Central banks have been striving to fight inflation since March 2022, but they won’t be allowed to crush it as they could, said Steve Russell, investment director at Ruffer.

The medicine they administer in the form of interest rate hikes might be too bitter to be politically viable or practically acceptable by markets going forward, with the manager predicting that politicians will step in and gain more say over what happens to markets in the future.

Central banks and governors like Jerome Powell have had too much power, but that is about to change.

“They have been effectively the masters of the universe for the past 20 years. Whatever they said happened and they could control everything. Now we think that's finished and that they are now the servants of the broader world, who don't call the shots as such anymore,” he said.

“While they absolutely could crush inflation if they really wanted to, the level of pain and the degree of interest rate rises needed to do that will not be politically acceptable or practically acceptable in markets, as they would blow up banks, blow up markets and cause vast amounts of unpopular unemployment, and so they are not going to be allowed to fight inflation.”

“Politicians, for good or bad, are going to be a bigger force in directing what happens in financial markets, which was the case traditionally. I’m not at all sure that's a good thing, but in the past 20 years there’s been an extraordinary swing in power, return and reward from labour to capital, and that is long-term politically unacceptable,” he concluded.

Markets are already feeling the brunt, as we are in the process of moving from a regime that was very asset-friendly, characterised by low inflation and low interest rates, to one of “persistently higher inflation and higher interest rates”, where risks come from two different directions.

“One is inflation, which continues to surprise on the upside, and the other is liquidity and the persistence of higher interest rates, which are bringing forward the risk of a recession. Markets haven't properly repriced that shift yet,” said the manager.

Investors don’t seem to realise this and have been allocating more money back to the riskier areas of the market that were thriving before 2022. For example, they were more bullish on the technology sector in the first months of the year, as Trustnet revealed in a recent feature, but Russell believes this move won’t reward them.

“There's a muscle memory within investors, especially among those who were not around 10 or 20 years ago, who think that we're going to go back to the old normal of interest rates close to zero and growth stocks and the FAANGs returning to be market leaders,” he said.

“The events of the first quarter, with that short but very sharp rally in January on the backdrop of China reopening and a return to quite a few of the tech poster children of the latest bubble, or bull market, are understandable, but we don't believe it will last. Unfortunately, 2022 is representative of the new normal. Albeit painful, the blueprint for what will happen going forward is 2022, not 2023.”

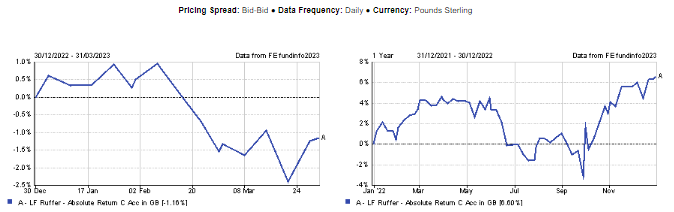

Russell’s fund didn't join the rally in the first quarter, as shown in the chart below, but “quite happily so”.

“Not owning any of those stocks was quite useful for us in helping us make a positive return and make money for clients through 2022, when pretty much everyone else was losing money in whatever asset class they were,” he said.

Performance of fund in 2022 and over the year to date

Source: FE Analytics

Asked what the role of central banks will be if inflation is to remain high, Russell took “the typical Ruffer long-term view, with the benefit of hindsight over the past 20 years”, which allowed him to say that central bank inflation targets were “simply too high”.

Central banks had to work “too hard” in trying to keep interest rates extraordinarily low to hit an “almost impossible” target of 2%.

“It is a natural and probably good thing for that pendulum to swing back more towards labour so more inflation, more wages, less low interest rates, even if it's going to be a painful transition for financial markets,” he said.