UK investors continue to pile in to cash, according to data from Quilter, which shows savers are more likely to top up their savings reserves than invest.

Around 66% of the 2,000 people surveyed intended to put any spare income towards their ‘financial resilience’ with two-fifths of those intending to allocate it to cash savings. Topping up a stocks and shares ISA was the third most popular choice (24%) behind paying off debt (26%).

Emma Prince, a financial planner at Quilter, said: “The cost-of-living crisis has had a huge impact on people’s finances, so it is encouraging to see that boosting overall financial resilience is a top priority. However, it is important that people consider how best to do this. It is key that people do not overlook the benefits of investing for the longer term.”

Some 8.6 million people have more than £10,000 in investible assets sitting in cash, according to the Financial Conduct Authority’s Financial Lives Survey, and Prince warned that they could be missing out on better returns elsewhere.

“Though cash has felt like a relatively safe place to be for some time now given the higher interest rates on offer, our analysis shows just how much could be at stake if people miss out on elevated returns following any rate cuts by the Bank of England,” she said.

“In the same way that banks are quick to pass on rate hikes when it comes to interest on borrowing, they will be equally quick to claw back interest paid on cash savings. As such, if the Bank of England does begin to cut rates, savers will notice a rapid fall in any returns they may be getting.”

One option for savers is to move into money market funds. These invest in floating-rate notes and other cash-like instruments, meaning they are very low risk and offer similar yields to cash.

In 2023 the average fund in the IA Short Term Money Market and IA Standard Money Market sectors made 4.2% and 4.7% respectively.

This year could be another strong one for money market funds, according to Fidelity Money Market fund manager Chris Ellinger and investment specialist Izzi Halewood, who expect decent returns regardless of the economic situation.

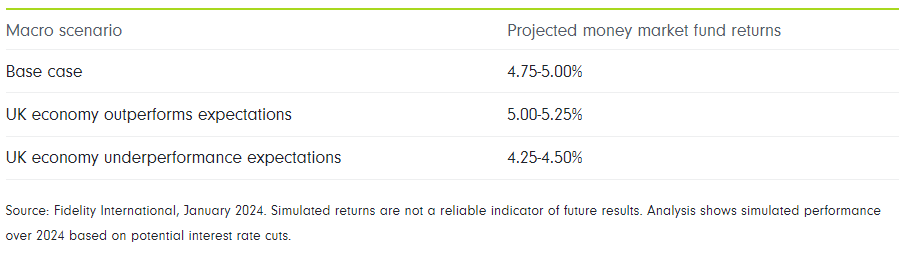

Below they highlight three scenarios and the potential returns for each.

The first is the most likely. Here a soft landing occurs, where inflation slowly returns to target without a significant hit to growth.

Possible returns for money market funds in 2024

“The Bank of England (BoE) cuts rates roughly in line with the path that overnight index swap forward markets currently foresee, starting in June, with four to five cuts over the year. This leaves the BoE base rate 100-125bps lower and would deliver an estimated total return for money market investors of 4.75% to 5%,” they said.

In the second scenario, cuts begin later in the year as inflation proves stickier than expected and the economy is more resilient. Around 50-75bps of cuts over the year would mean money market funds return between 5% and 5.25%.

“Our third and final scenario looks at a much more adverse economic outcome, with a hard landing and recession,” they said, with inflation tumbling. In this case, central banks would be forced to cut rates more aggressively, which reduces the expected total return from money market funds to around 4.25%-4.5%

“The above scenarios seem to suggest that returns for money market investors will remain attractive over the coming year, compared to history. When market volatility remains high, we think it makes sense to keep a portion of a portfolio in cash,” Ellinger and Halewood concluded.