Family-owned conglomerates offer a rare, complex and often profitable route to access high quality companies at a discount. Family-owned companies are less liquid and less researched than other stocks, so their valuations are often attractive, according to Joe Bauernfreund, chief investment officer of Asset Value Investors (AVI).

As a case in point, the £1bn AVI Global trust recently invested in Bolloré Group, which Bauernfreund described as “one of Europe’s last byzantine corporate structures”.

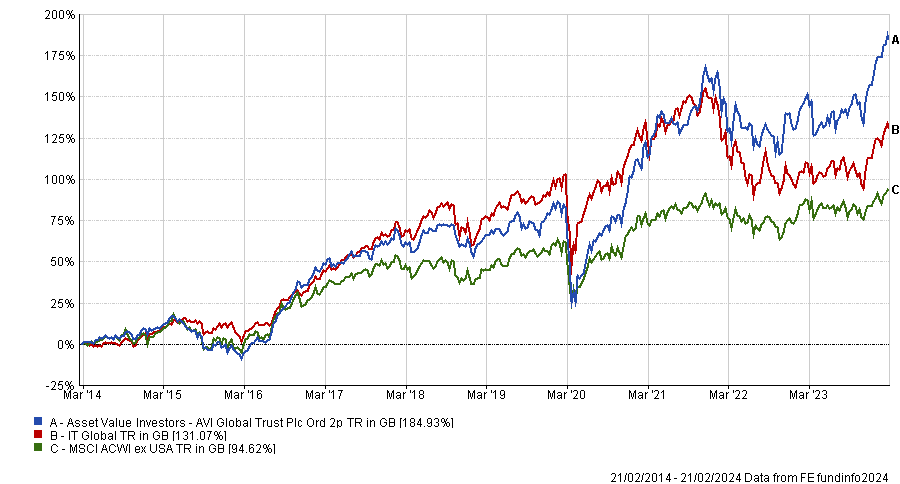

Performance of trust vs benchmark and sector over 10yrs

Source: FE Analytics

Bolloré has an 18% stake in Universal Music Group, as well as 30% in the media conglomerate Vivendi, which in turn has a 10% stake in Universal Music Group (a company that Bauernfreund wants to own because he believes the music industry is undervalued).

Bolloré’s entire market capitalisation is more than covered by the value of its holding in Universal Music Group plus 40% in cash, Bauernfreund said.

The position was funded by selling Pershing Square Holdings, which also owns Universal Music Group and has performed well, but Bauernfreund thinks Bolloré has greater upside and is trading at a 45-50% discount to its intrinsic value.

Bolloré could use its €6bn net cash balance for buybacks, tender offers or further transactions, he continued. “We believe it is an interesting time to align capital with a flush Vincent Bolloré and that the market is under-pricing the potential for value to be unlocked.”

Meanwhile, Vivendi is going to be broken up into four listed businesses to reduce its sum-of-the-parts discount. “This is the only time a Bolloré company has openly and proactively tried to address the issue of a discount,” Bauernfreund noted. “More tangibly, this raises the prospects of further tender offers and simplifications higher up the Bolloré structure.”

AVI Global also invests in Christian Dior, the listed holding company through which Bernard Arnault’s family controls LVMH, the luxury products group he leads. The Arnault family owns 48% of LVMH and 97.5% of Christian Dior.

During the Covid pandemic, shares in LVMH fell sharply over fears that demand from Chinese consumers would fall.

Christian Dior’s shares, which usually trade around the value of LVMH, fell further to trade at a 25% discount to LVMH. The situation presented a “fantastic opportunity” to invest in LVMH at an additional discount through Christian Dior.

AVI Global’s search for dislocated valuations has also led it into private equity. It owns three trusts – Princess Private Equity Holding, Pantheon International and Oakley Capital Investments – and the shares of two alternative investment managers, Kohlberg Kravis Roberts & Co. (KKR) and Apollo Global Management.

Bauernfreund thinks other investors fail to appreciate how diversified KKR and Apollo are across a range of asset classes, from private debt to infrastructure, real estate and private equity. These are resilient businesses with significant assets under management and consistent fee revenue, often back by committed capital, which is “fantastically valuable”, he said.

KKR and Apollo both have direct investments as well as funds, but the market is inefficient at valuing balance sheet assets and tends to apply a discount to these earnings streams, Bauernfreund said.

Share price performance of KKR and Apollo over 5yrs

Source: Google Finance

Meanwhile, Bauernfreund thinks private equity trusts are trading at wide discounts because investors have a “rear-view mirror perception” that the volatility of 2008 and 2009 will repeat itself.

During the financial crisis, private equity was highly leveraged and valuations were too high, resulting in write downs. Now, however, there is less evidence of worrying valuations or excessive gearing.

Pantheon has an attractive valuation and a well-diversified portfolio. It focuses on mid-market opportunities where valuations are more reasonable. The manager, Pantheon Ventures, has a good, long-term track record and employs sensible valuation metrics, Bauernfreund said.

Princess invests directly in companies and is managed by Partners Group, the large Swiss alternative investment firm. Princess cancelled its dividend when market conditions grew difficult so income investors fled and the discount widened, providing a buying opportunity for AVI.

Meanwhile, Oakley has a solid track record of exits delivering upside surprises to the net asset value. It has become more shareholder-friendly in recent years and has been buying back its own shares, he explained.

Another area where AVI Global has been hunting for value is Japan, which now accounts for 20% of the trust’s portfolio. “As a value-minded manager focussed on inefficient markets, Japan has always intrigued us,” Bauernfreund said. He sees corporate governance reforms as a catalyst for improving valuations and shareholder-friendly behaviour.

AVI Global has been buying good quality companies with a lot of cash on their balance sheets, then engaging constructively with management about doing share buybacks, paying dividends, or investing in the business to generate returns.