So far this year investors have been rewarded for keeping the faith with tech stocks, which have boosted returns of global stock markets, but there has been little to cheer elsewhere, according to Trustnet research.

Inflation remains sticky, with central banks continuing to up interest rates in an attempt to stymy rising prices, leading to a range of consequences for different assets.

Below, Trustnet reviews the first half of the year from a range of viewpoints to show what worked for investors and what did not.

Asset classes

Investors could be forgiven for thinking this year has been a strong one for returns, but it has only been in stocks where meaningful gains have been made.

The MSCI AC World index has risen 7.8% so far this year as investors have bet on central banks getting to grip with inflation and interest rates levelling out, which has led them to be more willing to take on risk.

While global stocks have risen, it has largely been the only game in town with the next best – gold – down 0.3% in sterling terms.

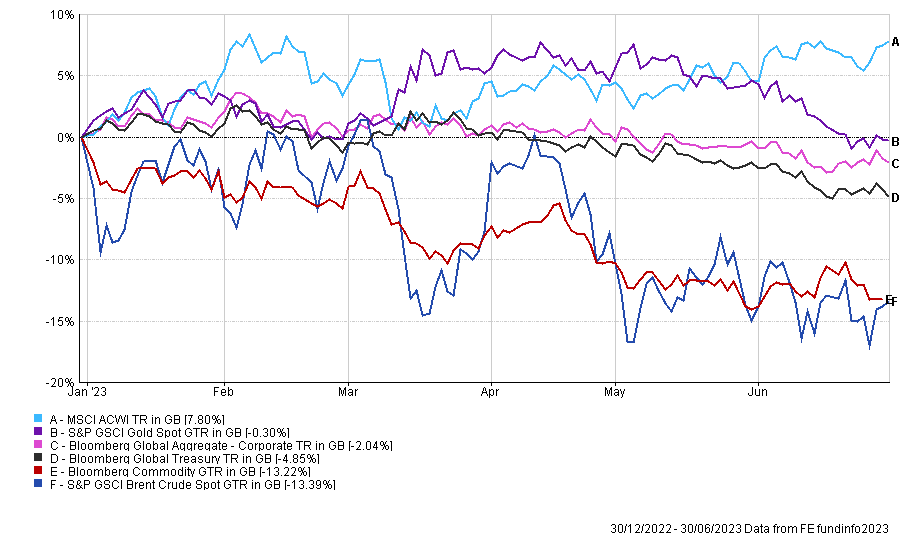

Performance of asset classes in H1 2023

Source: FE Analytics

Bonds have had a disappointing year, with the Bloomberg Global Aggregate index (measuring corporate bonds) and Bloomberg Global Treasury (representing government bonds) down 2% and 4.9% respectively as rising rates have increased prices.

However, the worst area to be invested in has been oil – the darling of 2022. The S&P GSCI Brent Crude Spot index rose 53.7% last year but has dropped 13.4% so far year-to-date, while the wider Bloomberg Commodity index is down 13.2%.

Geographies and themes

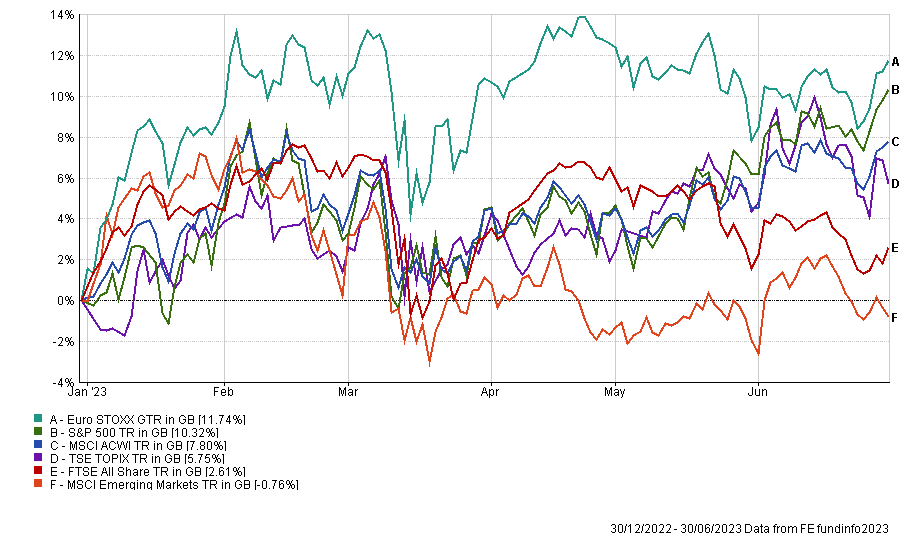

Looking at individual markets, Europe has made the biggest comeback this year, up 11.7% as investors have returned to the market despite the ongoing war in Ukraine and poor economic data.

The outperformance of the European equity market has been out of step with the European economy, according to Jupiter Asset Management fund managers Mark Nichols and Mark Heslop.

With inflation still high, the European Central Bank (ECB) increased rates last month by 25 basis points to 3.5%, despite the economy being in a mild recession.

Investors have been cheered by the mild winter and subsequent reduction to the risk of an energy crisis, while managers have noted that the market is not the same as the domestic economy, with many large international businesses more in tune to the wider global economy.

Performance of stock market indices in H1 2023

Source: FE Analytics

Just behind the European market was the S&P 500, with the largest US companies up 10.3% over the first half of 2023.

The rise of artificial intelligence (AI) has contributed to a resurgence for the sector. Not all are convinced it makes a good investment however, with Luca Paolini, chief strategist at Pictet Asset Management, describing this as “AI mania”.

“Wall Street trundled back into bull market territory during June, but the move feels unconvincing,” he warned.

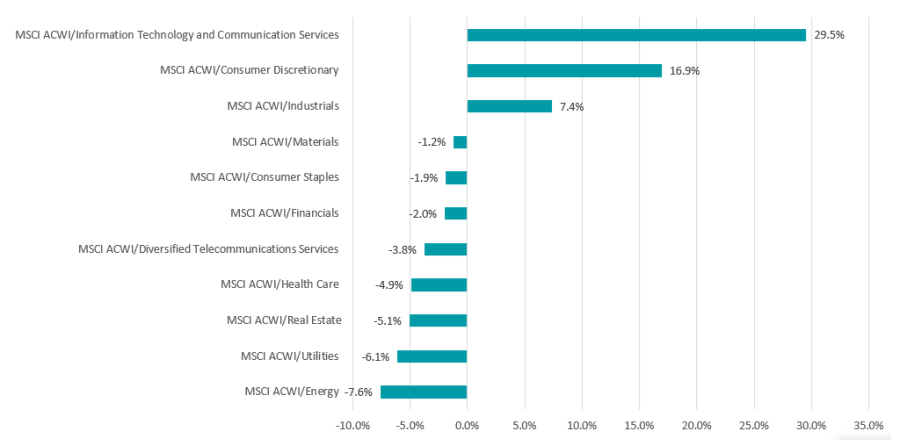

This theme can also be seen in the performance of global industries below, with tech names leading the charge despite rising interest rates, which hampered the sector in 2022.

Performance of global industries in H1 2023

Source: FE Analytics

Consumer discretionary stocks have also held up well this year despite the squeeze on household finances by rising interest rates and higher prices as investors forecast softer inflation figures, while energy, utilities and real estate have all struggled in 2023 so far.

Investment styles

Growth and quality were the clear winners of the first half of the year as investors were encouraged by the strong rebound in global growth.

Performance of investment styles in H1 2023

Source: FE Analytics

Paul Mielczarski, head of global macro strategy at Brandywine Global Investment Management, said this was driven by three main factors: the removal of COVID-19 pandemic restrictions in China; the reversal of the energy shock in Europe; and a decline in headline inflation, which boosted consumer incomes and spending.

Fund sectors

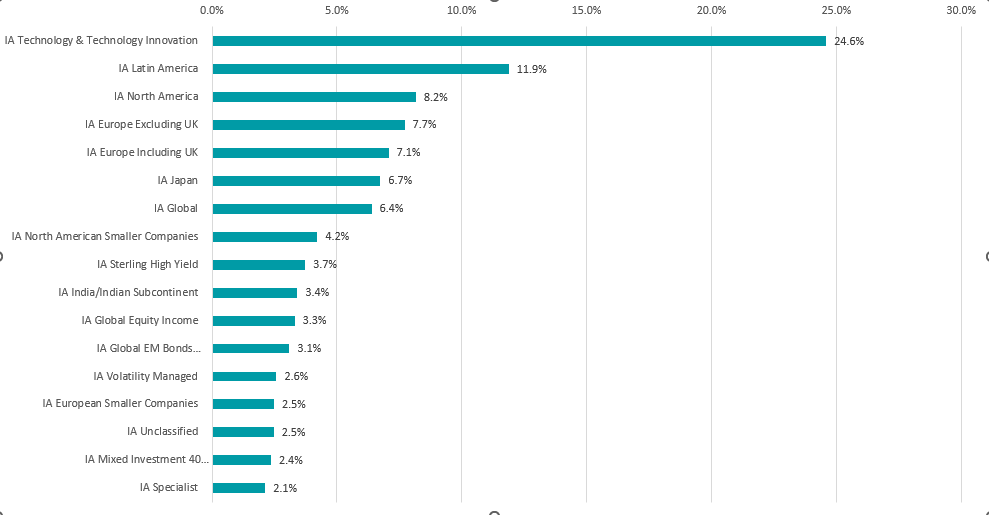

Sticking with the technology theme, the performance of Investment Association sectors tracked those of the charts above, with technology specialists leading the way.

There were also healthy gains for those in the IA Latin America sector, which was boosted by an increase in trade with the US, as the latter continues its ongoing dispute with China.

Performance of the top performing IA sectors in H1 2023

Source: FE Analytics

European and American funds also performed strongly, while Japanese portfolios rose 6.7%. The BlackRock Investment Institute said the outlook was “brightening” for the market and was considering upping its modest underweight to the region last week.

“The Bank of Japan likely winding down its ultra loose policy slowly and corporate reforms differentiate Japan’s stocks from developed market peers, we think, even as we stay cautious on developed markets overall,” it said.

“We see higher inflation spurring households to search for better returns instead of hoarding cash, especially as incentives for stock investment are rolled out and think foreign investors could consider unhedged Japanese equity exposures to benefit from any yen strength.

At the other end of the spectrum, China funds struggled after disappointing economic data in April and May amid continuing friction with the US.

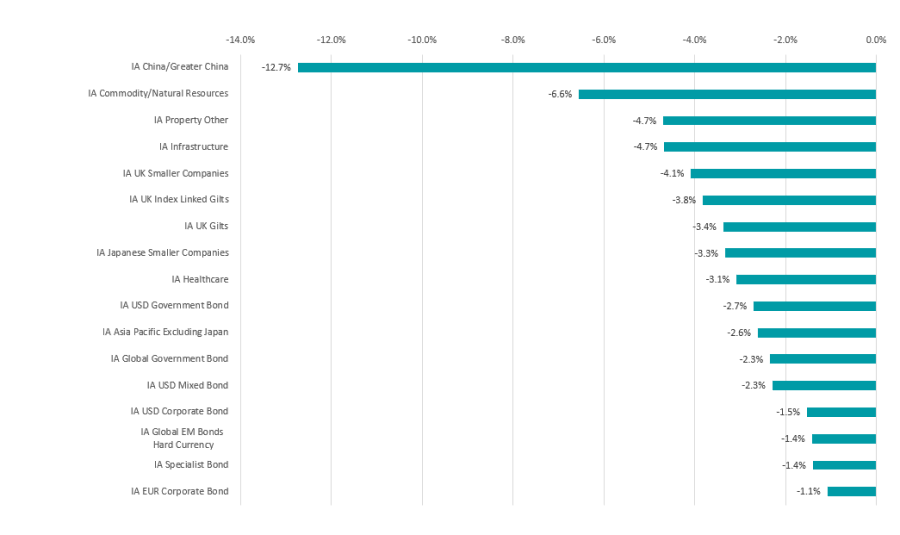

Performance of the worst performing IA sectors in H1 2023

Source: FE Analytics

Commodity funds were also lower on the back of a slower than expected recovery in China, viewed as the world’s manufacturer, while property and infrastructure funds also dropped, as investors moved away from dependable dividend streams sought after during times of economic uncertainty.