The UK was one of the best performing markets in 2022 but some of its stocks still have a long runway of success ahead of them, according to analyst predictions.

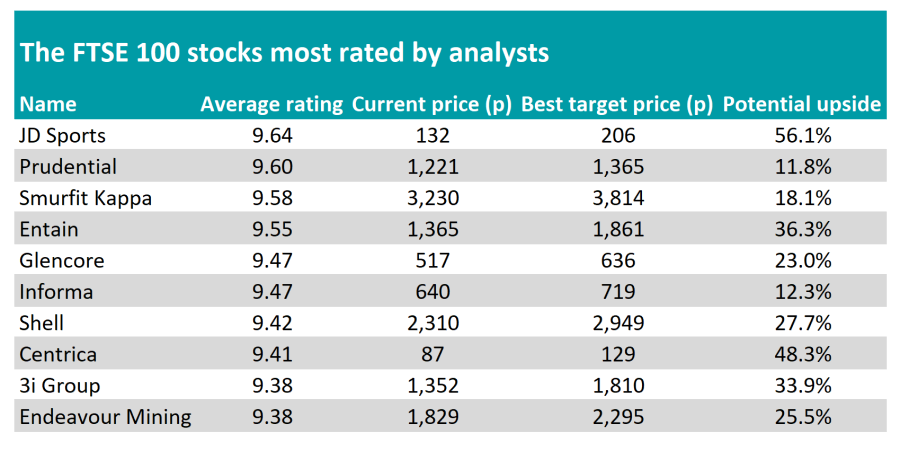

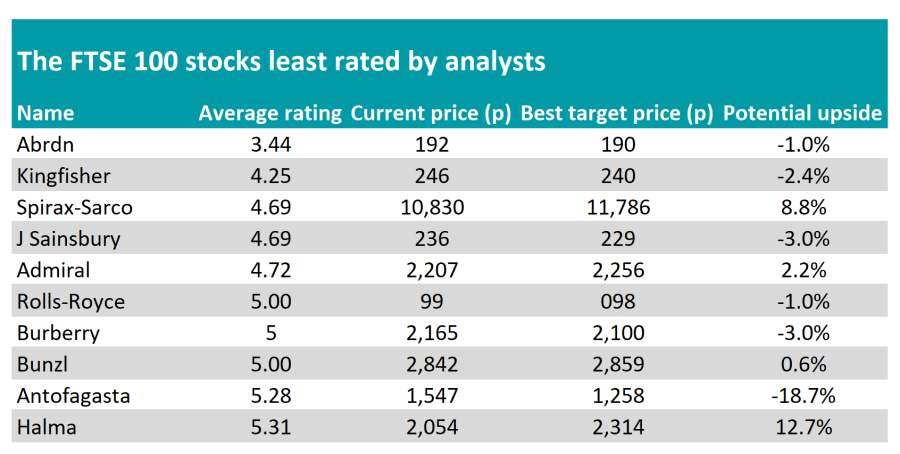

Wealth manager RBC Brewin Dolphin has compiled a list of stocks that are the most highly rated by analysts. To do this it looked at the average rating given to a stock, with 10 attributed to a ‘buy’ recommendation, five for a ‘hold’ and nothing for a ‘sell’. All figures are derived from Bloomberg.

Rob Burgeman, senior investment manager at RBC Brewin Dolphin, said: “The list of most and least loved FTSE 100 stocks has changed dramatically since the beginning of 2022, when the likes of Hikma Pharmaceuticals, housebuilder Taylor Wimpey, and Vodafone were among the highest rated.

“In fact, Hikma was top and has since been relegated to the FTSE 250, which underlines the importance of taking professional financial advice before making any significant investment decisions.”

One stock stands out from all others. At the top of the list is JD Sports, which scores 9.64 out of 10. According to the average market analyst, of which 14 have ‘buy’ ratings on the stock, the current price of 132p needs to rise to 56.1% to reach its target.

Source: RBC Brewin Dolphin. All data correct as of 04/01/2023.

It was also the most recommended stock this time a year ago, holding on to its top spot even though shares fell around 40% in 2022.

“JD Sports’ continued status among analysts is curious, with consumer spending expected to take a sharp downturn. That said, this is largely already built into the share price and there is a much more optimistic view of JD Sports’ long-term prospects,” Burgeman said.

Asian insurance group Prudential is second, with the stock scoring an average 9.6 rating among analysts. There are 25 analysts with a ‘buy’ recommendation, although the target price is only 11% higher than the current value of the shares.

Burgeman noted: “Prudential is on the tail-end of a long-running restructuring process, which has created a leaner and more focused business that should benefit from the growth in demand for its services in Asia.”

British Gas owner Centrica has the second-most upside behind JD Sports, with a target price 48% higher than its current level, while betting company Entain has a target price 36% higher.

Conversely, asset manager abrdn is the least recommended, with an average rating of 3.4. The firm was reintroduced into the FTSE 100 in the most recent reshuffle, but has nine ‘sell’ recommendations against it.

Burgeman said: “The phonetically challenged abrdn faces pressure on a number of fronts. It purchased interactive investor as an engine for growth, but instead has seen the price of its platform peers fall as competition stiffens. The new management team is continuing to focus on cutting costs from the business, but the wait for revenue growth may be long and the outlook remains cloudy.”

Source: RBC Brewin Dolphin. All data correct as of 04/01/2023.

It is not the stock likely to suffer the biggest fall according to analysts, however: miner Antofagasta takes this dubious award, with its share price expected to drop by about 18%.

Retailers such as Kingfisher and Sainsbury’s also make the list, something that Burgeman said was “unsurprising” as the cost-of-living crisis makes the outlook for consumer spending more troubled than it has been in recent years.

“The combination of fewer people moving house and having less money in their pockets is bad news for B&Q and, although it has businesses elsewhere, rising interest rates and high inflation are a fact of life in many countries. Similarly, less money to spend leads many people to trade down on everyday purchases – Sainsbury’s is likely to find its customers defecting to cheaper competitors,” the investment manager finished.