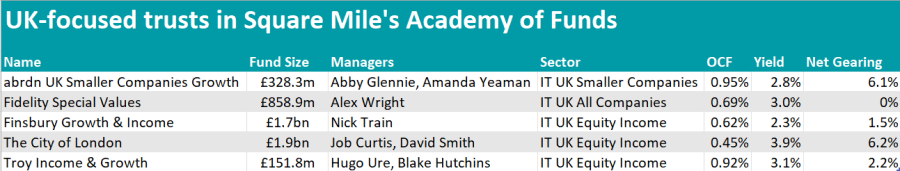

Square Mile has added five UK trusts to its Academy of Funds, which opened its doors to investment companies for the first time last week.

At the first time of asking, the list of UK trusts included three vehicles in the IT Equity UK Income sector, one broader UK equity strategy and one focusing on UK smaller companies, as per the list below.

Source: FE Analytics

Square Mile also reviewed trusts in the IT Global, IT Multi Asset and regional sectors.

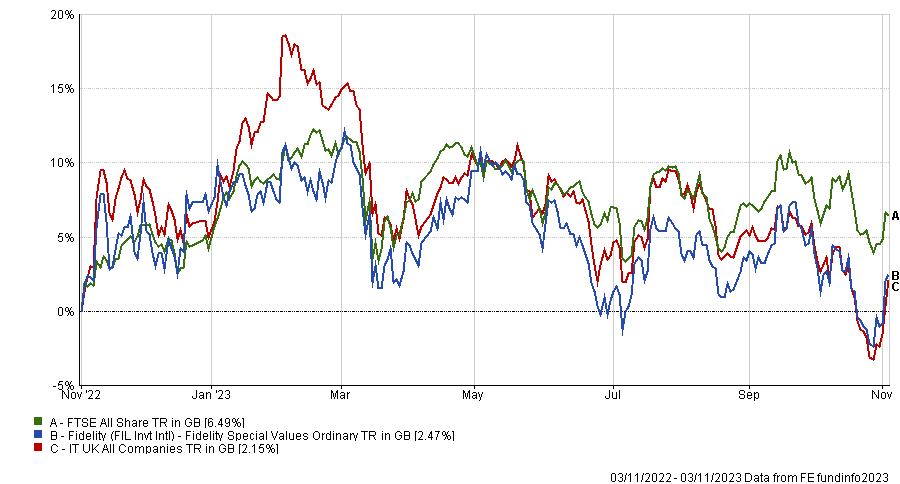

For an all-cap exposure to the UK equity market, the team selected Fidelity Special Values, the £885m trust that invests with a contrarian mindset in companies which manager Alex Wright believes are undervalued or where the potential has not been recognised by the market.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

The trust should be able to outperform the FTSE All Share index by 2.5% per annum over the next five years at least, by maintaining a bias to medium and smaller-sized firms and also allocating to overseas listed companies where “a compelling opportunity exists or a similar investment is not available in the UK market”, according to Square Mile analysts.

“The contrarian approach applied and the trust's bias towards the lower end of the market capitalisation scale will undoubtedly be important drivers of return, a fact that has been borne out in relative performance, and can also lead to higher levels of volatility when compared to the wider market at times,” they said.

“In our opinion, this trust is a compelling proposition run by a highly motivated and passionate investor. Ultimately, there is a lot to like here, especially the fact that the manager has remained consistently true to his investment style.”

In the income space, Finsbury Growth & Income was highlighted, which currently yields 2.28% and is run by the “highly experienced, articulate and thoughtful” Nick Train, whose philosophy is to choose strong businesses and hold them for the long term.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

Because of the strict criteria, only 20 to 30 stocks make it into the portfolio which, together with the trust’s “sizeable asset base” (£1.7bn of assets under management) and the liquidity profiles of some of the underlying companies, “could lead to a deterioration in liquidity”.

Square Mile is nonetheless convinced that the trust should be able to achieve its long-term objective of outperforming the FTSE All Share index by 2-3% per annum.

“The trust has successfully and consistently met its long-term performance objective and we have conviction in the manager and his ability to continue to meet this over the long term,” the ratings provider said.

“Nonetheless, we would stress that this strategy is probably best suited to investors that have little interest in the month to month and year to year performance of their investments, but instead seek attractive returns over very long time periods.”

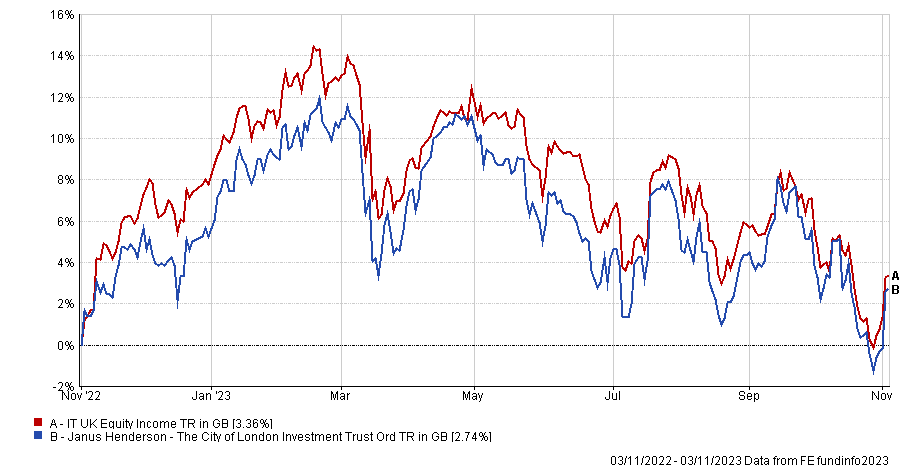

Next up is the City of London investment trust, which, unlike many UK equity income fund managers, is primarily focused on larger companies, especially those that are financially robust enough to weather economic storms and continue to pay and increase dividends to shareholders over the medium to longer term.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

Run by Job Curtis, the trust generates a yearly income of 4.95% for investors.

“The larger market cap profile gives this trust a point of differentiation from many income peers, especially those that invest across the market cap spectrum. In essence, this is an income focused strategy that invests in a very liquid portfolio, has a lower beta but higher quality and less indebted portfolio than the broad UK market,” researchers said.

Other positives according to Square Mile are the trust’s “enviable record of increasing its distributions to investors”, with dividends increasing every year since 1966, and its “exceptionally competitive” level of fees, which provides “a material tail wind for the portfolio's ability to outperform the wider UK market and peers”.

The last strategy in the IT UK Equity Income sector is Troy Income & Growth, which was ranked despite the recent difficulties in terms of performance and the recent change of manager line up, with Blake Hutchins joining Hugo Ure as co-manager in 2020.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

The vehicle “continues to be managed in a consistent manner” and “remains suitable for investors seeking a lower risk UK equity income strategy”, with the overall the consistency of returns and protection during periods of market stress that should compound into a “rewarding” investment.

“While there is a clear focus on providing a premium yield over the market, the managers will not unnecessarily place capital at risk by chasing higher yielding yet perhaps more risky and less income reliable stocks,” the analysts said.

“The managers and indeed the firm very much consider risk as the potential for permanent loss of capital and rightly take pride in this strategy's capacity to provide protection in more volatile periods.”

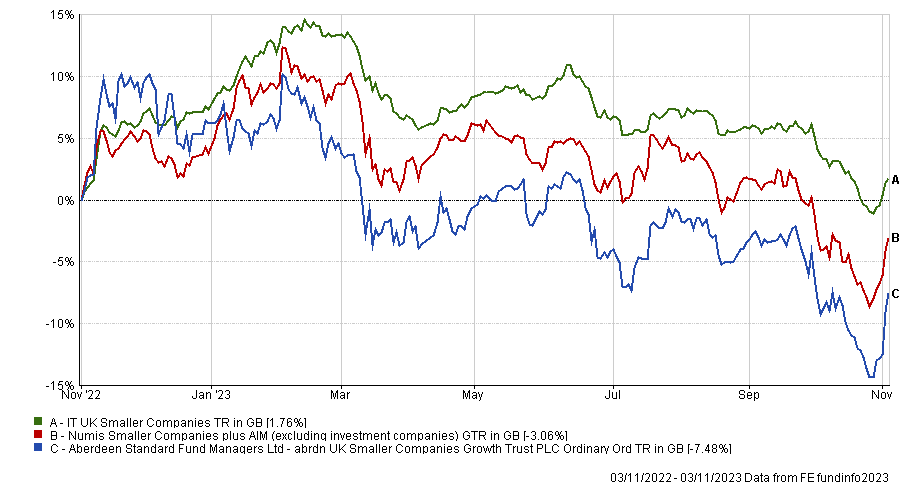

Finally, the abrdn UK Smaller Companies Growth trust is Square Mile’s pick for the IT UK Smaller Companies sector.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

“Highly capable and pragmatic” Abby Glennie stepped up from co-manager to lead manager at the end of 2022, when predecessor Harry Nimmo retired, and takes “a dispassionate view on stocks” held in the portfolio, which all meet objective criteria for quality, growth and the potential to be “future leaders” in their fields.

“Overall, we believe that this is a credible investment proposition for investors looking for longer term exposure to the smaller echelons of the UK market,” concluded Square Mile.