“Not good enough” is how Nick Train, manager of Finsbury Growth & Income, assessed the recent performance of the portfolio at the investment trust’s annual general meeting.

While the trust has largely outperformed its benchmark since Train stepped in as portfolio manager in December 2000, it lagged the FTSE All-Share for a third consecutive year in 2023.

Nonetheless, the FE fundinfo Alpha Manager is optimistic for the future, as he believes some of his holdings will enable his portfolio to benefit from the artificial intelligence (AI) megatrend, which is more typically associated with the Nasdaq rather than with the FTSE All-Share.

Train said: “Over the past five years, I've come increasingly to the view that it's possible to capture some of those incredible effects happening on Nasdaq with companies listed on the UK stock market.”

Performance of trust over 3yrs vs sector and benchmark

Source: FE Analytics

The six holdings, which could be beneficiaries of this investment theme, are data provider RELX, London Stock Exchange, financial software firm Sage, investment platform Hargreaves Lansdown, credit provider Experian and online estate agent Rightmove.

Deputy portfolio manager Madeline Wright explained: “They all own caches of valuable unique data and we believe they are very likely to be able to use AI to enhance the value of those data sets. All six happen to be listed in the UK, which will come as a surprise to some asset allocators who perceive the UK to be lacking these kinds of exceptional data and software businesses.

“Taken together, these six holdings account for just 7.5% of the UK index, making Finsbury Growth & Income’s 53% exposure a really significant differentiator.”

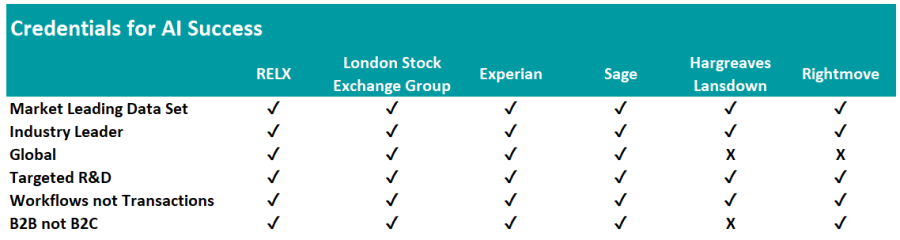

To identify the AI potential of those six stocks, the investment team of Finsbury Growth & Income assessed them against six criteria - market leading data set, industry leader, global, targeted research & development (R&D), workflows not transactions and business-to-business (B2B) not business-to-consumer (B2C) – based on a research from Bank of America.

Source: Lindsell Train & Bank of America 2023

The six holdings ticked all the boxed for the market leading data set, industry leader, targeted R&D and workflows not transactions criteria.

While most have an international reach, Hargreaves Lansdown and Rightmove are the two exceptions. Wright argued, however, that both have “fantastic” reach in the UK with “substantial” domestic opportunities. Rightmove is also an outlier when it comes to the ‘B2B not B2C’ criteria.

Train also noted that all of the stocks are trading on lower valuations than equivalent businesses listed on the Nasdaq, such as CoStar, a US competitor of Rightmove, for example.

He said: “What I can’t help but notice is that you have to pay a 67x earnings to own CoStar. That's what successful digital businesses trade at after a decade of bull market on Nasdaq. We can buy Rightmove, arguably with superior economics to CoStar, on 20x earnings.”

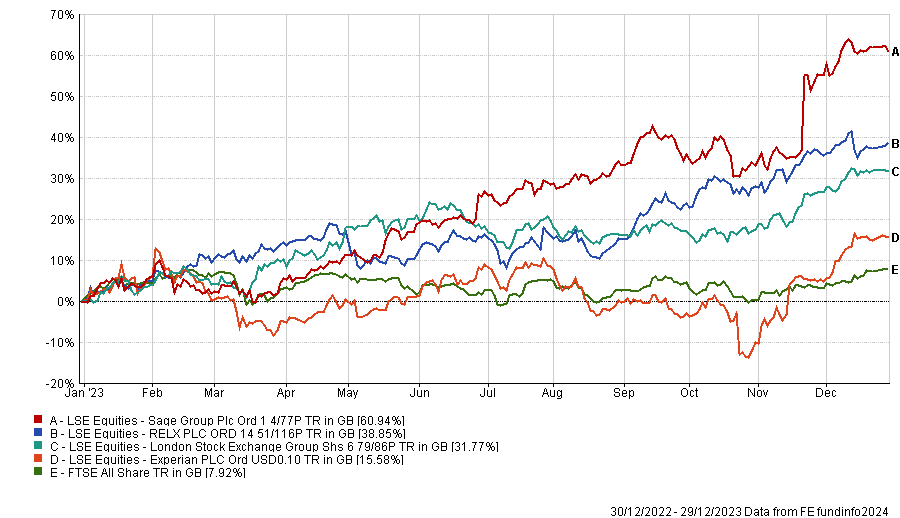

This strategic decision seems to be bearing fruits already, as four of those six stocks – RELX, Sage, London Stock Exchange and Experian – were the best performing holdings in the portfolio in 2023.

Performance of stocks in 2023 vs index

Source: FE Analytics

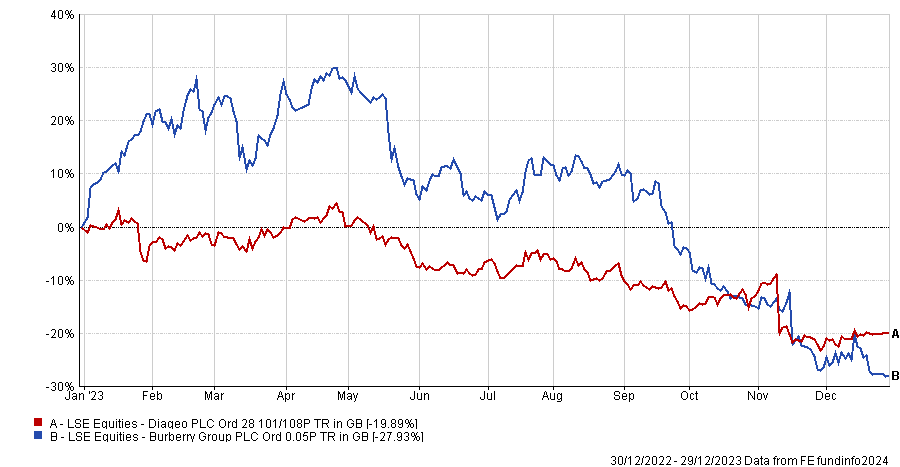

The other way around, Diageo and Burberry were among the main detractors to performance. Yet, Train is confident that both companies are simply going through a cyclical “blip” due to high interest rates and higher input cost, but also a poor macroenvironment in China, which is an important market for both companies.

He said: “We have to accept that macroeconomics or even geopolitics can depress or boost regions at times, but the fondness of Chinese drinkers for Johnnie Walker Blue Label is a really important asset that Diageo has for the next quarter of a century, not just for the next 12 months.

“Burberry’s trenchcoat is an iconic luxury item for Chinese people. It has been for 50 years and it will still be in another 50 years. It's so hard to get that brand resonance anywhere in the world, let alone in that dynamic region.”

Performance of stocks in 2023 vs index

Source: FE Analytics

Train also looked back at the performance of the two companies on the stock market in the 21st century. Burberry shares rose 768% since listing on the London stock exchange in September 2002, while Diageo surged 586.4% over the same period.

Train concluded: “Global investors are spending an increasing proportion of their growing wealth on luxury products and fine liquors. There is a hiccup in that trajectory, but it's more than likely that those consumer preferences will reassert themselves.”