Rising inflation, global supply chain issues, political tensions, Delta variant concerns and markets swinging between growth and value are just some of the issues that have made it a tough time for cautious investors.

Despite all of the issues, stock markets continue to push forwards, making risk-on assets the place to be, but this is not suitable for all investors.

David Miller, investment director at Quilter Cheviot, said the “aim of the game” is to beat inflation, something that is proving difficult without turning to stocks.

“Cautious investors should favour a portfolio that displays only moderate fluctuations in value in the short-term,” he added.

People that fall into this category could include those nearing, or in, retirement as they must ensure they have enough income to live on after they finish working.

But “managing money for cautious investors is particularly tough at the moment,” Miller said.

In the past there were reliable go-to assets for cautious investors; a high weighting to fixed interest assets as the starting point, with some equities added in for longer-term growth, Miller said.

“Unfortunately, these days fixed interest returns are very low and, after adjusting for inflation, negative in real terms,” he added.

This means that investors unable to stomach the risks that come with investing solely in the stock market need to look elsewhere if they want to protect the value of their investments while dampening down the short-term fluctuations.

For example, going from absolute return funds to infrastructure or hedge funds could be effective, but the underlying assets may be very illiquid, introducing liquidity risks at an already “stressful” time.

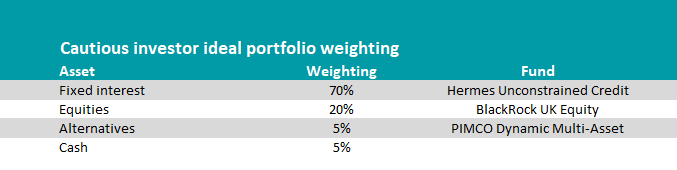

Miller said the ideal portfolio construction for a cautious investor and which funds to hold: 70% in fixed income, 20% in equites with the remainder split between alternatives and cash. Below he gives three funds that would fit well as part of a wider portfolio within each bucket.

Fixed interest: Hermes Unconstrained Credit

First is Miller’s biggest portfolio allocation, fixed interest, with a focus on strategic bond funds.

He called these types of portfolios “flexible bond funds,” noting that they can help maximise returns, even when traditional bonds are struggling, like they are now.

As part of the 70% bond allocation, Miller picked the $1.2bn (£800m) Hermes Unconstrained Credit fund.

Run by a four-strong management team made-up of, Fraser Lundie, Andrew Jackson, Nachu Chockalingam and Vincent Benguigui it takes an unconstrained approach, investing across the global, liquid credit spectrum.

Investing in various types of bonds the managers will change their positioning in response to the market environment, Miller said.

Currently the majority of the fund is in five-to-seven and seven-to-10-year maturity bonds, over 91% combined.

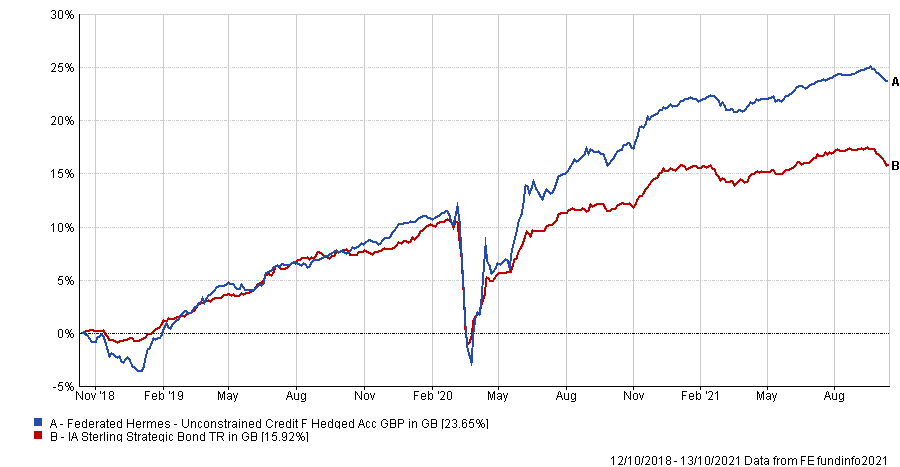

Over three years Hermes Unconstrained Credit made the 10th best returns in the IA Sterling Strategic sector, making 23.7%.

Performance of fund vs sector over 3yrs

Source: FE Analytics

Domiciled in Ireland it holds an FE fundinfo Crown Rating of five.

Equities: BlackRock UK Equity

Next is equities, which Miller recommends a 20% allocation to.

He said that although a cautious investment fund is generally centred on fixed interest to provide the defensive characteristics there is room for some equity exposure, which can provide capital growth potential.

For UK investors they will most want a UK option he added.

BlackRock UK Equity was his choice here, a multi-cap approach, though the majority of the fund is currently invested in large-caps at 69% of the portfolio. This curbs the risk from having small-cap exposure which is a more risky asset class,

Since it launched in 1989 it has made 1264.5%, ahead of the FTSE All Share and average IA UK All Companies fund.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

It holds a Crown rating of four.

Alternatives: Pimco Dynamic Multi-Asset

“A cautious investor will need alternative assets to act as a ballast in the portfolio,” Miller said.

Alternative covers a very broad range of asset classes, including commodities, real estates, private equity and even collectibles. What is important for cautious, or any investor, is to make sure it is “aligned with their wide investment strategy,” Miller said.

“One option could be the Pimco Dynamic Multi-Asset fund. While it may participate in both the market upside and downside, the impressive lead portfolio manager, Geraldine Sundstrom, seeks to smooth the path of returns for investors,” he added.

Performance of fund vs sector since launch

Source: FE Analytics

Square Mile Investment and Consulting said that although the fund “has plenty of appeal for the more sophisticated investor” and agreed that the manager does a good job of minimising risks they cannot be completely eliminated nor is the fund immune from capital drawdowns.

“We believe this fund has the potential to provide good risk-adjusted returns for investors over the long term based on the skills and experience of the manager and her ability to leverage the strong resources of the group,” Square Mile said.

Sundstorm runs the fund with Emmanuel Sharef and Erin Browne, who joined in 2019. Its performance has lagged the IA Flexible Investment sector since launch, making 52%.

The €7.3bn (£6.2bn) fund holds a five Crown Rating.

|

Fund |

OCF |

|

Hermes Unconstrained Credit |

0.8% |

|

BlackRock UK Equity |

0.92% |

|

Pimco Dynamic Multi-Asset |

0.85% |