14.6bn of dividends forecasted to be paid by banks this year greatly exceeds the £13.3bn peak seen before the global financial crisis in 2008.

Three banks are among the 10 FTSE 100 companies likely to increase their payouts by the most in 2023, with HSBC leading the charge.

It should increase its dividend by a considerable £3.9bn, while Shell, in second place, is only likely to raise its payout by £751m.

HSBC should be joined in the top 10 by Natwest and Barclays, which are expected to raise dividends by £415m and £277m respectively in 2023.

Dividend payouts from UK banks since 2007

Source: AJ Bell

Mining groups Fresnillo, Antofagasta, Rio Tinto and Anglo American, on the other hand, are expected to slash their dividends the most, with an expected decline of £609m.

However, analysts at AJ Bell said that these cuts will be offset by the increases from UK banks.

“Such a largesse helps to compensate for the second straight expected drop in miners’ aggregate dividends, which presumably reflects fears that a recession will dent demand for industrial metals,” the report read.

Analysts at the investment platform said that mining groups led a spike in dividend growth in the first half of 2022 as commodity prices surged, but their lower-than-expected payouts in the second half of the year were a “disappointment”.

In this latest report, the analysts lowered their final dividend estimates for 2022 from £81.2bn to £76bn, with mining companies looking poised to disappoint.

Given these deratings, it noted that “analysts do not seem entirely confident in their forecasts” for 2023 in case companies fall short again.

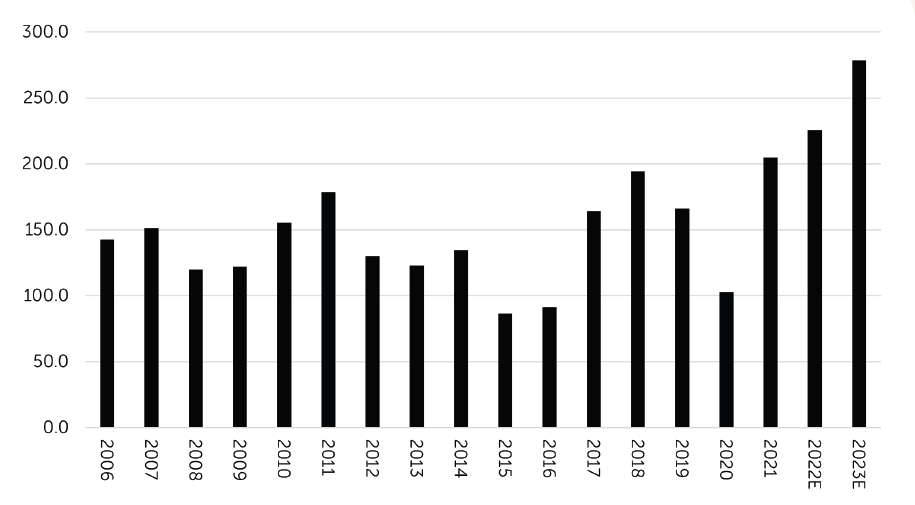

They currently predict an 11% leap in dividends for 2023 to £84.4bn, with a further 7% increase the following year, but that could change if recessionary fears or further volatility in the banking sector affect payouts.

Midway through 2022, for example, analysts at AJ Bell bumped their profit forecasts for the FTSE 100 up to £371bn but that ended up tumbling to £226bn after miners disappointed.

Even with this fall, pre-tax profits last year were still the highest on record. If estimates are proved correct, another high will be set in 2023 with a rise of 23%.

FTSE 100 pre-tax profit (in billions) since 2006

Source: AJ Bell

In addition to dividends, almost a quarter (23%) of the FTSE 100’s constituents announced buyback programmes last year, with £55.2bn to be returned to shareholders in this way.

This overtakes the £34bn record set in 2018. FTSE 100 companies have already committed £22.7bn to share buybacks this year.

Nevertheless, analysts at AJ Bell warned income-hungry investors not to become obssessed by the amount of money being returned to shareholders.

“Investors will have to look carefully at the highest-yielding firms, as some of them have a track record of having to cut their dividend payments when times get tough,” they said.

Instead, they recommended that investors pay more attention to dividend cover, which refers to the profit a business makes divided by the amount it pays out to sharholders. This can be a good indicator of its sustainability.

Researchers warned that a dividend cover below 1 should “ring alarm bells” as it means a company is paying out more money than it is generating.

“This means it has to dip into cash reserves, sell assets or borrow money to maintain the payment,” they added. “This is unlikely to be sustainable over the long-term.”

Dividend cover of 1.5 is better, but it still means companies have less flexibility when profits fall and could lead to them choosing between reducing their dividend, halting reinvestment in the business or taking on debt.

Those with a cover of more than 2 are ideal as their profits are double that of their dividend, meaning payouts are likely to be sustainable, even in challenging conditions.

“[Such a company] can continue to invest in the business and has the scope to maintain its dividend payment in a bad year,” AJ Bell’s analysts finished.