In its latest The Longest Pictures report, Bank of America attributes the quote “buy humiliation, sell hubris” to an unnamed in-house strategist. The meaning, of course, is well-known: investors should buy undervalued assets, often ignored or disliked by the market, and sell overvalued ones that are perhaps too popular or overhyped.

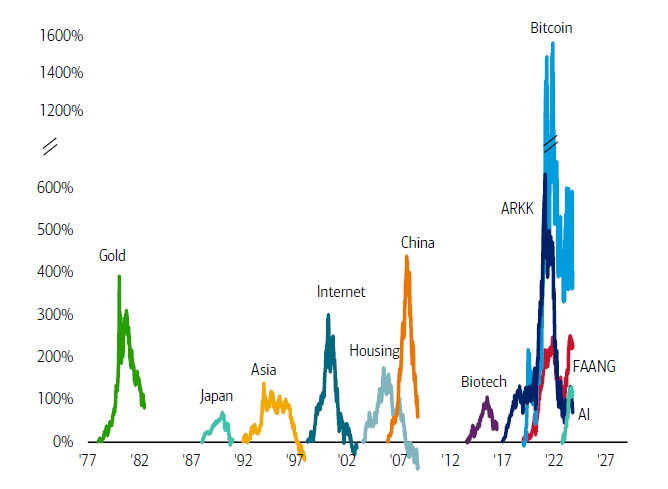

History of asset bubbles since 1977

Source: BofA Global Investment Strategy, Bloomberg

Bubbles are a recurring feature of markets, as investors tend to overestimate the future prospects of ‘hot’ assets and bid up their prices to unsustainable levels.

Bank of America’s chart above shows some of the most notable bubbles since 1977, such as the Japanese stock market in the late 1980s, the dot-com bubble in the late 1990s, and the US housing bubble in the mid-2000s.

Each of these bubbles was followed by a sharp correction that erased most of the previous gains and caused significant losses for many investors. Bubbles are often driven by psychological factors, such as greed, fear and herd behaviour, as well as by fundamental changes in the economy, technology or regulation.

Bank of America argued the bubble that has burst in 2022 and 2023 is the bond bubble, after rising interest rates brought the era of ultra-loose monetary policy to an end. However, they warned that the next bubble might not be too far behind.

“The asset class most bubble-like in 2023 is AI and the Magnificent Seven big tech monopolies/oligopolies which until recently accounted for well over 90% of all the market cap gains in the S&P500 this year; we have termed this a ‘baby bubble’,” its strategists said.

“The Magnificent Seven trade on roughly 30x earnings versus the rest of the US market which trades on 15x; we fear the ghastly lack of breadth in the US equity market will be resolved via the ‘strong’ getting weak before the ‘weak’ get strong.”