Easy monetary policy, quantitative easing and strong corporate earnings all combined to deliver investors some quite extraordinary gains over the past decade. The beginning of 2022 however has given investors a stark reminder that investment returns don’t always move upwards.

Whether it is Russia’s horrific invasion of Ukraine, spiking levels of inflation, rising interest rates or the possibility of an impending recession, negative noise seems everywhere.

As long-term investors it is important not to get caught up in the negativity and react irrationally, losing sight of why you invested in the first place. Here are a few basic investing principles worth remembering.

It’s all about time in the market

Stock markets are an emotional beast. They react to news quickly, and without prejudice. From announcements about rising interest rates to geo-political events, stock markets will digest the information and decide on the trajectory almost instantly.

Even at the best of times, trying to time these moves can be futile. By holding on through the ups and downs, investors may give themselves an opportunity to participate in sharp rallies, which could lead to better longer-term returns. Exiting the market for any length of time can have stark consequences on returns.

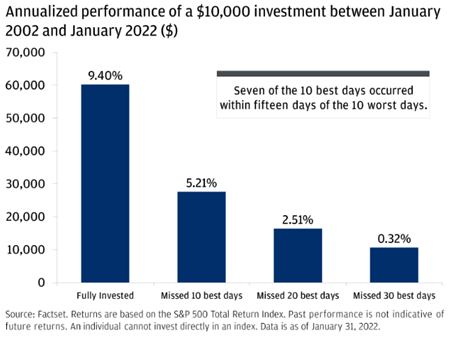

JP Morgan’s graph below shows the impact of missing the 10 best days the S&P 500 experienced over the past 20 years. An investor’s annualised return would have been nearly half that of someone fully invested over the same period, so the implications are significant.

Diversification

The saying “don’t put all your eggs in one basket” is worth remembering in investing. Diversification in investment terms means allocating your funds across different geographical regions and assets including things like equities, fixed income, property and infrastructure.

Returns from different assets classes ebb and flow depending on prevailing economic conditions. Importantly, these don’t all move in the same direction all of the time. Diversifying means if one asset class is not doing well, the opposite is likely to be true of another.

As a result, diversified investors often receive better consistency of returns in most market conditions while meeting their overall expectations.

Making volatility work for you

When investing through volatile times, making regular investment contributions can help to smooth out your investment journey, and reduce the apprehension of investing a lump sum all at once.

Through the process called ‘pound cost averaging’, investors making regular investment contributions will buy fewer units when prices are rising, and more when prices are falling. This can potentially improve returns over time, and more specifically during volatile times.

Investing is never a straight-line process. The hypothetical example below from Royal London demonstrates pound cost averaging at work in a volatile market, comparing Customer A’s returns with regular contributions against Customer B who makes a lump sum contribution.

Source: Parmenion

Economic and geopolitical events are notoriously hard to predict. Behavioural research shows knee-jerk reactions or decisions based on heightened emotions have rarely been useful investment techniques.

In uncertain times, consider why you invested in the first place and whether those reasons have fundamentally changed. By riding out the peaks and troughs, history suggests patience will be rewarded.

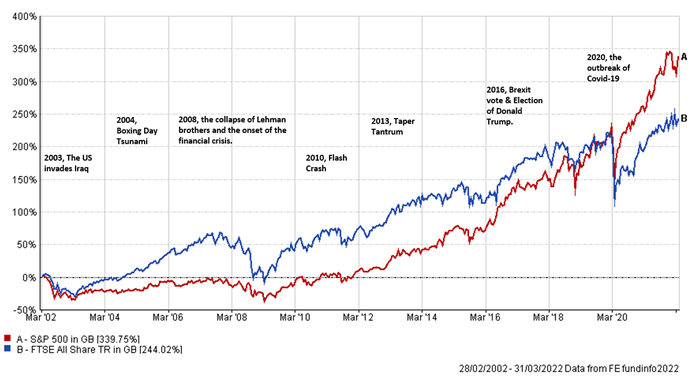

There will always be reasons to sell but as the graph below demonstrates, those with long-term horizons would have been handsomely rewarded over the past 20 years.

Source: Parmenion

Isaac Stell is fund research manager at Parmenion. The views expressed above should not be taken as investment advice.