Inflation is the enemy of the bond investor, who this year have borne the brunt of their asset class precipitously falling together with equities.

While data from FE Analytics shows that the IA Sterling Strategic Bond sector has a staggering 79% correlation to the MSCI World index, not all of its members do.

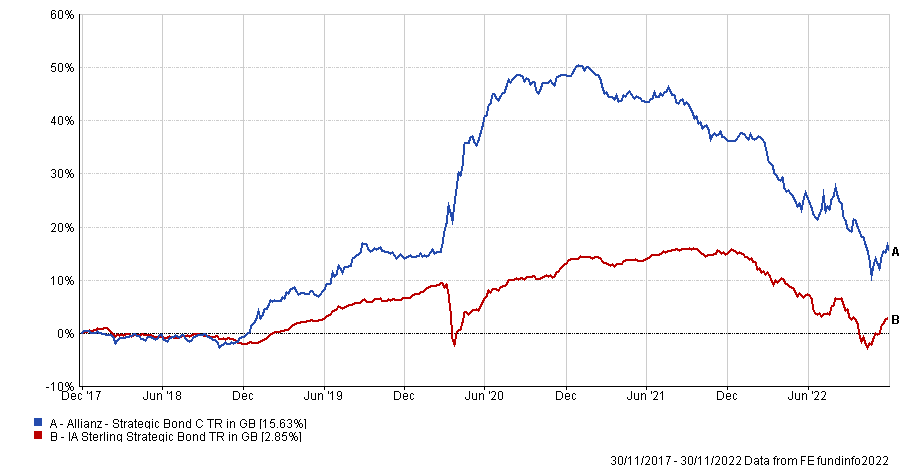

The £2.3bn Allianz Strategic Bond fund aims for a zero correlation to the MSCI World index: currently it stands at 4%. It has an 18% correlation score to its sector, which it significantly outperformed over the long term, before falling to the last performance quartile over recent years.

Below, its lead manager Mike Riddell tells Trustnet why he is “very high conviction” that the world is entering a deep recession and believes that government bonds are in for a “phenomenal” rally.

Performance of fund vs sector over 5yrs

Source: FE Analytics

Can you describe your philosophy and investment process?

Our investment process is entirely global macro and top down. We try to understand where the economy will be going in six to 12 months and find the best way of expressing that view through rates or government bonds, credit, inflation or forex. We're looking for when different markets are pricing in different macro outcomes.

What does your fund offer to investors?

The fund is designed to be very different to most competitors within the strategic bond space. Most funds in the sector are credit funds and behave like high-yield corporate bonds, and therefore like equities. We have far less in credit over the economic cycle and a much lower correlation to equities. If we get the macro views correct, we can generate decent returns.

As such, we act as a diversifier for those who own either a riskier credit or fixed income portfolio within their bond bucket, or those who have lots of equities within their portfolio.

How many of your past predictions proved right today?

The view that we got correct, and it's still a very high conviction view, is that we are going into a deep recession, so we got the economic growth views correct and for the right reasons. But what we got wrong was the inflation being higher for longer and particularly that central banks would be extremely aggressive in hiking rates to move inflation lower. Central bank stopped caring about recessions and actually have tried to cause one. That's what we basically got wrong.

We were very bearish of risky assets, which has been correct. But at the same time, we got more bullish of government bonds, and that was incorrect.

What’s your view for the next 12 months?

Interest rates were too low for too long, and central banks were asleep at the wheel, but this year they've been rapidly making up for their errors and they've gone too far the other way. The market is pricing inflation to go down sharply next year with interest rates staying above the inflation rates one year from now.

This means that now you can beat inflation by buying index-linked gilts, let alone if you take risk on top of that. That hasn’t been the case for a long time.

But that’s the only positive view I have, as we’ve only just started to feel the pain from interest rate hikes. It takes about 12 months before they have any effect on the economy, so most of the pain is going to be the first half of next year.

House prices are already under pressure, company earnings have caused many downgrades in the past six months and the labour market will be the next to suffer. Unemployment rate is a lagging indicator, which starts to rise when we're already in the middle of the recession. It will probably do so next year.

How do you position your fund, based on these assumptions?

We are positive that inflation is not systematic and only caused by supply shocks, so we see it as about to move much lower from the second quarter of next year. But growth is going to be horrific for six or 12 months, given the rate hikes that we've seen.

This makes me the most bullish of government bonds I've ever been in my career. Duration is a measure of how sensitive your fund is to interest rates and yields, and I'm the longest duration that I've ever been, even longer than 2011.

If government bond yields and economic activity, which now are diverging in an unprecedented way, will realign, we could be in for a phenomenal rally in bonds.

Does that apply to all geographies?

While bond yields are very high, historically, almost everywhere, we're still a bit nervous about European markets, because they are more vulnerable to further inflation shocks, whether that is colder weather, or something happening in Russia or Ukraine. So we have more conviction in, for example, North America, where we also think that growth will fall but there's lower chance of a big inflation shock.

How has the team changed since the previous co-manager Kacper Brzezniak left in May 2021?

When Kacper left we were already in the process of hiring two people who had accepted to join us, and then when he left, we hired a third person. The team now has six people, all global, macro generalists, but all with different backgrounds.

For example, Ravin Seeneevassen was an inflation trader for a few years and is very familiar with inflation markets, so he contributed a lot of his ideas in the past 12 months as we've been taking views on inflation, and more recently, getting out of inflation positions.

What do you do in your free time?

My main interest are sports and music. On the sports side, a long time ago now, I was an international standard athlete as a junior. And on the music side, I call myself a pub standard pianist. I've played in bands in London in a few different pubs.