Investors removed £868m from UK funds in January, the third worst month for outflows on record, according to new data from Calastone, despite the FTSE 100 index reaching an all-time high during the month.

Although the FTSE 100 seems to be defying the doom and gloom hitting most equity markets, investors have been wary and the strong performance has not been enough to tempt investors back to the region.

Rather than enticing investors, the index’s outperformance may have encouraged investors to take advantage of higher prices and sell out of the UK at an even higher volume, according to Edward Glyn, head of global markets at Calastone.

He said: “The combination of January’s near-record high for the UK market with near-record outflows smacks of opportunistic selling against a backdrop of chronic pessimism, exploiting a moment of higher prices to head for the exits.”

This is part of a long-term deterioration, with UK funds losing money for the 20th consecutive month in January. Glyn said that “political instability and a sense of unstoppable decline” were keeping investors away from the UK.

“UK equities used to be a core holding for global investors, but, dominated by a few big cyclical sectors such as oil and commodities or slow-growth giants such as banking, pharma and tobacco, they now occupy a dusty and diminished corner of these big portfolios,” he said.

January may have been a miserable month for UK funds, but it marked a rebound for global portfolios, which took in £969m.

The 18% recovery of the MSCI World index since its trough in October has sparked a wave of optimism, with January being the second-best month for inflows in three decades.

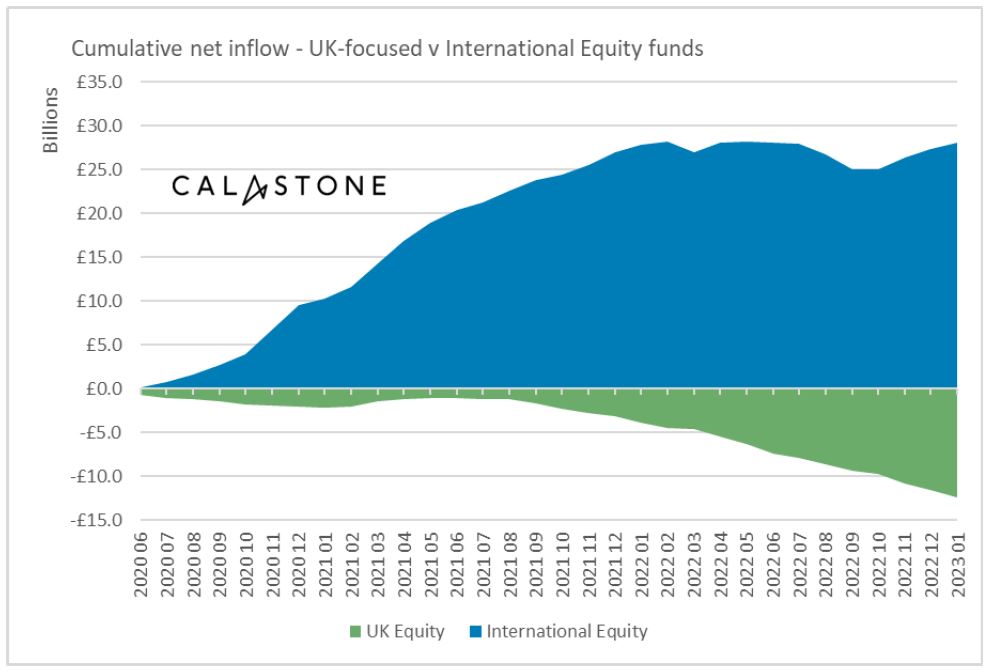

The move away from the UK in favour of global funds has been an ongoing trend for some time – since 2015 investors have removed £7.3bn from UK funds and bought £58bn in global funds.

Cumulative net inflow – UK vs international equity funds

Source: Calastone

Investors are moving away from the UK and into global funds that are likely to return to bull-market conditions sooner, according to Glyn. However, he warned investors that making this leap now could be untimely.

“This confidence may be premature, as although interest rates globally are still on the up and corporate earnings are coming under pressure – this is not yet fully reflected in global markets,” Glyn added.

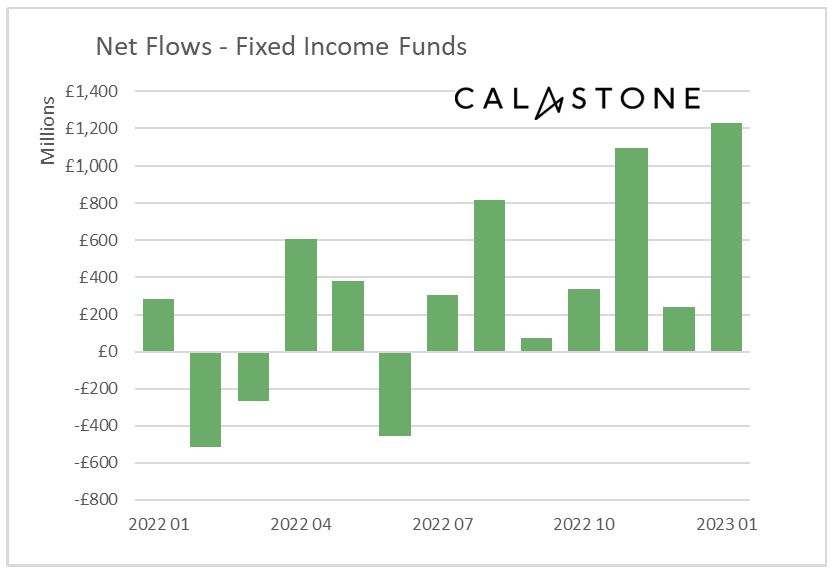

January also marked the second highest inflows on record for fixed income funds, with investors allocating £1.2bn to bonds through the month.

Tightening monetary policies around the world have led to some of the best yields in a decade, creating an attractive investment case for the asset class.

Investors added £3.8bn to fixed income funds over the past year, while withdrawing £6.6bn from equities over the same period.

Net flows – fixed income funds

Source: Calastone

Glyn said: “Central banks are still raising policy rates, though dovish comments from the governor of the Bank of England have also raised hopes that the UK’s rate-tightening cycle is at or near its peak.

“The developing slowdown in the economy and moderating inflation are also likely to push market interest rates lower in the months ahead. All this could signal capital gains to bondholders over time too.”