India recently overtook China as the most populous country, with a population exceeding 1.4286 billion people versus 1.4257 billion in China.

While it does not make much of a difference for investors in the immediate term, it illustrates the changes in dynamics for the two Asian giants and their growth prospects.

Going forward, India will benefit from a demographic dividend while China is already struggling with an ageing society.

Kristy Fong and James Thom, investment directors at abrdn New India Investment Trust, said: “Half of India’s population are below the age of 30, making for a growing middle class and strong workforce over several decades.

“This also places the country well towards becoming the world’s fastest-growing major economy in the coming years.”

In addition to demographics, Templeton Emerging Markets lead portfolio manager Chetan Sehgal highlighted improvements in India’s infrastructure, bureaucratic practices and taxation.

He said: “Over the past decade, infrastructure investment has surged, the ease of doing business has improved and the government’s fiscal position has been transformed by improved tax collection and the introduction of a national value added tax.”

Perhaps as a result of those improvements, Indian equities have been thriving in the past 10 years, outperforming both the Chinese and emerging markets indices.

Performance of indices over 10 yrs

Source: FE Analytics

Moreover, India already benefits to some degree from the China Plus One strategy (where companies avoid investing solely in China and diversify to other destinations) as a result of geopolitical tension between China and the West as well as the increase in costs to do business in China.

Arnab Das, global market strategist at Invesco, said: “Apple, for example, has begun manufacturing iPhones in India; Taiwan’s Foxconn and others are establishing manufacturing presences.

“India’s government is pulling out all the stops with massive infrastructure projects in road, rail, ports and airports to facilitate a manufacturing renaissance to reintegrate the Indian economy internally and with the wider world, and restore India’s weight in manufacturing and trade towards its high pre-colonial global market shares.”

In spite of those improvements, Vinay Agarwal, co-manager of the FSSA Indian Subcontinent All-Cap, does not believe India will grow as fast as China did over the past decades.

He said: “India's manufacturing share is very low. Services represent 60% of the GDP while manufacturing is 15% or less.

“For such a large young population to get jobs, manufacturing has to become bigger. Otherwise you will have a big social problem of educated youths who cannot find a job.”

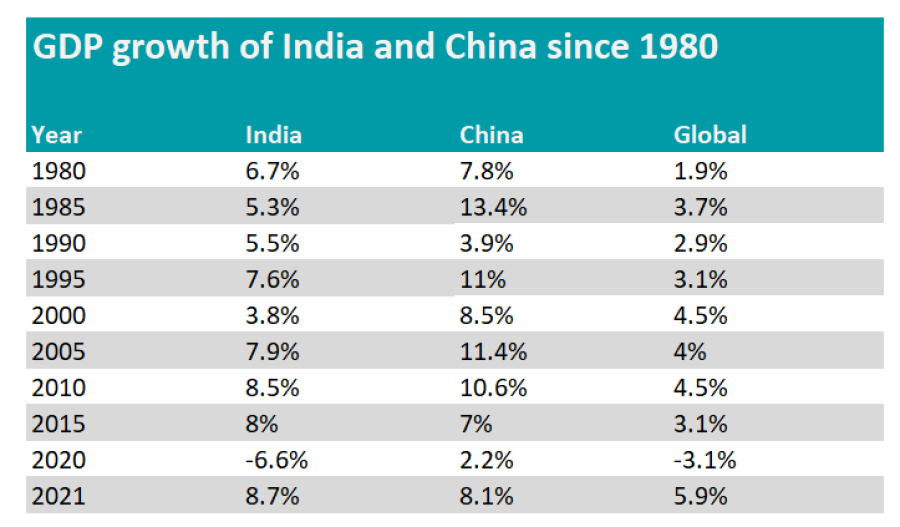

GDP growth of India and China since 1980

Source: The World Bank

Another headwind for India is that it will not be able to use the same amount of resources for its development as Western countries did in the last 200 years or China in the last 50 years.

“India will have to find a way to use less resources to achieve that potential growth,” Agarwal said.

“This is why I don't think India can ever grow at those rates, like China did, because it's just not possible. It would be great if India could have 10% real growth, but I don't think it can happen.”

Yet, he added that growth should be steadier and more stable than in China due to the democratic administration in India.

However, Invesco’s Das added that rules, rights and responsibilities stand in the way in “India’s complex democracy”.

Notwithstanding the previously mentioned improvement in recent years, land acquisition to establish plant and transport links is still difficult, labor rules are still very tight and tax rules as well as judicial disputes are still complicated and lengthy.

Das said: “These are all front burner reasons why India’s economy is dominated by agriculture, like many other low-income countries; and services, like high-income countries; but not manufacturing, unlike China.”