Investors who bet on Scottish Mortgage Investment Trust 10 years ago have been richly rewarded, quadrupling their cash since 2014.

This phenomenal return has made it the best performing portfolio of the past decade in the IT Global sector – a feat it achieved thanks to a focus on long-term global structural growth across both public and private markets.

Yet, Scottish Mortgage’s outperformance has not been without its bumpy moments. Indeed, newer investors may wonder what all the fuss is about, after performance in recent years has underwhelmed.

Below, experts explain how investors can use this strategy in their portfolio, when to expect outperformance or underperformance and how to complement it.

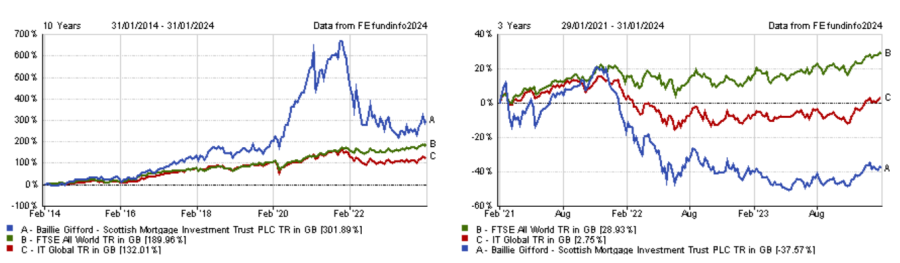

Performance of trust over 10yrs and 3yrs vs sector and benchmark

Source: FE Analytics

Why has Scottish Mortgage fallen like a stone and when may it return to its heyday?

Scottish Mortgage’s outperformance in the 2010s coincided with an era of low interest rates, which favoured the growth style of investment, as future cash flows were discounted at a lower rate.

Emma Bird, head of investment trust research at Winterflood, said: “The fund delivered particularly strong returns during the low interest rate environment in 2020 and 2021, with a number of ‘growth’ portfolio holdings benefiting from pandemic-related trends, not least in the technology sector.”

Yet, this outperformance suddenly stopped in late 2021 when interest rate expectations started to move up.

Nick Wood, head of fund research at Quilter Cheviot, explained: “As interest rates surged, valuations of higher growth companies fell fairly dramatically from highs, whilst expectations for private equity, which makes up around 30% of the portfolio today, were marked down.”

In short, higher interest rates are a headwind for Scottish Mortgage, while low interest rates are a tailwind. Therefore, there is a possibility that the trust thrives again if central banks are done with their hiking cycle and start cutting rates.

What should investors be aware of before buying shares in Scottish Mortgage?

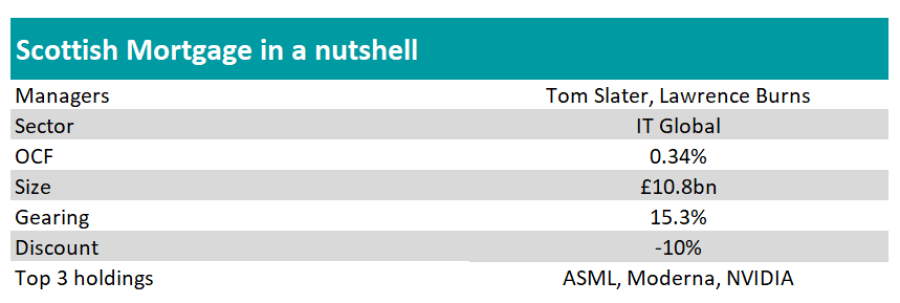

A strength of this investment trust is that if offers exposure to what managers Tom Slater and Lawrence Burns perceive to be the world’s most exceptional growth companies at a relatively low cost (0.35%).

Matthew Read, senior analyst at QuotedData, said: “The managers achieve this by first looking to identify key drivers of change, and then look to invest in a small number of names that they believe are the best placed to benefit from these structural changes.

“The managers have to be unconstrained to build it, but the result is a portfolio of long-term investments (a 5% turnover per annum implies an average holding period of 20 years) that looks very different to the index (active share of 92%), so you are getting true active management and quite idiosyncratic NAV returns.”

The flipside of this long-term and high-conviction approach is that the portfolio is likely to behave very differently from the index and to display a higher level of volatility than other global investment trusts.

For instance, data from FE Analytics shows that Scottish Mortgage has been among the three most volatile trusts in the IT Global sector over 10 years alongside stablemate Keystone Positive Change and Lindsell Train IT.

Source: FE Analytics

Another strength of the portfolio is its ability to hold private equities, which can offer returns that are more insulated from public markets.

Read added: “Baillie Gifford has a strong private markets team that sees a lot of deal flow and Scottish Mortgage’s managers are able to draw on this expertise.

“In selecting private investments, the managers are judicious. They do not invest in private companies for the sake of doing so but look for holdings that are genuinely additive to the portfolio – to make the grade a private company needs to offer exposure to something that public markets cannot do in an affordable way.”

Yet, this allocation to private equities hasn’t been without its challenges in recent times. As Scottish Mortgage’s growth stocks have dropped in value, the private equity allocation has become a larger part of the portfolio. As a result, the trust’s allocation to private equity has hit its limit.

Read explained that it might be a problem, as the managers’ ability to make follow on investments is now restricted at a time when these holdings could struggle to find finance elsewhere.

He added: “The limit was raised but the episode illustrated the challenges of having both public and private equity in a portfolio during more volatile markets when the allocation between the two is constrained.”

However, Bird suggested that a potential catalyst for the investment trust’s renaissance could be from exactly the part of the portfolio that investors are most worried about.

A reopening of the global IPO market – and a currently private holding going public – “would help provide evidence as to the accuracy of Scottish Mortgage’s unquoted holdings valuations, as well as helping to alleviate concerns around the private company exposure exceeding the maximum allocation (at time of investment) of 30%,” she said.

Read also pointed out that Scottish Mortgage may not be suitable for investors strongly reliant on income or those with a short-time horizon. Similarly, it may not be appropriate for investors preferring a more defensive portfolio or with a value focus.