For those of us who have been in financial markets since the 1980’s we have learnt from sometimes bitter experience that there are two rules that you should never break.

The first is ‘don’t fight the Fed’. The second is ‘never bet against the US consumer’. We suspect only one of those rules will be left standing in 2023.

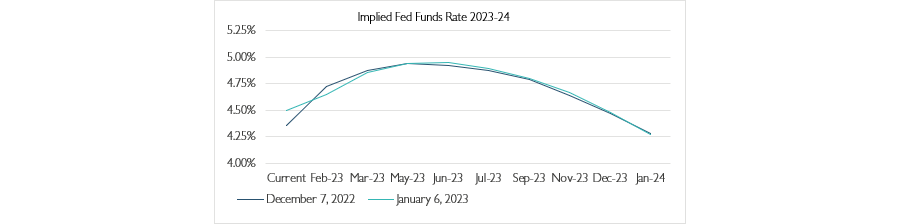

One could argue that to be bullish today requires you to be fighting the Fed. To be bullish requires that, despite policy makers talking tough on how they will raise interest rates further and keep them higher for longer, they will in fact pivot in 2023 and start to cut interest rates.

Conversely, to be bearish, you are required to bet that the US consumer will imminently hit a metaphorical wall and stop spending.

Despite the very low unemployment rate (3.5% in December, back to its post Covid low), the ongoing survey indications that finding workers is difficult and the relief that consumers have had from falling gas (petrol) prices in recent months means you have to believe that the monetary policy tightening will in fact bite, which will lead to widespread layoffs and a knock-on curbing of spending as workers become more nervous about their job prospects.

We are underweight equities as we are choosing not to fight the Fed but to make the bet that the consumer will begin to slow spending as the delayed impact of the interest rate increases already seen, combined with more rate hikes in the months ahead, creates a weaker labour market.

The market remains of the view that the Fed will start cutting rates in 2023 but we are sceptical.

Source: Waverton

The US labour market data released on 6 January showed both the payroll data from the survey of companies and the employment data derived from the survey of households, reporting a robust picture. The unemployment rate returned to its post-Covid low of 3.5% and more than 220,000 non-farm jobs were created in December.

On top of that, although the bond market liked the fact that wage growth slowed to 4.6% from a downward revised 4.8% in November, that level of wage growth is well above the 2-3% that was evident in the decade preceding Covid.

Betting against the US consumer has been, along with fighting the Fed, a disastrous trade for the past 40 years. But we have reached a point in this cycle, thanks to levels of inflation not seen for four decades, where we need to see a curbing of consumer demand to get the Fed to stop tightening policy.

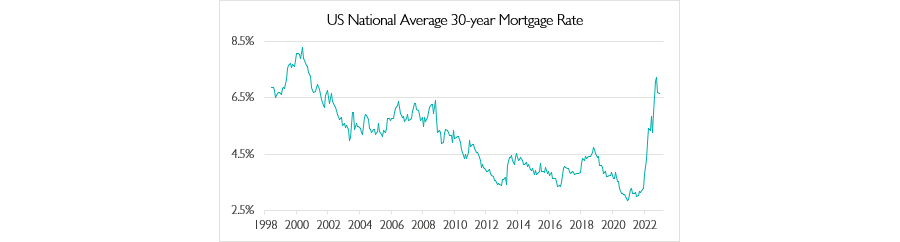

The housing market is weakening in the face of the interest rate rises already seen, which have taken the 30-year mortgage rate to its highest levels for 22 years.

The bond market rally in the last two months of the year has given some relief but the change in rates will dampen housing demand.

House prices nationally are still up 8.6% on a year ago but we would expect that to fall below zero in the coming months. That will be another headwind for consumer confidence and thus spending.

Source: Waverton

Therefore as 2023 unfolds we expect to see consumer spending moderate and a mild recession in the US. Don’t fight the Fed will be the ‘rule’ that survives this year in our view.

William Dinning is chief investment officer at Waverton. The views expressed above should not be taken as investment advice.