Gross domestic product (GDP) in the UK stagnated in February as strike action put the breaks on economic growth, according to new data from the Office for National Statistics (ONS).

The economy grew 0.4% the month prior, but some of the sectors most hit by industrial action – education and public administration and defence – dragged on the UK’s performance in February.

Strike action across these sectors dampened growth at a time when the UK should be recovering from the volatility of last year, according to Susannah Streeter, head of money and markets at Hargreaves Lansdown.

She said: “The armies of striking public sector workers have stamped out the signs of green shoots that had been emerging in January and before the chill winds of the banking crisis blew up in March.

“Industrial strife is piling on pressure just when the economy needs it the least, as stagflation takes hold, and this will put the government under extra pressure to come up with resolutions.”

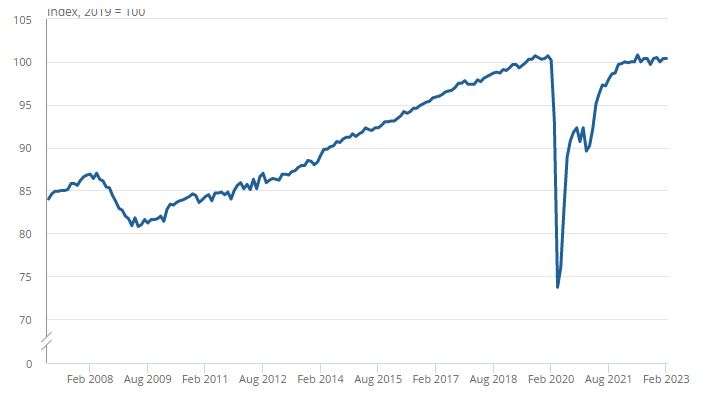

UK GDP from January 2007 to February 2023

Source: ONS

However, the fact that industrial strikes are holding growth back is more solvable than having fundamental problems in the economy, according to Jonathan Moyes, head of investment research at Wealth Club.

He said: “The release will do little to change the gloomy outlook for the economy, but if one were looking for positives in the data, unseasonably warm weather and industrial action were the chief drivers of lower growth, rather than a downturn in general business and consumer spending.”

Even so, with further industrial strike action scheduled throughout April, Charles Hepworth, investment director at GAM Investments, said that it is likely to remain a problem for GDP growth over the coming months.

Likewise, recent forecasts from the International Monetary Fund suggest the UK will be the slowest growing G7 economy. This, paired with high inflation expectations, paints a bleak outlook for the economy.

Hepworth said: “Inflation data will still be the driver for Bank of England policy, which is more than likely past the peak but a stagnating economy.

“However, expectations of inflation to continue to underperform other developed market peers still puts UK risk assets in the unloved box for global allocators.”

Despite these headwinds, Derrick Dunne, chief executive of YOU Asset Management, said that there is still room for optimism.

Inflation in the UK has fallen from its 11.1% peak in October and is likely to continue dropping from here, which could be followed by a cutting of interest rates by the Bank of England (BoE).

Dunne said: “There will be light at the end of the tunnel if inflation – and in turn, interest rates – become more stable in the coming months as expected, but the effects could take some time to feed through.

“In the meantime, it is essential investors keep their focus on retaining diversified exposures in order to safeguard their long-term goals.”

Chancellor Jeremy Hunt’s claim that “the economy is looking brighter than expected” this morning is difficult to believe, according to Charles White-Thomson, CEO of Saxo UK.

He said that the stagnated growth figures in February are evidence that the UK is an “economic danger zone” and the chancellor will have to work hard to amend it.

“The status quo is increasingly painful and uninspiring, and this should not be about celebrating the avoidance of a technical recession,” White-Thompson said.

“The UK continues to underperform its key counterparties and have underserved the majority and their aspirations. Change is required.”