The number of companies leading the S&P 500 has narrowed in recent times, with just seven stocks commanding nearly 30% of the index.

Experts have warned that this concentration in the “magnificent seven” (Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta) leaves investors vulnerable should these shares fall, either through earnings-related issues or they eventually run out of momentum.

It would therefore be prudent to get some diversification even among the big US passive funds, which are predominantly invested in the index heavyweights.

Tom Sparke, investment manager at GDIM, suggested Tyndall North American, which takes meaningful positions in the manager’s highest conviction ideas.

He said: “It has a high active share and currently holds some refreshingly unfamiliar names in its top holdings, such as DraftKings, Fair Isaac and Lennar Corp.

“The fund does hold some allocation to Meta and Alphabet but these are proactive decisions rather than benchmark positions. This blended approach provides genuine diversification and would be a good selection alongside the ever-popular tracker funds.”

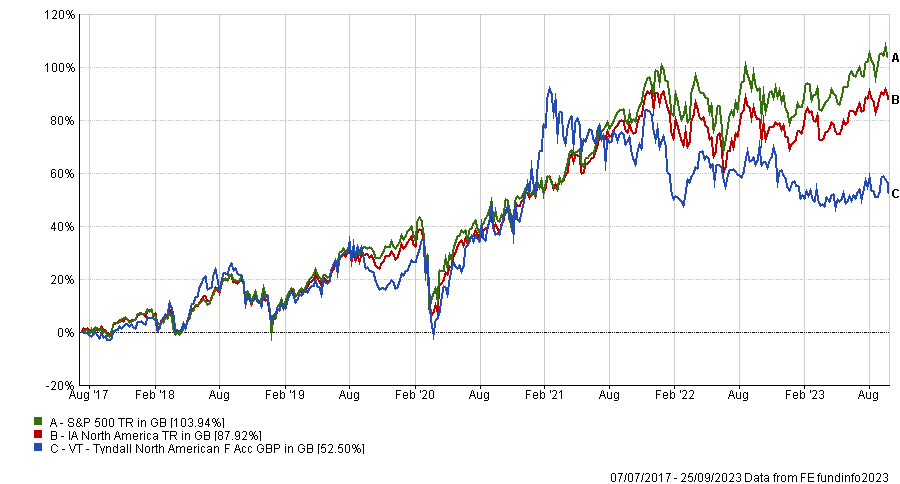

Performance of fund since launch vs sector and index

Source: FE Analytics

Since its launch in July 2017, the fund has underperformed both the S&P 500 and the IA North America sector, but the period has been largely dominated by US tech mega-caps.

Another option to complement an S&P 500 tracker is Premier Miton US Opportunities, which takes a multi-cap approach in its investment process.

Rob Morgan, chief analyst at Charles Stanley, said: “An attraction is its ability to search for opportunities from the small to the very large in terms of company size and the flexibility with which the portfolio is managed.

“The managers’ approach centres on identifying good-quality companies and paying appropriate valuations. They are not wedded to ‘growth’ or ‘value’ stocks, preferring to take a more nimble and pragmatic approach.”

Performance of fund over 10yrs vs sector and index

Source: FE Analytics

Although the fund lags the S&P 500 over 10 years, it has beaten most peers in that period and sits in the second quartile of the IA North America sector in terms of performance.

Morgan added: “Large-cap technology names getting ever more expensive has been a headwind, but good stock selection further down the market cap spectrum has compensated for this.”

As the US tech mega-caps are associated with growth investing, a fund taking a value-based approach can also be a good pairing for an S&P 500 tracker.

Therefore, Morgan suggested Fidelity American Special Situations, managed by Ashish Bhardwaj and Rosanna Burcheri, who aim to uncover businesses that are unappreciated and therefore cheap.

He said: “The aim is to provide a ‘margin of safety’ by buying into fundamentally sound companies below their true worth. To guard against ‘value traps’ the process aims to identify stocks with an identifiable long-term tailwind that are not part of a ‘dying’ industry.”

Performance of fund over 10yrs vs sector and index

Source: FE Analytics

Not holding any of the tech mega-caps has hampered relative performance and the fund sits in the third quartile of the sector over 10 years as a result.

Yet Morgan said that the fund is well positioned to benefit if the gap between the magnificent seven and the rest of the market closes, as seen during the value rally from December 2021 into 2022.

He added: “It was a spell in which the fund significantly outperformed because the more richly-valued, growth-orientated parts of the market sold off most aggressively and the team’s valuation discipline kept them out of the worst performing areas of the market.”