Average earners will be £2,016 poorer over the next five years if the government stands pat on tax, a new study by wealth manager and financial adviser Quilter found.

Rishi Sunak has expressed interest in holding down income tax thresholds for two more years, after the current freeze ends in April 2026, but the consequences could be severe.

The fiscal move qualifies as a so-called ‘stealth tax’, because it will earn the government a total of £30bn without materially raising taxes and could therefore go unnoticed, but is almost certain to make people in the UK poorer.

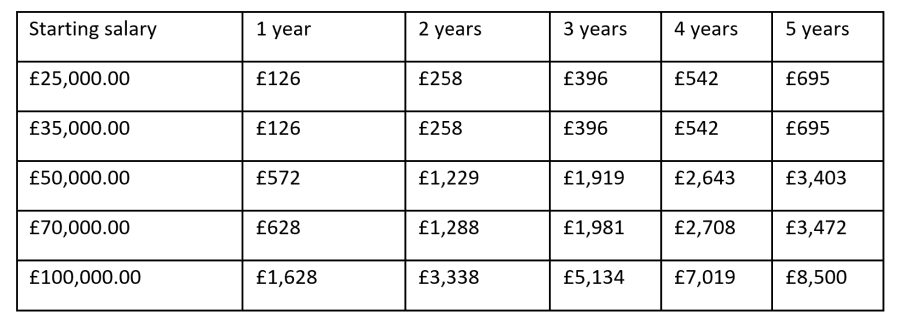

According to Quilter, the stealth tax will silently chip £695 away in the 28/29 tax year from someone earning £35,000 today, which adds up to £2,016 over five years.

For higher earners, the numbers go up: if you earn £50,000 today, then you will be £3,403 worse off in the 28/29 tax year and in total be £9,765 poorer over the five-year period, as illustrated below.

Amount earners will lose in five years by today’s salary and 5% wage growth

Source: Quilter

This calculation assumes that wage growth will be driven up by inflation from the current 3% a year (where it’s been for 20 years) to at least 5% per year for the next five years.

According to Shaun Moore, tax and financial planning expert at Quilter, it’s unlikely that these frozen thresholds will thaw anytime soon, as the government needs to make up for a £50bn fiscal hole.

“It is likely that Sunak and chancellor Jeremy Hunt, in their Budget in November, will seek to tighten the government’s belt,” he said.

“The new tax year presents no better time to plan for efficient use of allowances for the tax-year ahead. If you are unsure about where to start, a financial adviser can help you identify how to make better use of the tax allowances available to you and while April may feel like a long time off it is worth starting to think about this sooner rather than later.”