The cost-of-living crisis is over and the economic environment could actually be better than people think, according to Matthew Tillet, manager of the Premier Miton UK Value Opportunities fund.

Inflation, supply chain disruption, companies suddenly having to put prices up – it all sounds very familiar and painfully close to our daily experiences, but all these shocks belong to the past, said the manager.

Commodity costs – including gas, oil and shipping – have come down, which is good news for the consumers, whose situation, if not improving, is “definitely not getting worse”.

So confident that the economic outlook is improving, Tillet proclaimed: “We are past the cost-of-living crisis.”

The peak of the crisis came at the end of 2022, he noted, at which point he decided to buy consumer discretionary stocks based on their low valuations. This continued into 2023, but the market had caught up with expectations.

Yet there is a turning point, with consumers seeing increases in their wages on a year-on-year basis, giving them a fighting chance against inflation.

“[Relative to inflation] it’s obviously still below the level of 2021 – I'm not trying to say that it's a wonderful environment for the consumer. But, when we talk about cost-of-living crisis, to say that things are getting worse for the consumer, I'd argue that's history,” he said.

Tillet is not alone in noticing the resilience of UK consumers. Commenting on this morning’s labour market print, Hugh Gimber, global market strategist at JP Morgan Asset Management, said that “the more recent combination of easing price pressures and still tight labour markets has driven UK consumer confidence to its highest level in two years”.

“This morning’s UK labour market data will therefore be welcome news to consumers, showing wage growth above inflation for a seventh consecutive month,” he said.

The majority of commentators, however, stress that, although inflation is easing, prices are still building on top of double digit rises at the peak of the crisis, as highlighted by Laith Khalaf, head of investment analysis at AJ Bell.

“The crunch hasn’t gone away and while wages are rising consumers are now facing increased mortgage costs thanks to higher interest rates and at the same time dealing with frozen income tax allowances, which are taking a bite out of any nice little bumps they get in their earnings,” he said.

“I think it’s probably a bit premature to call the end of the cost of living crisis, though inflation is clearly heading in the right direction.”

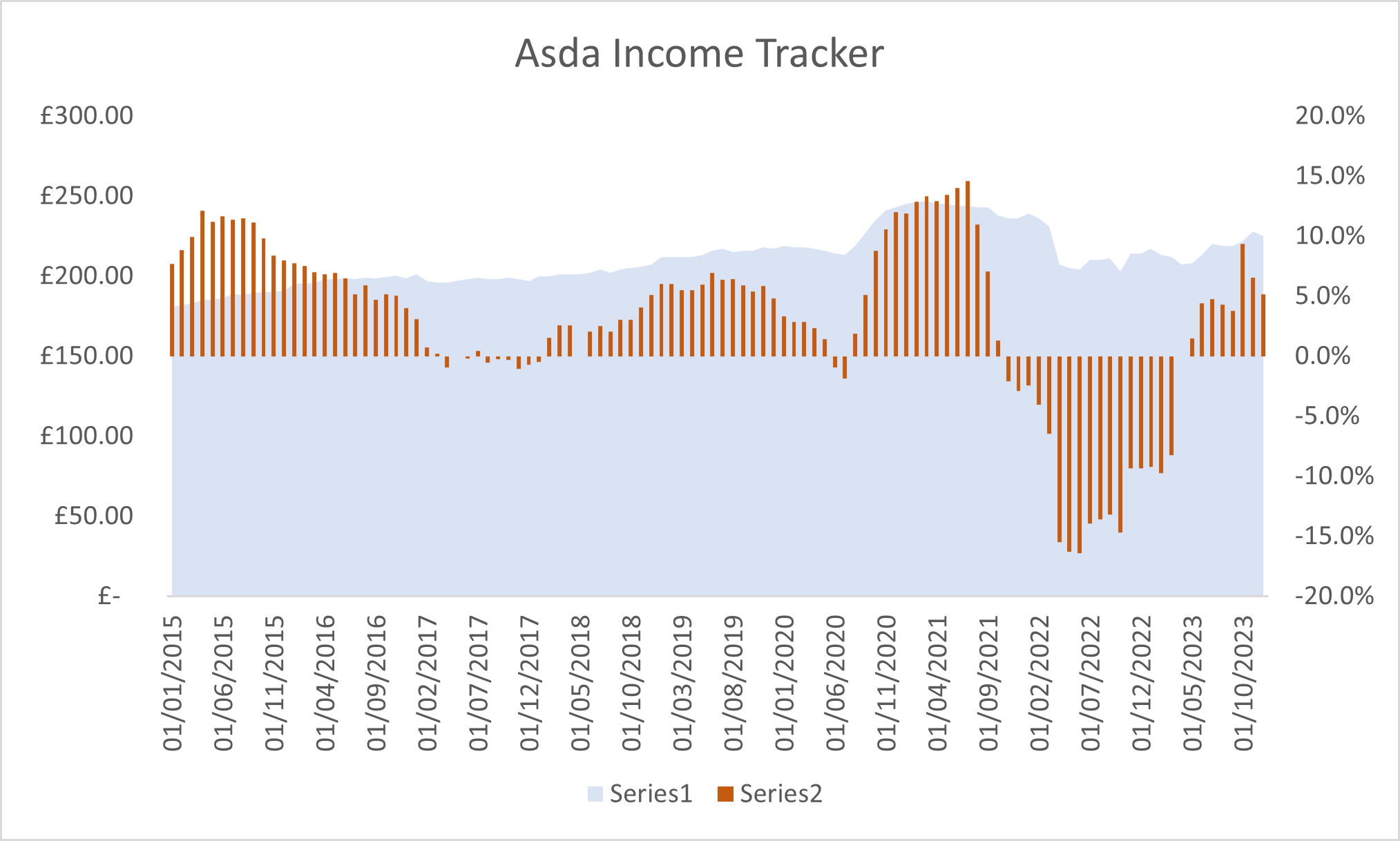

But Tillet went further and illustrated his point with the chart below.

Source: Asda, Premier Miton

The grey bar tracks the weekly income and the orange bars are the year-on-year change on a monthly basis, with an upward trend having started in 2023.

The manager has started to see the effect of this trend in his portfolio too. Around 20.3% of the Premier Miton UK Value Opportunities’ portfolio is invested in consumer discretionary companies, a sector that’s been hit by negative sentiment but has more than rebounded.

Clothing retailer Next, the fund’s best-performing stock of the past 18 months, soared more than 70% from its lows, so much so that the manager has been cutting his exposure.

“We still think it's undervalued, but I can't make the same argument for it that I made back in 2022,” he said.

Tillet also sees drivers of outperformance in the travel sectors, where he finds several companies that are still undervalued but are due a cyclical rebound based on stronger consumer dynamics.

“Consumers are prioritising experiences, which you can see in what's going on in the travel market and in companies such as airlines SSP, Jet2.com and Wizzair,” he said.

And then there are also companies that are recovering from their Covid troughs, such as upholstery market leader DFS Furniture.

“This is a stock we’ve recently started to buy because it’s coming back from what the managers say have been their most difficult years, even worse than the great financial crisis. If you can stomach the ups and downs, it’s is a good way to play the cyclical recovery theme,” said Tillet.

“Generally, I'm more optimistic about the UK consumer than most people are because of what's going on on the ground and also because expectations are still very depressed.”