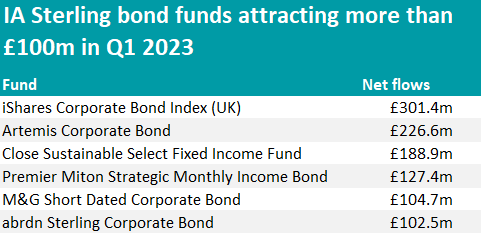

The great bond resurgence of 2023 has been relatively slow to get going, data from FE Analytics shows, with just six funds across the IA Sterling Strategic Bond, Sterling Corporate Bond and Sterling High Yield sectors taking in more than £100m in the first quarter of the year.

Many have predicted that this will be the year for fixed income as the rising interest rates environment means bonds offer good levels of returns for the first time since quantitative easing began post the financial crisis.

Equity investors are even feeling the competition, as Sam Witherow, manager of the JPM Global Equity Income fund, admitted in a recent Trustnet article.

“It’s a very painful thing for an equity investor to say but I do agree that bonds are back,” he said. “If I wasn’t managing this fund, I’d have a higher allocation to bonds today than I would a couple of years ago.”

Within the fixed-income space, high-yield bonds are offering yields close to double digits, and Fatima Luis, senior portfolio manager at Mirabaud Asset Management recently wrote on Trustnet that “the risk/reward trade-off is currently more favourable in high yield than in equities, as you still have double-digit upside in credit, but with much greater downside protection”.

Investors, however, have largely shunned the IA Sterling High Yield sector in the first quarter of 2023 and preferred investing in funds from the IA Sterling Corporate Bond and the IA Sterling Strategic Bond sectors, as the latest flows data from FE Analytics showed.

The most-bought vehicle in this period was an index fund, iShares Corporate Bond Index, which was the only passive investment in the list and attracted £301.3m, as the below table shows.

Source: FE Analytics

Corporate bond portfolios were the clear winners, with four out of six funds belonging to the IA Corporate Bond sector.

In second position was the £1.3bn Artemis Corporate Bond, which, according to Square Mile researchers, follows “an active approach focused on alpha generation.”

“This is a high-conviction sterling corporate bond fund managed by Stephen Snowden, one of the most experienced fund managers in the sterling corporate bond market sector,” they said.

The fund doesn’t have any style bias and added £226.6m in the first months of 2023.

The abrdn Sterling Corporate Bond and M&G Short Dated Corporate Bond fund also attracted investors’ attention. The latter has a five-crown FE fundinfo rating and didn’t shoot the lights out in the past three years, but is also the one of the three with greater downside protection, having only lost 2.1% in the calendar year 2022, when the rest of the market capitulated (the Artemis fund lost 15.6%, abdrn’s 20%).

The two strategic bond funds on the list were Premier Miton Strategic Monthly Income Bond and Close Sustainable Select Fixed Income. The former is co-led by FE fundinfo Alpha Manager Lloyd Harris, who currently invests 67% of the portfolio in investment-grade and 14.8% in high-yield bonds – primarily in the banking sector (40.1%), insurance (14.1%) and other financial services (12.6%) with a yield of 5.6%; the latter is a FE fundinfo five-crown-rated portfolio yielding 5.1%.

We have to loosen the criteria to encounter the first IA Sterling High Yield fund, Man GLG High Yield Opportunities, which gained £85.3 of investors’ new money.

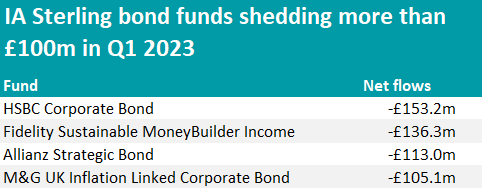

Source: FE Analytics

Among the funds that shed the most money, HSBC Corporate Bond had the biggest disappointment, as it lost £153.2m of assets under management (AUM) and almost halved in size to £195.7m.

The £2bn Fidelity Sustainable MoneyBuilder Income fund, also in the IA Sterling Corporate Bond sector, didn’t convince investors either. In total they withdrew a net £136.3m in the first quarter.

Although the former has a more significant bias towards UK fixed income than the latter, which focuses on Europe and North America instead, the two funds are very highly correlated to each other and have moved in tandem 99% of the time in the past three years.

Finally, the most-sold strategic bond portfolios were M&G UK Inflation Linked Corporate Bond and Mike Riddell’s popular Allianz Strategic Bond portfolio.

According to FE Investments researchers, the Allianz fund “has been able to offer an impressively low correlation to equities in recent years meaning valuable diversification is added to portfolios”.

“A large reason for this is due to the manager’s proven ability to add value from four independent return drivers: credit, interest rates, inflation and currency,” they said.

“Riddell has been able to time fixed-income markets impressively for the most part, often by implementing contrarian views that have driven superb performance over the long term.”

As for the M&G fund, Square Mile researchers said it “should provide investors with a good hedge against UK inflation over the medium to long term, but may deviate from its goal over the short term, as technical and sentiment-driven factors can affect the fund's price”.