Almost half of the funds that jumped to the top of the tables during the Covid lockdown have handed back the bulk of their returns and are now underperforming since the start of the pandemic, Trustnet research shows.

When the global economy locked down in early 2020 to slow the spread of Covid-19, markets initially crashed but went onto rally thanks to massive government and central bank stimulus packages.

This rally was led by growth stocks, especially those in the information technology space and linked to a new way of living – online shopping, remote working, sustainability and the like. Funds with high weightings to sectors such as US tech surged in this environment.

Among the best funds for this period are MS INVF US Growth, Baillie Gifford American, iShares Global Clean Energy UCITS ETF, Baillie Gifford Long Term Global Growth Investment, Lord Abbett Innovation Growth and Invesco CoinShares Global Blockchain UCITS ETF.

The bull run in growth stocks was brought to a halt, however, by the announcement of Covid vaccines in November 2020. Investors started to price in a post-lockdown future with higher inflation – which was ultimately exacerbated in 2022 as Russia’s invasion of Ukraine added pressure on top of these supply bottlenecks.

This made value stocks more attractive and started an upending of the fund performance tables. Between ‘Vaccine Monday’ on 9 November 2020 and now, the best performers have been funds such as BlackRock World Mining, VT De Lisle America, TM Redwheel UK Equity Income, Liontrust India and VT Tyndall Real Income, which favour value over growth.

The rotation away from growth stocks has caused significant market dislocation. Close to half of the funds that were in the top quartile of their respective sectors between 11 March 2020 (the day that the Covid-19 outbreak was declared to be a pandemic by the World Health Organization) and 9 November 2020 are in the bottom quartile since Vaccine Monday. Another 26% are in the third quartile.

Conversely, half of the funds that were in the bottom quartile in the initial phase of the pandemic have since jumped into the top quartile with another 23% in the second quartile, FE fundinfo data shows.

The challenging conditions that Covid winners have faced since the vaccines were unveiled means that many of their early gains have been washed out by this later underperformance and investors who held on will have seen little benefit.

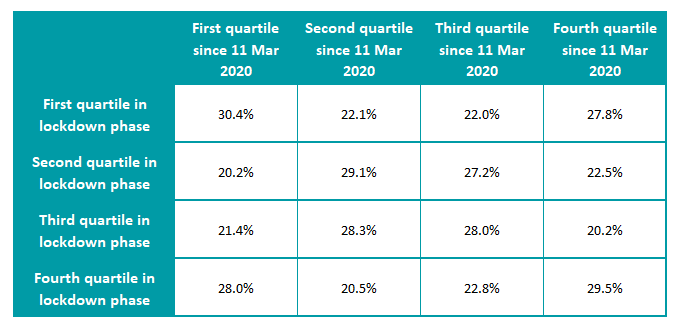

Quartile rankings since 11 March 2020, broken down by quartile in first part of Covid-19 pandemic

Source: FE Analytics. Total return in sterling between 11 Mar 2020 and 13 Jan 2022.

The table above shows the overlap between funds' quartiles in the early part of the pandemic (11 March to 8 November 2020) and where they currently rank for the entire period (spanning 11 March 2020 to now). For example, 30.4% that were first quartile during lockdown have managed to hold onto that position even after the market rotation.

However, 49.8% of those funds that were Covid winners in the lockdown phase are now in the third (22%) or fourth (27.8%) quartile for the entire period.

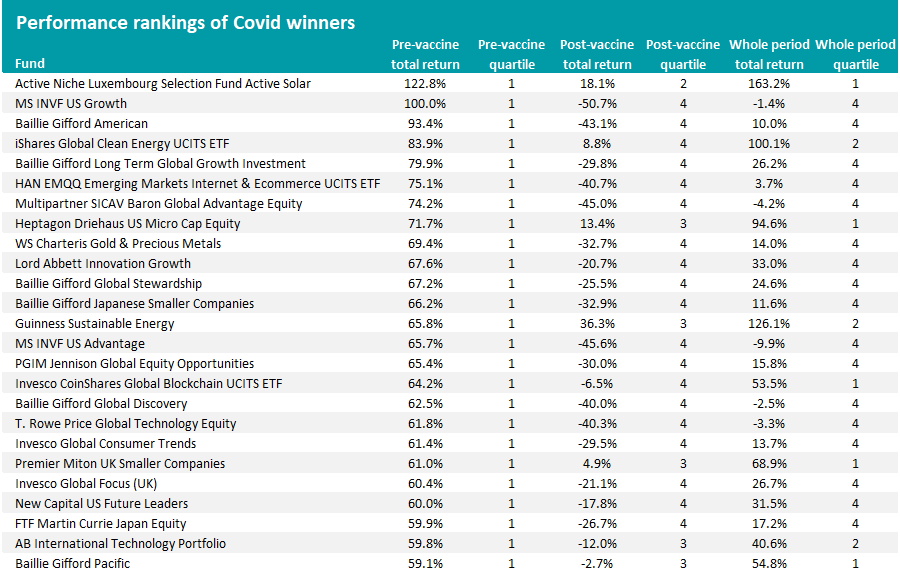

Source: FE Analytics. Total return in sterling between 11 Mar 2020 and 13 Jan 2022

The table above shows the 25 funds that made the highest returns during the Covid-19 lockdown period along with their performance since the vaccines were announced and for the entire period.

Just five funds have held onto their top-quartile ranking, among them Active Niche Luxembourg Selection Fund Active Solar, Heptagon Driehaus US Micro Cap Equity and Premier Miton UK Smaller Companies.

But 17 of the 25 best performers during Covid are now in the bottom quartile since the pandemic started, including Baillie Gifford American - which made 2020’s highest return but is now up just 10% for the whole period.

Several are posting a negative return since March 2020 (such as MS INVF US Growth, Baillie Gifford Global Discovery and T. Rowe Price Global Technology Equity), showing that the strong Covid-winner returns have now been erased.

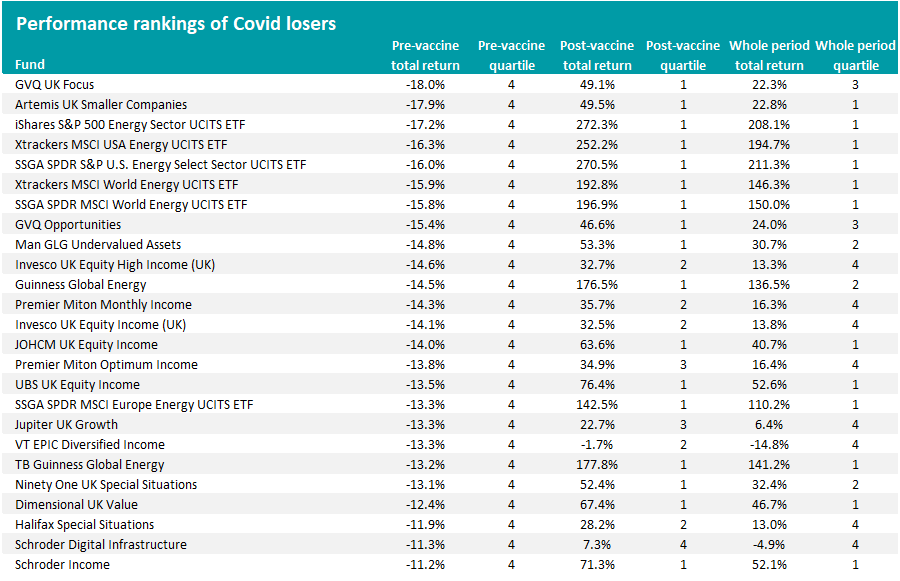

Source: FE Analytics. Total return in sterling between 11 Mar 2020 and 13 Jan 2022

At the same time, 48.5% of the funds that were fourth quartile at the start of the pandemic have made enough since to put them in the top two quartiles for the whole period. The above table shows the performance of the 25 funds with the lowest returns in the first phase of the pandemic.

Given the jump in oil and gas prices since the pandemic, it’s no surprise to see energy strategies such as iShares S&P 500 Energy Sector UCITS ETF, Xtrackers MSCI World Energy UCITS ETF and TB Guinness Global Energy among the funds moving from the bottom to the top quartile.

The relative outperformance of the UK recently – owing to a heavy weighting to ‘old economy’ stocks in the home market and a weak pound – also means that UK equity funds have rebounded well.

Artemis UK Smaller Companies, JOHCM UK Equity Income, UBS UK Equity Income, Dimensional UK Value and Schroder Income are the only non-energy funds on the above list that have made top quartile returns since the start of the pandemic despite being among the worst performers at its beginning.