Scottish Mortgage, Law Debenture and JP Morgan UK Smaller companies have all been added to Winterflood’s recommended trusts list of 2024, while the likes of Monks, Murray Income and The Mercantile Investment Trust has all been dropped.

Only 10 of the original trusts outperformed in 2023 – a challenging year for the whole universe, which underperformed the broader UK market by 3 percentage points (4.9% versus 7.9%). The strategies, however, are selected with the view that they should outperform in 18 to 24 months.

The challenging year meant there were plenty of changes to the list for 2023, including Scottish Mortgage, which made it back into the list after losing its spot to the Monks Investment Trust last year.

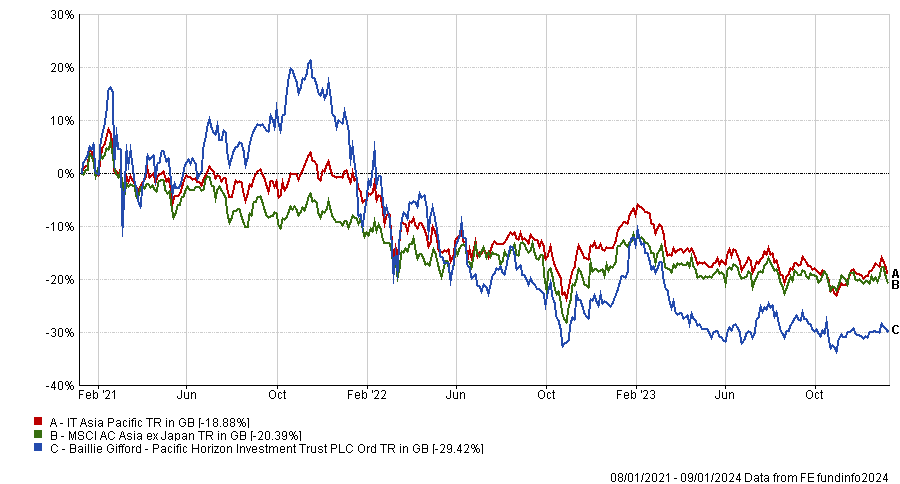

The 11.6% discount convinced Winterflood analysts, who thought that, after the “extremely challenging” 2022 and 2023 when the trust lost 34% (as shown below), there is scope for “a notable re-rating and significant pick-up in performance” courtesy of a more stable interest rate environment and a potentially more positive sentiment towards private markets.

“While the fund’s market cap has shrunk by 45% since the end of 2021, it still offers excellent secondary market liquidity as one of the largest UK-listed investment trusts,” they said.

“Scottish Mortgage also benefits from one of the lowest fee ratios in the investment trust universe, with ongoing charges of just 0.34%, particularly attractive when compared with the costs of traditional private equity funds.”

Performance of fund vs sector and index over 2yrs

Source: FE Analytics

Outperforming the MSCI AC World Index in each calendar year from 2019 to 2023, JPMorgan Global Growth & Income maintained its ranking in the IT Global sector.

In the UK, The Mercantile Investment Trust was dropped after a year of positive absolute and relative performance and a narrowing of its discount, while Murray Income lost its place to Law Debenture Corporation.

The latter doesn’t particularly offer great value at the moment (the discount is 1.5%), but is “a unique proposition in the investment trust universe, offering a strong dividend growth track record and impressive historical relative returns”.

Here, Winterflood analysts praised the trust’s subsidiary Independent Professional Services business, which funded 34% of the dividends over the past 10 years and gives managers James Henderson and Laura Foll “greater flexibility in stock selection”, enabling the holding of zero or low dividend yield shares.

JPMorgan UK Smaller Companies was a new entry and could benefit from a re-rating following the merger with JPMorgan Mid Cap scheduled for February and introduction of an enhanced dividend policy targeting 4% of net asset value (NAV) per annum.

Fidelity Special Values, Finsbury Growth & Income and Odyssean Investment Trust were kept unchanged.

Turning to North America, JPMorgan American couldn’t defend itself against a generic S&P tracker, as the latter “may well provide investors with better risk-adjusted core US equity exposure”, and was removed.

Pershing Square Holdings was maintained thanks to its concentrated set of cash-generative large-cap US names (eight to 12 holdings) in the hospitality, real estate and transport sectors, and to its “strong” long-term track record, returning 41% per year over the past five years.

Winterflood sees “no good reason” why this portfolio should trade at a 32% discount, despite manager Bill Ackman’s high profile, which “may present a key man risk to the strategy”.

In Europe, Fidelity European Trust was retained as it still provides “core defensive exposure to high-quality companies with good dividend growth prospects on attractive valuations”, while The European Smaller Companies Trust was removed for the sake of “consolidation”, although Winterflood analysts “continue to rate the management team highly”.

Meanwhile, there were no changes in Asia and Emerging Markets. Pacific Horizon has consistently remained the top performer in its peer group over the past five years, driven by the strong performance of growth names since March 2020.

Performance of fund vs sector and index over 3yrs

Source: FE Analytics

“Far from a buy-and-hold portfolio of former pandemic beneficiaries, manager Roderick Snell has aligned the portfolio towards structural themes such as commodities fuelling the energy transition, real estate trends in India and manufacturing exports in Vietnam and achieving an active share of 83%,” Winterflood analysts said.

With the research not making macro calls, Fidelity China Special Situations looked “attractive” at a 10% discount with downside risk limited by the board’s policy to keep it in single digits through buybacks.

It delivered a NAV total return of 134% since Dale Nicholls took over the fund’s management in 2014, outperforming the MSCI China Index’ 51%.

In Japan, Nippon Active Value’s “outstanding performance record since its launch in 2020” was preferred to Baillie Gifford Shin Nippon, while JPMorgan Japanese remains a good option for core exposure to Japan with a quality growth bias.

Finally, specialist equity recommendations included the Allianz Technology Trust, the Worldwide Heathcare Trust and Blackrock Energy and Resources Income, with the addition of RTW Biotech Opportunities and Impax Environmental Markets.

The former strategy was the favoured choice for investors seeking direct exposure to healthcare, as it invests in high-growth global biotech and med-tech investments across public and private markets.

“We believe that the team deserves credit for the range of successful fundraisings and clinical trial outcomes in the portfolio, and the team’s high-conviction investment selection has been validated by market transactions,” Winterflood analysts said.

“As the fund’s de-rating over the past two years was largely driven by interest rate rises, a reversal of the monetary trajectory could aid a recovery this year. Furthermore, the enhanced scale that may result from the proposed merger and the remainder of the $10m pledged towards buybacks (£1.7m deployed) should be supportive as well.”

Impax Environmental Markets, with its focus on environmental and resource efficiency markets, benefits from “a highly experienced management team and its current discount of 10% is at one of the widest levels seen in the past five years”.

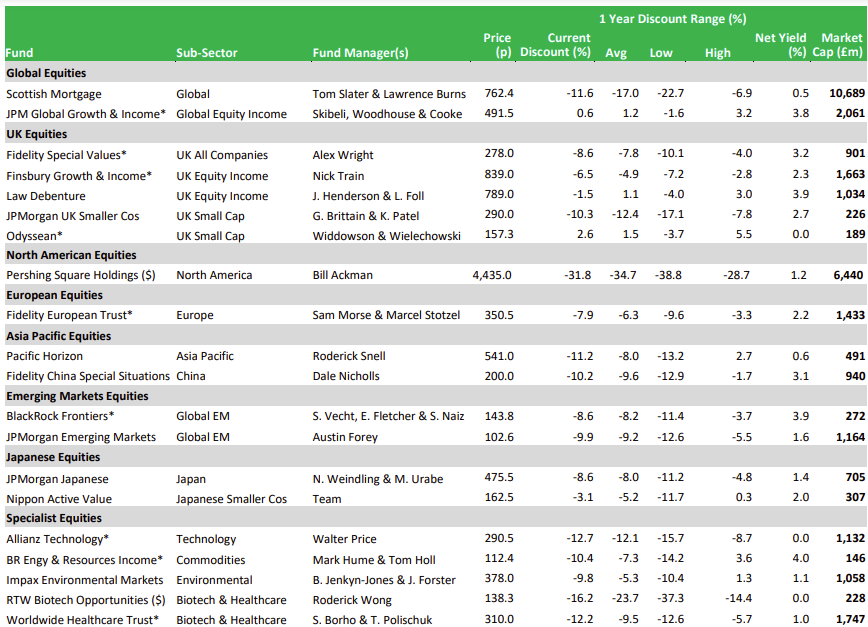

Winterflood’s 2024 equity trusts recommendations

Source: Winterflood