Demand for venture capital trusts (VCTs) has picked up over the past few weeks as the tax deadline fast approaches.

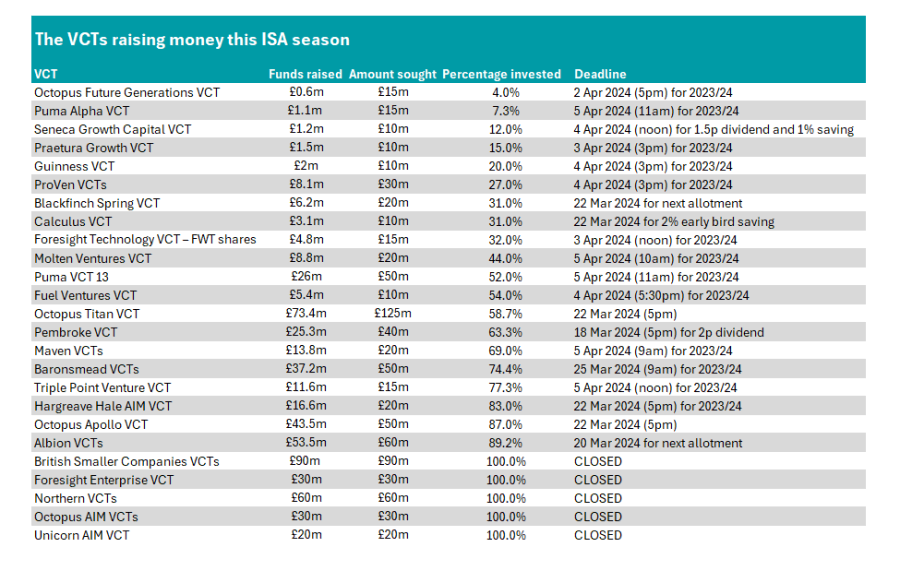

Some five issuances have already been closed, while four more are already three-quarters placed, according to data from Wealth Club.

Nicholas Hyett, investment manager at the firm, said: “The VCT season has been slower this year, with clients delaying investment decisions until closer to the tax year-end. However, we have seen demand pick up in recent weeks, with more than £80m invested since the start of March.”

VCTs have proven extremely popular in recent years as a way for higher earners to shield money from the tax man. There is a 30% income tax relief up front for any cash added to VCTs, providing they are held for a minimum of five years.

A £35,000 investment this year would save some £10,500 through income tax relief this year. Dividends from the trusts are also free from tax.

However, the trade off is that they are riskier. Most VCTs invest in small UK companies, which can be significantly more volatile and, as such, a long-term investing horizon is recommended.

“The combination of higher risk and longer investment horizons means VCTs tend to be more popular among more experienced investors who already have a conventional investment portfolio,” said Hyett.

“They are able to take the increased risk and able to tie money up for an extended period. They’re also more likely to have a sizeable income tax bill to offset – so benefit most from a VCT’s tax-saving side effects.”

Unlike other investments, VCTs have a finite capacity in any given tax year, meaning the most popular offerings tend to sell out fast.

This has been the case so far in 2024, with the likes of British Smaller Companies VCTs and Northern VCTs rapidly reaching their full allocations. Unicorn AIM VCT’s £20m fundraising meanwhile was available for just one week before it was oversubscribed.

“VCTs likely to close ahead of the tax year end include the Albion VCTs, Octopus Apollo VCT and Baronsmead VCTs. And, with Wealth Club expecting a strong end to the tax year, the speed at which funds close is likely to pick up,” said Hyett.

Source: Wealth Club

There are some attractive options still left, however, for those leaving things until the last minute. Hyett suggested someone with a £35,000 lump sum to invest in VCTs should consider splitting up their allocations among four remaining options.

First is Octopus Apollo – the closest to closing. Here he would allocate £10,000 with the same amount also going to Baronsmead VCTs and Pembroke VCT.

“When investing in small companies, diversity is key. Small companies are more likely to fail than larger ones, and having all your eggs in one basket increases the risk of significant financial losses,” he said.

“The manager of Pembroke VCT has particular expertise in more consumer-exposed investments, whereas Octopus Apollo focuses on more established B2B software businesses, and Baronsmead VCT includes a portfolio of listed companies,” he noted.

The final £5,000 would go to Foresight Technology VCT, the smallest and newest to the market of the group, which “specialises in deep-tech investments that generally take a longer time to pay off”.

“By diversifying your investment you not only reduce that risk, but also increase the chance you hit a winner. And often in venture capital just one or two investments will end up delivering the vast majority of overall returns. Picking just four VCTs can give you an underlying portfolio of hundreds of companies,” he concluded.