Investors are reconsidering their holdings in the world’s leading tech companies after the FAANGs (Meta, Apple, Amazon, Netflix and Alphabet) announced disappointing results in October.

These stocks have thrived over the past decade, becoming the top constituents of the S&P 500 index and leading the global market, but their share prices have slumped in 2022 as the era of high growth comes to a screeching halt.

More than 10 years of loose monetary policy boosted them to staggering heights, but investors are no longer willing to pay so much now that rising interest rates and inflation mean there are more attractive options elsewhere, without the need to pay up for future potential earnings.

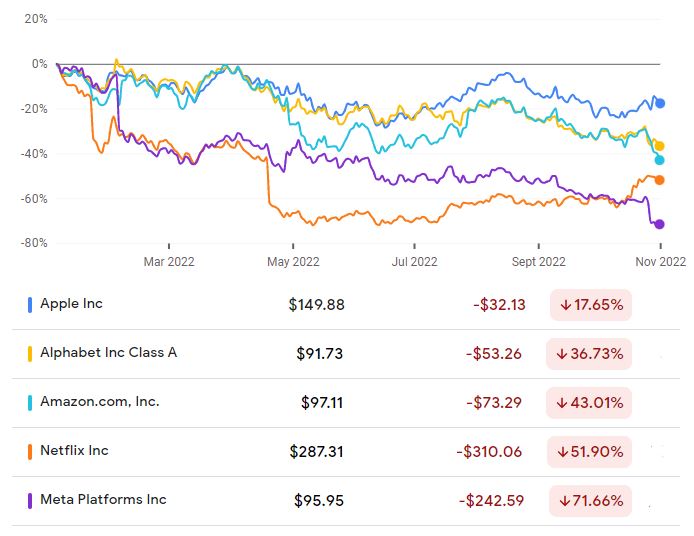

Share prices of the FAANGs in 2022

Source: Google Finance

The FAANGs were a source of reliable and rapid growth in many portfolios, so investors may be asking themselves whether they are still worth holding now that the environment that supported them has come crumbling down.

Laith Khalaf, head of investment analysis at AJ Bell, said that investors should not expect the same level of outperformance that the FAANGs enjoyed over the past 10 years.

“Investors might need to accustom themselves to more modest levels of profit growth from these companies, as inflation bites into the purchasing power of consumers and businesses, and higher energy costs eat into margins,” he added.

However, dropping all the FAANGs as a group would not be wise – some of them still present an appealing investment case.

Khalaf said: “Investors should evaluate each company on its own merits as they all have different strengths and challenges. That’s probably more important in leaner times than it was when a sharply rising digital tide was lifting all boats.”

Storm Uru, co-head of the Global Innovation team at Liontrust, for example, said that Meta and Alphabet will face stronger headwinds than their peers since Apple introduced App Tracking Transparency (ATT) last year.

This feature reduced how much companies can track users’ online activity, meaning that the revenues Meta and Alphabet received from targeted adverting on their sites took a hit.

Uru said: “It is now much more difficult for digital advertising platforms to track monetisation economics for advertising spent on these key platforms – meaning there is less data to run effective ad campaigns for digital advertisers – leading to lower profitability for social media platforms.”

He added that Meta will feel the impact of lessened advertising inflows more so than Alphabet.

Neil Campling, head of TMT research at Mirabaud Equity Research, agreed that the investment case for the Facebook, Instagram and WhatsApp owner appears increasingly bleak, stating that “Meta is a company facing an existential crisis, no matter what it says.”

Crucially, Meta is spending large amounts of money in developing their virtual reality venture at a time when it should be reigning in expenditure, according to Campling.

In its third quarter results, the company revealed that net income was down 52% to $4.4bn (£3.9bn) over the past year while expenditure had increased 17% to $22.1bn.

Meta intends to make high returns from its substantial investment in the metaverse over the long-term, but it could end in disaster if this bet doesn’t pay off, according to Campling.

He said: “There is no proof that cost hikes lead to revenue increases so far. Like IBM symbolises dinosaur tech 1.0, so Meta faces the risk of being the next generation fossil.”

Indeed, Richard Saldanha, manager of the Aviva Global Equity Income fund, agreed that Meta faces the possibility of becoming a money pit if spending continues as quickly as revenues shrink.

He said: “We do think in the case of Meta there are major reasons for concern right now – particularly around the huge increase in operating expenditure and capex at the same time as the key growth engine for the business (advertising) is slowing.”

Amazon and Alphabet, on the other hand, could be more resilient than the rest of the FAANGs in volatile markets due to their respective Google Search and Amazon Web Services (AWS) features.

Saldanha said that they will benefit from the trend of growing internet penetration and rising e-commerce that companies with a strong digital presence will be well positioned for.

“The reality is all these businesses are certainly not immune from the macroeconomic pressures we are seeing right now,” he added.

“Having said that we firmly believe the structural trends these companies benefit from (such as digital advertising and cloud computing) are likely to manage compelling growth over the next five years – investors should be wary of throwing the baby out with the bathwater right now.”