WS Lindsell Train UK Equity, managed by FE fundinfo Alpha Manager Nick Train, is one of the most popular active UK equity funds, with £4bn of assets under management.

The performance over long timeframes is an important factor explaining this popularity, although the fund has struggled in more recent years.

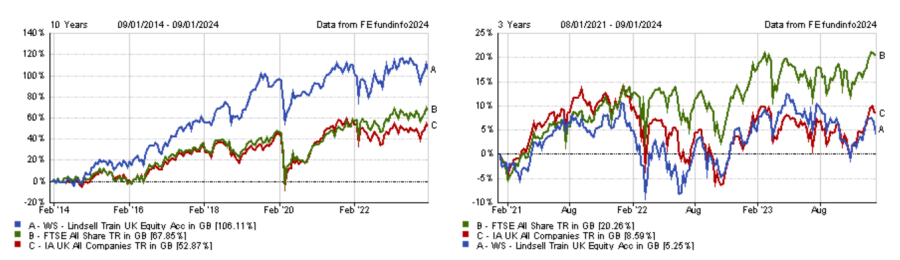

Since launch, the fund has beaten its benchmark, the FTSE All Share, by more than 248 percentage points and is the fifth best performing strategy in the IA UK All Companies sector over 10 years.

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

Below, experts explain how investors can use this strategy in their portfolio, when to expect outperformance or underperformance and how to complement it.

A core strategy

WS Lindsell Train UK Equity follows a quality-growth strategy via a select number of FTSE 100 companies as well as a few continental businesses such as Heineken.

A peculiarity of the fund is the manager’s high conviction in his holdings, with the top 10 positions accounting for 82.4% of the portfolio according to FE Analytics.

Dzmitry Lipski, head of fund research at interactive investors, said: “The manager's investment horizon is long term and relies on building a high-conviction portfolio of quality-growth stocks. It is unconstrained by its benchmark and sector.

“As such the portfolio may look very different from the FTSE All-Share index and performance is likely to substantially deviate from its benchmark.”

Due to the long-term approach of the manager, John Monaghan, research director at Square Mile, added that the fund might not be suited for tactical uses. He suggested investors to hold the fund for at least five years.

When will the fund thrive and struggle?

The idiosyncratic nature of the portfolio resulting from its high concentration means that Train’s stockpicking will be the most important factor for performance. Yet, some macroeconomic environments are more favourable to the strategy than others.

The fund thrived in the post-quantitative easing era in the previous decade when the market rewarded Train’s ability to identify resilient growing businesses with long-term cash flows. Yet, Gavin Haynes, co-founder of Fairview Investing, explained that the focus on quality businesses means that investors can also expect the fund to perform well in a low growth economic environment when there is a flight to quality.

Monaghan added that the fund has the potential to be resilient when there are uncertainties in the market. He said: “I'm not saying the fund is going to do exceptionally well in a down market, but you would normally expect high quality stocks to be more robust and hold better in that kind of environment.”

Performance of fund over 10yrs and 3yrs vs sector and benchmark

Source: FE Analytics

The other way around, the fund might lag the market in risk rallies and could struggle in an environment with higher inflation and interest rates, as has been the case in recent years.

Rob Morgan, chief investment analyst at Charles Stanley, said: “A sharp style rotation away from his preferred quality compounders has reduced the valuation multiples of growth companies listed in the UK.

“At times, the portfolio’s lack of exposure to oil, miners and banks has been a headwind versus the wider market. Investors should expect the fund to underperform when these ‘traditional’ cyclical sectors are leading the market as Train actively avoids them owing to their capital intensity.”

Should investors go for the investment trust version instead?

Finsbury Growth & Income can be considered as the close-ended equivalent of WS Lindsell Train UK Equity. The two portfolios follow the same strategy, roughly share the same holdings and have a similar fee structure.

Although the trust has a low level of gearing, it is trading on a 6% discount to net asset value (NAV) and could, therefore, be a better tactical choice at the moment.

Monaghan said: “The trust has traded close to NAV and even at a premium in the past. If you get a more positive sentiment around UK equities, the current discount might close up.”

Moreover, the trust has an active discount management policy, triggering share buybacks when the discount exceeds 5% to try to close the gap.

Morgan also highlighted structural reasons to favour the trust over the open-ended fund.

He explained: “The investment trust structure is the optimal way of accessing the talents of Train and his tendency to run a concentrated and low turnover portfolio.

“Given the fixed pool of capital, the trust isn’t under the same negative flow pressures that have hit UK open-ended funds necessitating managers to offload stocks, though share buybacks do stand to shrink the trust a little and apply some selling pressure on the portfolio for the manager to deal with.”

What should you pair it with?

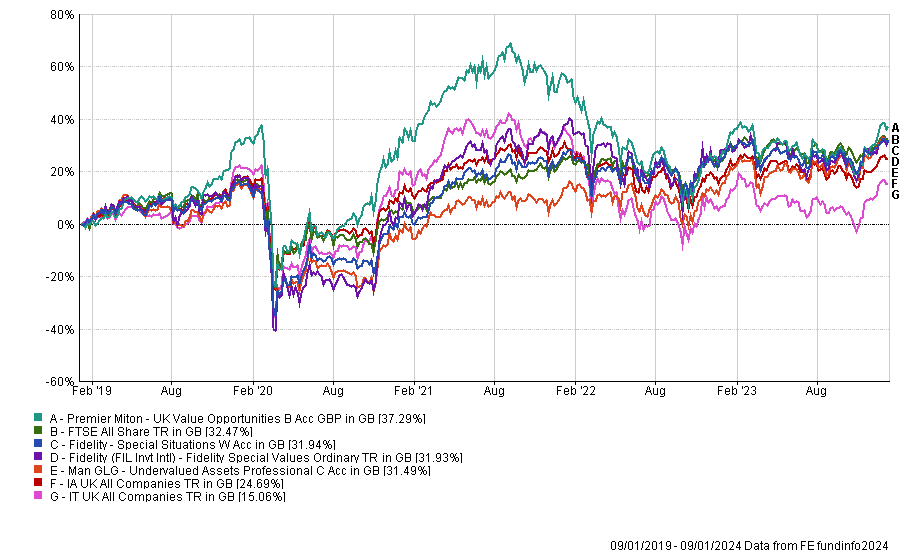

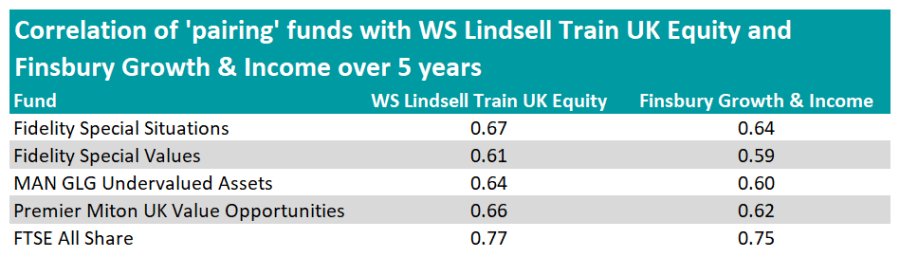

As WS Lindsell Train UK Equity focuses on a small number of FTSE 100 stocks reflecting the quality growth style of investment, the consensus among experts is that the ideal pairing should be a value strategy, potentially with a multi-cap approach.

Therefore, Lipski and Haynes picked Fidelity Special Values, managed by Alpha Manager Alex Wright, as the ideal pairing, while Monaghan chose the open-ended version, Fidelity Special Situations.

Lipski said: “The Fidelity Special Values trust looks to identify unloved companies across various sectors which the team believes to be undervalued or where the potential has not been recognised by the market.

“The portfolio invests across the UK market-cap spectrum and shows biases down the market-cap scale versus the FTSE All Share Index.”

Performance of funds over 5yrs vs sectors and index

Source: FE Analytics

Morgan suggested MAN GLG Undervalued Assets and Premier Miton UK Value Opportunities as other suitable complements to WS Lindsell Train UK Equity.

Monaghan added that a passive fund tracking the FTSE All Share or the FTSE 100 would also be a suitable pairing, as Train’s fund does not have any exposure to energy, mining and bank stocks.

Source: FE Analytics

Alternatives

Despite the fund’s excellent long-term track record, there are some reasons investors may want to pick a rival. Some suggested picking funds that offer a similar quality-growth bias with more diversification. One example, picked by Morgan, is Liontrust Special Situations, managed by Alpha Managers Julian Fosh and Anthony Cross.

Morgan said: “It has a broader portfolio but also focuses on good quality companies with growth prospects and ‘moats’ that keep competitors at bay.”

Performance of funds over 5yrs vs index

Source: FE Analytics

Both Haynes and Monaghan highlighted WS Evenlode Income, managed by Alpha Managers Hugh Yarrow and Ben Peters as well as Chris Moore.

Monaghan said: “There's an element of crossover with WS Lindsell Train UK Equity, as both are quality growth strategies, but I wouldn't say they are identical. WS Evenlode Income is a lot more diverse and probably a bit more active in terms of stock turnover.”