Investors looking to find top funds that are flying under the radar may look to smaller fund groups with fewer portfolios to choose from in an attempt to beat the market, but not all asset managers with a limited range are small.

Between them, Fundsmith and Lindsell Train run portfolios with a combined £34.2bn in assets under management – although £23.7bn of this is in the Fundsmith Equity fund alone.

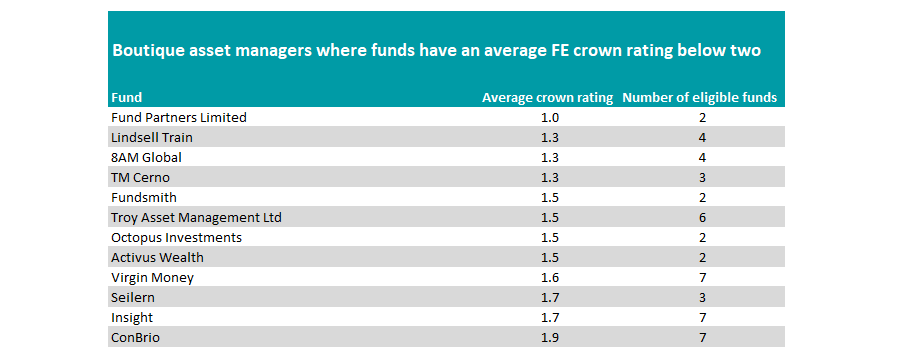

However, they may not be the best choices for investors looking to pick a group with highly rated funds, as both have among the worst average FE fundinfo Crown across boutique fund groups.

Yesterday we looked at the larger asset managers with the highest and lowest average crown ratings. In this research we take a look at the boutique groups, filtering out those with between two and nine funds in their suite of offerings.

Lindsell Train has lower average of the two at 1.3 crowns. Of its four funds, only LF Lindsell Train North American Equity does not have a rating of one (it has a score of two).

Meanwhile, Terry Smith’s Fundsmith group has an average of 1.5 crowns, with the flagship fund down to two crowns and Fundsmith Sustainable Equity getting a one-crown rating.

Like Smith, Nick Train and Michael Lindsell hold FE fundinfo Alpha Manager status – which proves that their long-term track records have been stellar. However, despite very different holdings, both portfolios are run with a quality-growth bias, picking companies with strong brands that should stand many economic environments.

Some of these names are known as ‘bond-proxy’ stocks and have been a strong place to be over the past decade as low interest rates forced fixed income investors into equities to chase a yield.

However, with rising rates brought about by increased inflation, their returns in more recent years have stuttered, causing these funds to underperform.

Fundsmith Equity has dropped to the third quartile of the IA Global sector over three years, while the flagship Lindsell Train Global Equity fund is in the fourth quartile over this timeframe.

Source: FE Analytics

Troy Asset Management is another big name among the list. Four of its six funds have a one-crown rating including Trojan, Trojan Ethical and Trojan Income.

Its managers run money with a lean towards capital preservation and protecting investors when markets get rough. However, this means that they can miss out on sharp market rallies and, as such, all of the group’s funds are in the third or fourth quartile over the past three years.

The fund group with the lowest average crown rating is Fund Partners, with both the Foresight Global Real Infrastructure and Foresight Sustainable Real Estate Securities funds getting a one-crown rating at the latest rebalance.

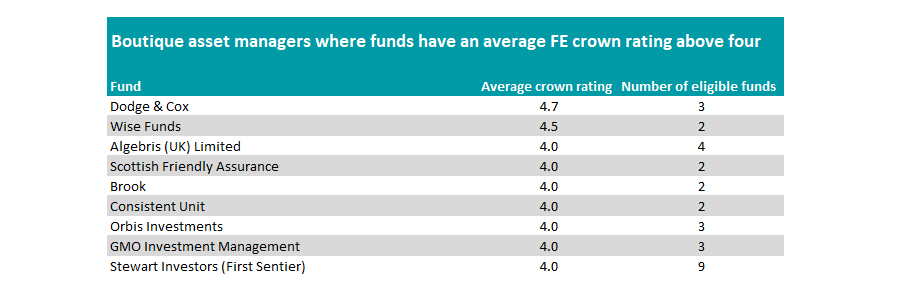

Turning to the fund groups with the highest average crown ratings, US firm Dodge & Cox takes the top spot with an average crown rating of 4.7. Dodge & Cox Global Stock and Dodge & Cox US Stock both hold five crowns while Dodge & Cox Global Bond Fund holds four. All have been top-quartile performers in their respective sectors over three years.

The only other group above five is Wise Funds, with a 4.5 average rating. TB Wise Multi-Asset Income has five crowns while TB Wise Multi-Asset Growth has four.

Source: FE Analytics

For this study, Trustnet looked at those with more than 10 portfolios in their stable with an FE fundinfo Crown Rating. The criteria for the crowns is made up of three parts, each with a reference to a benchmark – an alpha-based test, a volatility score and a consistency score, calculated over a three-year period.

The top 10% of funds in the Investment Association universe are given a rating of five, with the next 15% allocated a four-crown score. The next 25% are allocated three crowns, while next and final 25% of funds are allocated a two- and one-crown rating.