The past year has seen the supposed peak in interest rates in this rate hiking cycle and inflation begin to fall, meaning investors have been piling into the short-dated the gilt market as cash-like instruments have become increasingly popular. Passive funds also enjoyed another popular year, with £75bn of inflows in 2023, according to Investment Association data.

However, this does not dampen the need to diversify your portfolio and there are still plenty of actively managed funds and investment trusts out there worth considering for investors over the coming year to achieve that goal.

We’ve highlighted six trusts and funds for investors to keep an eye on in 2024, looking at a balanced approach through to some more adventurous ideas, as well as a couple of potential options for those seeking income.

Balanced investors

BlackRock Continental European Income

This European equity fund is managed with a concentrated approach without reference to its benchmark. The fund’s manager looks to identify quality companies with a high but sustainable dividend yield coming from a strong balance sheet and stable earnings.

In addition, the fund will also look to identify opportunities in companies that can deliver long-term dividend growth but may currently yield less than the broader market. The result is to build a diversified portfolio that offers both a reliable and growing income over time.

The fund has been managed by Andreas Zoellinger since 2011 and he is supported by Brian Hall, who became a co-manager in 2021. The managers typically run the fund with a more defensive risk profile when compared to broader European equity markets. The portfolio is built on an unconstrained basis, but it is typically focused towards large- and medium-sized companies and will have around 40 holdings.

Polar Capital Global Insurance

This fund has many of the elements that make for a great specialist strategy – a genuine niche in market exposure (non-life insurance businesses), an experienced and specialist team (Nick Martin and Dominic Evans), a fund genesis from within the insurance industry, and committed corporate backing from Polar Capital.

The managers target at least 10% book value growth across the portfolio each year. This growth is made up of the underwriting margins of the invested companies, alongside market returns from their investment portfolios.

The expectation is that this book value growth should lead to an equivalent annualised share price growth over time for underlying companies, and thereby a doubling of capital returns for the fund every seven to eight years.

Two structural tailwinds for the insurance industry persist at present, firstly increased risk complexity within the insurance market (e.g., cyber and climate risk), which increases premiums charged, and secondly, higher risk-free rates, which boost the investment yields earned in investment portfolios.

Adventurous investors

Baillie Gifford Global Alpha Growth

This is a long-term global equity strategy invested in growth-oriented companies. The fund therefore follows the investment style that is firmly embedded throughout Baillie Gifford. The investment process is entirely driven by bottom-up stock research stemming from a belief that companies which have the potential to grow at a faster rate, and on a more sustainable basis, than their peers are positioned for higher long-term returns.

The research process identifies companies which offer the prospect of sustainable above average growth in earnings and cash flow. The managers use the broader regional teams to identify stocks for consideration with company meetings an important input into the research process.

The resulting portfolio is typically benchmark agnostic and low turnover, usually comprising 70-120 stock positions. Investors should note however that the fund is likely to be highly volatile and act remarkably different to its index over short to medium time frames.

The Worldwide Healthcare trust is managed by OrbiMed, the world’s largest specialist healthcare fund management company. OrbiMed has been active for over 30 years, investing in early-stage private companies to large multinational corporations. The trust has a growth approach to what is traditionally a more defensive sector in equity markets.

The strategy’s three- and five-year relative returns are disappointing, predominantly driven by the portfolio’s large weightings within emerging markets and the emerging biotech sector, as well as the accompanying underweight to large cap pharma.

Performance of trust vs sector and benchmark over 5yrs

Source: FE Analytics

However, the managers believe that fundamentals within biotech remain attractive, with supportive valuations and increasing M&A expected across the sector, particularly given the increased investor attention towards innovation within drugs and related technology.

Given the calibre of the investment team and looking at the longer-term success of the strategy within the OrbiMed franchise, we continue to believe it provides a compelling investment proposition within the healthcare space. The trust stands at a 10% discount at the time of writing, with an active gearing position of 7% (max 20% position).

Income seekers

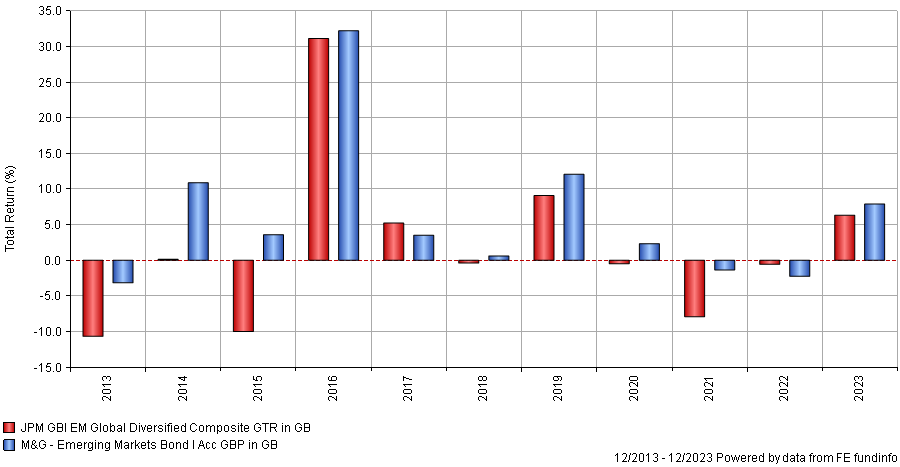

This emerging market debt fund has a neutral weighting of two third government bonds, issued in either developed market (DM) or local currencies, and one third corporate bonds, issued in DM currencies. The fund is managed by a strong investment team, headed up by the experienced Claudia Calich. Its long-term performance has been impressive, outperforming its composite index in all but one calendar year since its 2013 launch.

Performance of trust vs benchmark each year since 2013

Source: FE Analytics

The neutral split across (two third) government and (one third) corporate bonds, as well as (two third) DM and (one third) emerging market currencies results in a diversified portfolio by risk factors. The team’s bottom-up credit selection tends to then generate a higher yield than the composite index, given the team’s preference for both high yield credits as well as peripheral country bonds.

The team have a positive outlook on local currency bonds, whilst maintaining a preference for high yielding sovereigns over investment grade debt. M&G EM bond’s overall high yield exposure is running close to 60% versus 40% for the fund’s composite index.

Man GLG Income is a UK equity fund invested across the market cap spectrum. Fund manager Henry Dixon is experienced and his analytical approach provides a level of pragmatism that allows the fund to navigate through a variety of market conditions. He is ably supported by a small number of portfolio managers and analysts.

The team seek out undervalued and unloved companies through identifying two types of stocks, those trading below their replacement cost and those where the market appears to be undervaluing profit streams. Given the focus on generating income, all stocks held must have a yield in line with the market.

The manager also has a preference for stocks which have strong potential for dividend growth (exceeding twice the market average) and bonds (max 20%) that on a relative basis appear more attractive than their company’s equity. In order to avoid value traps the manager additionally focuses on a firm’s cash, cash flow and assets.

This is a very actively managed fund, which can diverge significantly from the index and have high levels of turnover. These factors often result in both the fund’s volatility and transaction costs being elevated.

Paul Angell is head of investment research at AJ Bell. The views expressed above should not be taken as investment advice.