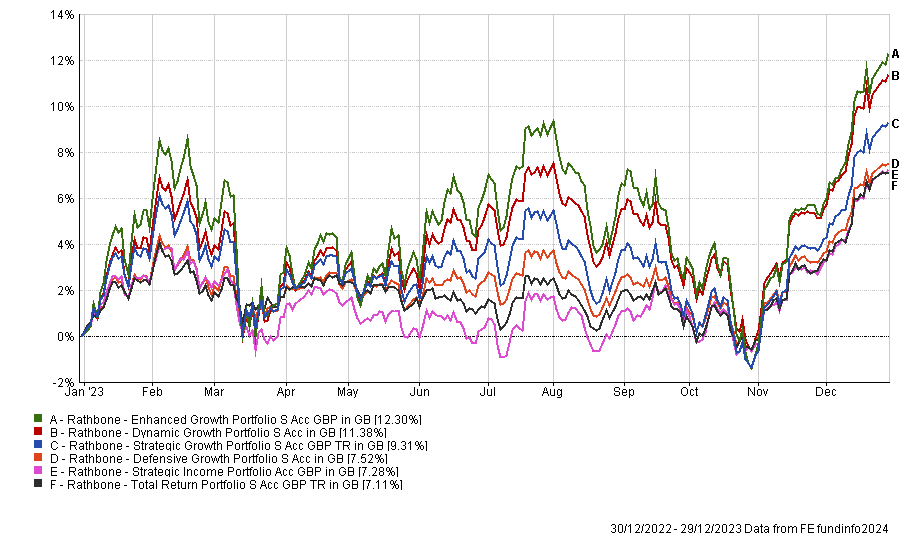

Rathbones’ multi-asset funds finished the year with strong returns but it was a nauseating ride. By October, Rathbones’ earlier move to increase duration was hurting performance, but David Coombs, head of multi-asset investments, persisted in buying more long-dated gilts as yields rose.

Coombs took advantage of mispricing to put on “a lot of uncomfortable trades” in October, which paid off as the fourth quarter progressed. He was able to pick up stocks for half the price they were trading at a few months prior.

The share prices of diabetes drug companies fell by some 50% between the summer and October as euphoria faded over GLP-1 (glucagon-like peptide 1 drugs that improve blood sugar control and lead to weight loss).

Coombs invested in medtech specialist Dexcom (which makes sensors to monitor glucose levels), which has already bounced back from its lows, as the chart below shows.

Dexcom’s share price over 1yr in US dollars

Source: Google Finance

Buying shares in a savage market was “uncomfortable but it’s unlikely to be stupid,” Coombs said. “The risk/reward was skewed in my favour.”

The market then rallied at pace in November and December. Some stocks such as Home Depot shot up so Coombs took profits, sticking to his funds’ maximum position size of 1.1%.

“We were trading all through last year, constantly taking profits,” Coombs recalled. “If it shoots up like Nvidia we take profits and if it falls, we add. We don’t allow these rotations to push our portfolio around. The ‘Magnificent Seven’ went through the roof so we cut back.”

Of the Magnificent Seven, the multi-asset funds own Apple, Alphabet, Amazon, Nvidia and Microsoft, but not Tesla or Meta.

Rathbones also used weakness in early Q4 to add to positions in the real estate investment trusts (REITs) American Tower and Equinix.

Coombs, who manages £6bn across several multi-asset portfolios, was able to take advantage of pockets of mispricing through his relationships with brokers. For instance, he was offered NatWest and HSBC two-year paper yielding 6.5% (cash at the time was yielding 5.25%).

When brokers are approached by a big institutional seller, Coombs said they call him about taking the other side of the trade because “we’re big enough to do a £30m ticket in five minutes. If you can move quickly and you’re a good buyer, you can deal inside the spread at a good price.”

Increasing duration and incurring a nosebleed

Last year, over the course of six to nine months, Coombs increased his portfolios’ duration from zero to eight years, “which was a bit of a nosebleed and shocked quite a few of our investors but that, to me, is active management.”

Central banks hiked interest rates so rapidly that “if you’re not making a change after that kind of move then you’re not doing your day job.”

At the start of this year, Coombs was an outlier in thinking that the US would not go into a recession and, even though he was ultimately proved right, his conviction was “lonely”. “We stuck to our soft landing view last year and kept buying duration and the data supported our view.”

The bond exposure “hurt” by September, “but we just bought more because we felt the market was wrong and the narrative was wrong.”

It got worse. “We were looking pretty poor in October,” Coombs continued, then “it got even more hair-raising” when yields on long-dated gilts went to 5%, “so we bought more”.

Coombs bought a combination of 10, 15, 20 and 30-year gilts in October, “wherever the curve was the best value on the day”. He believed that 30-year gilts yielding 5% offered much better value than equities, but even so, “it was hairy”.

“Buying Dexcom was just as scary as buying 30-year gilts in October. They were uncomfortable trades but you make the best returns when you are doing uncomfortable trades. I had a few sleepless nights but you should have sleepless nights if you’re doing this job because if you don’t have sleepless nights then you’re not taking risk.”

The hefty bond allocation paid off at the end of the year as consensus gathered that rates had peaked. “We made a huge amount of money on gilts last year,” he said.

Rathbones is still buying duration; Coombs bought 20-year US Treasuries last week and he has been adding 10-year US Treasuries. “There are punchy bets. The government bond market is very volatile.”

The £2.7bn Rathbone Strategic Growth Portfolio now has 25-30% of its assets in government bonds, comprising of 15-20% in gilts, 10% in US Treasuries and a couple of per cent in Australian government bonds.

“On a risk/reward basis, government bonds are more attractive than equities,” Coombs explained. “If we have a recession, government bonds will be your friend. Corporate bonds won’t.”

Moving into infrastructure after it had taken a kicking

In the fourth quarter of last year, Coombs also invested in UK infrastructure for the first time ever. He holds HICL Infrastructure, International Public Partnerships and GCP Infrastructure Investments.

Infrastructure investment trusts were trading at a discount of 25-35% to net asset value “because everyone was kicking infrastructure to death,” Coombs said. “People are dumping them so we’ll pick them up.”

Compared to a risk free rate over 5%, returns from infrastructure look less attractive on a comparative basis, which has led to outflows. He also thinks investors were disappointed to find that infrastructure is not as closely correlated to inflation as they expected.

“I’ve always thought they were cyclical, not real returns,” Coombs said. Other multi-asset managers are selling infrastructure from their ‘alternatives bucket’ but he sees infrastructure as low beta equity.

Capital will be more expensive to obtain, but infrastructure companies are bringing in good management teams and trying to deleverage. “They listen to us when we talk about refinancing,” he said.

Coombs thinks infrastructure companies that can manage their balance sheet and be better custodians of capital will be rewarded. “I can see a 25% upside”, he said. Infrastructure is now 2-3% of Coombs’ lowest risk fund but there is “not enough juice for the high risk funds”.

All of these trades – gilts, infrastructure, REITs and beaten-down shares – were correlated and propelled Rathbones’ multi-asset funds towards strong fourth quarter performance.

Performance of Rathbones' multi-asset funds in 2023

Source: FE Analytics

Last year was a “weird market” with “savage rotations”, Coombs reflected. “It was just unbelievable.”