There has been a dearth of new options available to investors looking to back a young fund across the three UK equity sectors, with just 20 launched since 2020.

Just six funds across the three UK equity sectors were created in 2020, seven in 2021, five in 2022 and two in 2023.

Many fund pickers like to wait until a fund has at least three years track record before deciding whether to buy or not. As such, below, Trustnet looks at how ‘young’ UK equity funds launched in 2020 – so have at least three years of evidence – have fared and how they compare with older strategies in their respective sector.

Four funds were launched in 2020 in the IA UK All Companies sector, which is also the largest of the three UK equity sector.

So far, not all of those six funds have been success stories. New Capital Dynamic UK Equity sits in the top quartile of the sector over three years, VT Downing Unique Opportunities made a third quartile performance, while WS Montanaro UK Income and Amundi Prime UK Mid And Small Cap are both in the bottom quartile.

The three latter portfolios have a bias towards UK small- and mid-caps, which have particularly suffered in recent years as inflation surged and the Bank of England raised interest rates, as it is harder for them to absorb higher expenses and to pass higher costs onto customers.

Moreover, smaller companies are often more labour intensive than large-caps, which means that increases in labour costs in inflationary periods eats into their profits.

Although New Capital Dynamic UK Equity has been the best performing ‘young’ fund over three years, it still lags 21 percentage points behind the 11-year-old Invesco UK Opportunities (UK), the sector’s leader over that period.

Performance of funds over 3yrs vs sector and index

Source: FE Analytics

Turning to the other UK sectors, WS Whitman UK Small Cap Growth is the only fund that was launched in 2020 in the IA UK Smaller Companies peer group.

Managers Joshua Northrop and Sean O’flanagan look to invest in smaller companies that have the potential to grow their earnings and cashflows at a rate of 15% or plus per annum for a minimum of five years.

Further characteristics they take into consideration are strong and sustainable competitive advantages, predictable and strong cash generation as well as good management teams with meaningful equity shareholdings.

The fund has delivered negative returns over three years, but still sits in the second quartile of the sector, albeit 35.6 percentage point behind Fidelity UK Smaller Companies, the best performing IA UK Smaller Companies fund of the period.

Performance of fund over 3yrs vs sector

Source: FE Analytics

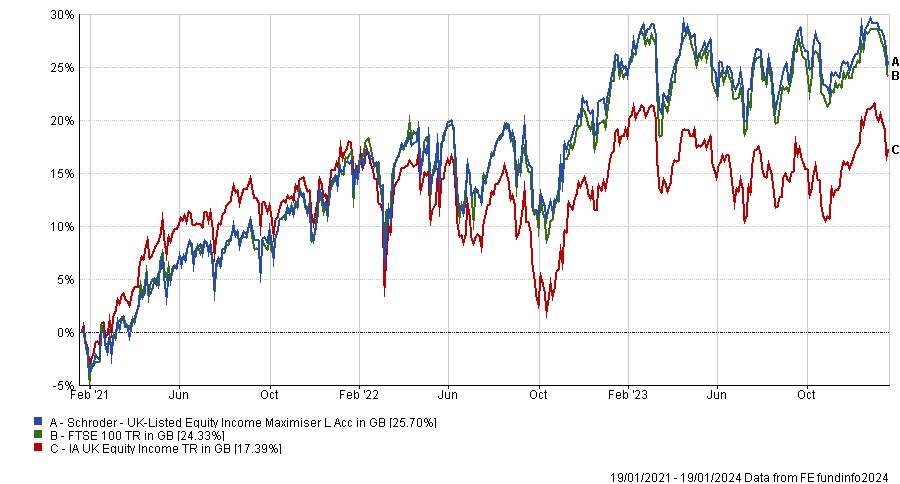

Finally, Schroder UK-Listed Equity Income Maximiser was also the only fund launched in 2020 in its sector: IA UK Equity Income. The performance of the fund so far has been promising, as it sits in the first quartile over three years.

The objective of this fund is to provide a yield of 7% via a portfolio of high yielding stocks and options premium received from writing calls on the underlying holdings.

Performance of fund over 3yrs vs sector and benchmark

Source: FE Analytics

Despite this good performance, the fund trails its stablemate Schroder Income Maximiser, which has been the best performing portfolio over three years in the IA UK Equity Income sector.

While fund launches have been scarce in recent years across the different UK equity sectors, 45 funds were launched in 2020 in the IA Global sector, with 12 of them having made a top quartile performance over three years.