More than half of the funds in the Investment Association universe have made a loss since the UK’s mini-Budget sent markets into a tailspin, FE fundinfo data shows.

On Friday 23 September, chancellor Kwasi Kwarteng presented his 2022 growth strategy and announced a plethora of tax cuts – the biggest in 50 years. The £45bn package, which is on top of government’s £150bn energy support plan, is to be funded by borrowing.

Markets have not reacted kindly to the mini-Budget, with UK stocks, gilts and sterling selling-off in the two trading sessions since. On Monday, the pound fell to its lowest level ever before recovering a little.

Investors are concerned that the government’s plans will add to inflation, forcing the Bank of England to hike interest rates higher than expected.

Charles Hepworth, investment director at GAM Investments, said: “Analogies of having one foot on the accelerator at Number 11 and one foot on the brake at the Bank of England succinctly emphasise the crisis the UK finds itself in.

“One thing is for certain – UK risk assets still have further downside from here.”

Here, Trustnet finds out which funds suffered the heaviest losses in the two days of turmoil after the mini-Budget, although it should be kept in mind that past performance is no guide to future returns and two days is a very short timeframe in markets.

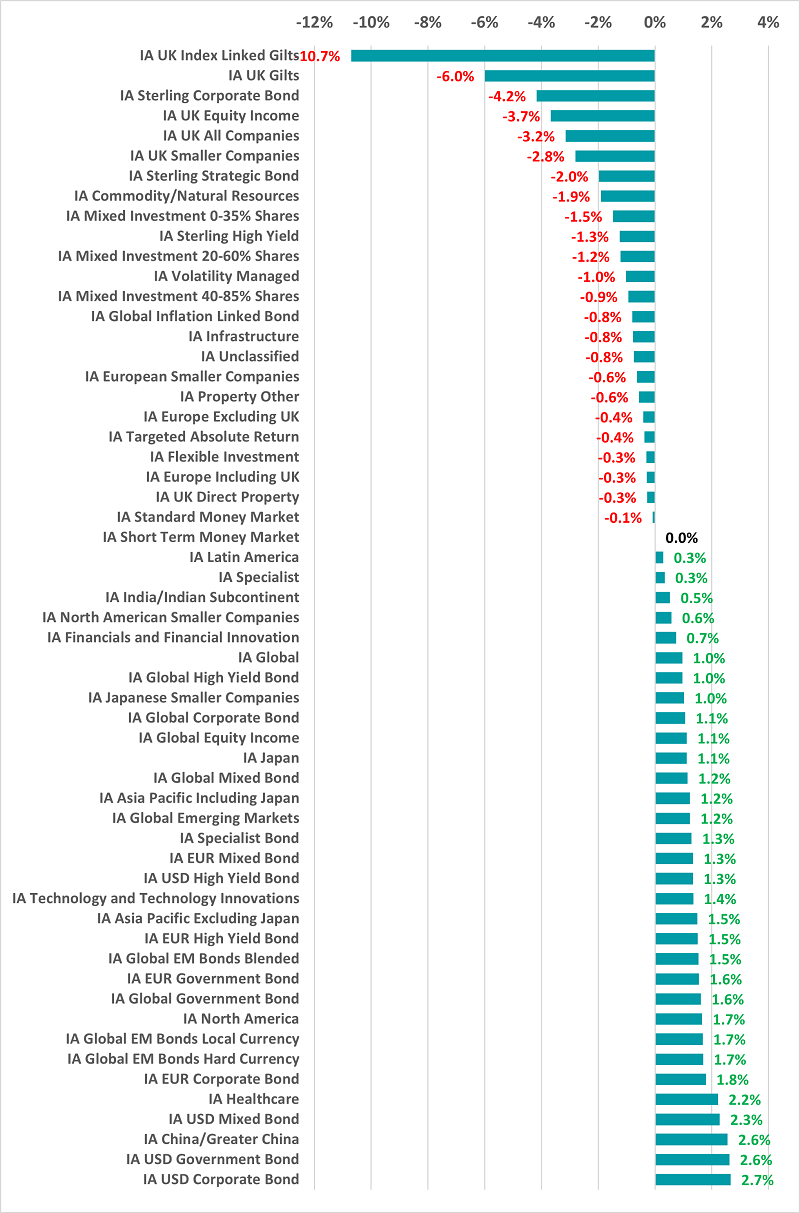

As the chart below shows, the obvious impact was on UK assets – with fixed income funds bearing the brunt.

Performance of fund sectors on Fri 23 Sep and Mon 26 Sep 2022

Source: FE Analytics

The average fund in the IA UK Index Linked Gilts fund dropped 10.7% over the two sessions in question, as investors worried about higher government borrowing, inflation and interest rates. The average IA UK Gilts fund lost 6% while the IA Sterling Corporate Bond sector was down 4.2%.

Stocks have less sensitivity to interest rate moves than bonds, but the three UK equity sectors also posted some of the heaviest average losses over the period. The IA UK Equity Income sector shed 3.7%, while IA UK All Companies and IA UK Smaller Companies were down 3.2% and 2.8% respectively.

The strongest returns since the mini-Budget have come from international bond funds, especially those denominated in US dollars, reflecting the strength of the greenback. The average IA USD Corporate Bond fund is up 2.7% since Friday while IA USD Government Bond funds have made 2.6%.

Chinese equity, healthcare and US equity funds have also made some of the Investment Association’s highest returns over the period.

Across Friday and Monday, 50.9% of the 5,160 funds we looked at in this research posted a negative return.

There were some clear differences by Investment Association peer group, as would be expected. Almost every member of the UK sectors was down over those days.

On the other hand, every IA China/Greater China, IA Healthcare and IA Japanese Smaller Companies fund was in positive territory, as were more than 90% of US and European government bond, US and European corporate bond, IA North America, IA Global Emerging Markets, IA North American Smaller Companies, IA Asia Pacific Excluding Japan, IA EUR High Yield Bond and IA Asia Pacific Including Japan funds.

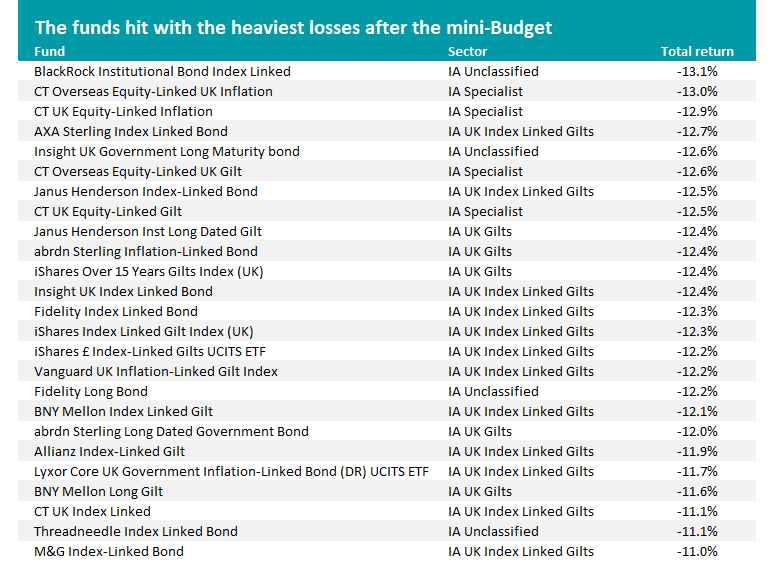

Source: FE Analytics

The table above shows 25 funds that made the biggest losses on Friday 23 September and Monday 26 September – every single one is a gilt fund, with most investing in index-linked gilts.

Non-gilt funds among the 100 heaviest falls over the period include Pimco GIS MLP & Energy Infrastructure (down 10%), VT Gravis UK Listed Property (down 7.9%) and Jupiter UK Mid Cap (down 7.6%).

There’s greater variety when looking at the individual funds that have performed best since Friday, although clearly all are funds that invest outside of the UK and have benefitted from the impact of a weaker pound.

Source: FE Analytics