As investors start to anticipate central banks tightening their monetary policy to curb the runaway inflation in developed markets, some might be tempted to look towards banks as a clear beneficiary.

When central banks raise interest rates, it directly raises the profitability of the sector because it creates a wider margin on their loans and other products.

So even though banks have had a torrid decade after the global financial crisis, they are now starting to look like an interesting proposition, according to Niall Gallagher, manager of the GAM Star European Equity fund.

Gallagher, an FE fundinfo Alpha Manager who managed money through the global financial crisis (GFC) of 2007, pointed to the fact that since then banks have gone through a period of “intense” deleveraging.

“In Europe you ended up with almost a decade and a half of deleveraging,” he said. “The leverage ratio of European banks went from 2.5% to 5.5%.”

“That period of deleveraging is in fact quite painful because you're in a period of time where banks aren't lending much, they're either shrinking their balance sheets or they're retaining profits for equity rather than trying to grow.”

A leverage ratio measures a bank's core capital relative to its total assets and is generally used as an indicator of a bank’s financial health.

Gallagher said: “The NPL [nonperforming loan] ratio of banks peaked after the global financial crisis, then rose into the eurozone crisis and then gradually came down.”

The NPL ratio of European banks is a measure of the amount of nonperforming loans in a bank's portfolio relative to the total amount of outstanding loans the bank holds.

He added: “But the key point is that by early 2020, before we were even thinking about a pandemic, this big deleveraging had largely occurred.”

Having had a negative view on banks for a long period of time, and with their deleveraging now over, Gallagher said they are now positioned to become vastly more profitable than markets expect.

“They have got to a point now where the loan to deposit ratios are low, the NPL ratios are very low too, they are well capitalised and arguably in many cases they are over capitalised,” he explained.

“We're beginning to see dividends get switched on and potentially buybacks, and if we are going to be in this environment of higher energy prices and potentially higher inflation, it is likely that at some point interest rates will go up, and banks are hugely geared towards rising rates.

“When you get to zero interest rates or even negative rates, banks become very, very sensitive to even quite small change in rates.”

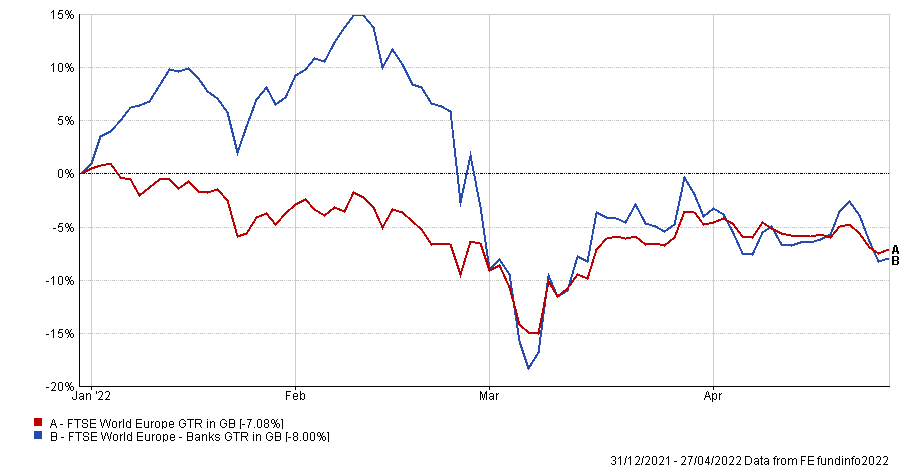

Performance of European Banks vs wider market year-to-date

Source: FE Analytics

Banks are trading relatively in-line with the wider market in Europe despite rising interest rate expectations across the continent in anticipation of central banks gearing up to raise interest rates to combat rising inflation.

The Bank of England is expected to raise interest rates again next month after hiking by 25 basis points in February, and the European Central Bank is expected to follow suit.

Gallagher said: “We're not yet seeing the market beginning to price in higher discount rates and higher yields into bank stocks, because that's very material.

“Just to give you an idea: if you add 1% or 100 basis points on to short rates in Europe, that adds about a quarter to the profitability of the European banking sector. If you have 200 basis points, it adds about 50%.

“That is really material, not only material in terms of the earnings, but because the banks are so well capitalised, that it also increases the prospect for higher dividends and higher buybacks, so there is a virtuous circle.”

Not all fund managers however are racing to buy bank stocks in anticipation of higher interest rates. Fraser Mackersie, co-manager of the Unicorn UK Growth fund, prefers to invest in companies taking market share away from the banks.

“I think banks are large and complicated, they run on lots of different systems,” he said. “If there's an area of banking that you want to get exposure to you can probably find a small-cap, cleaner, alternative way to do that.”

He pointed to his UK Growth fund’s biggest holding in a company called Alpha FX Group – which provides corporate foreign currency services and risk management to companies.

He said: “It is trading well because ultimately, it is taking share from big banks in a very small way – a small way for big banks, but a big way for Alpha FX.

“It is all built on the fact that some of the big banks are inefficient, there are certain areas they are focused on and other areas they aren’t – and that creates opportunities for small, nimble challengers in certain areas.

“It's admittedly quite a niche, but it's also a very big market when you look at it in the context of UK and Europe.”

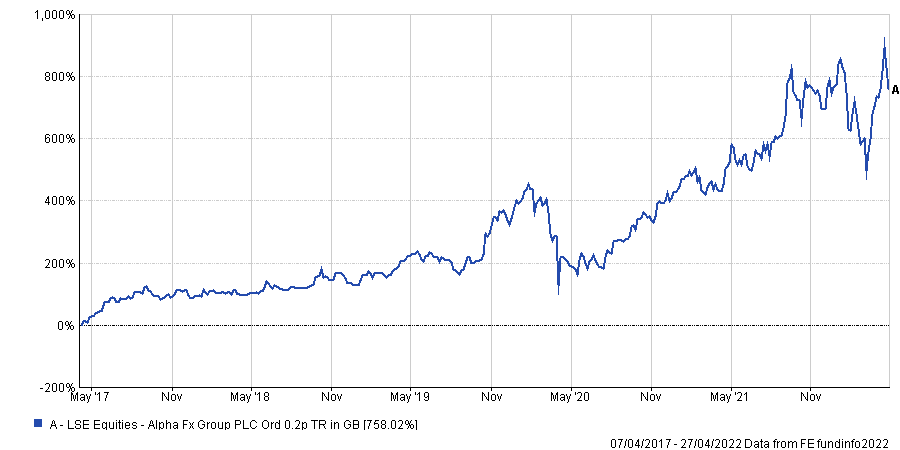

Performance of Alpha FX since IPO in 2017

Source: FE Analytics

Alex Game, co-manager of the Unicorn UK Growth fund, said Alpha FX’s focus on small- and medium-sized businesses has proven to be an advantage for the company.

“If those small companies wanted to hedge their FX exposure and went to a large high street blue-chip bank, they would be pushed down just by the spot FX,” he said.

“Alpha FX will sit down with them and work out a hedging programme using futures and they have a neat technology platform that customers can look at in real time.

“It's more hand-holding, its more service lead, and banks don't want to spend time and money on speaking to these smaller companies because it's just not going to move the needle for them.”

Although Alpha FX still has room to grow in the UK market but the managers also pointed to its growth in Europe which to them provides a “fairly predictable pathway of growth” if they continue to execute well.

“This is a very different investment case than investing in banks predicated on a rate rise,” Mackersie said. “Predictable long-term structural growth is what we're trying to get exposure to.”