Dividends paid out by companies quoted on AIM were 7.4% higher in the first half of 2022 compared with the previous year, according to the latest Link Dividend Monitor report.

The £574m paid out by these firms was held back slightly by a lack of one-off special payments, but excluding these, underlying base dividends were almost a fifth higher (19.8%).

This is on top of bumper numbers in 2021, when headline growth rose 60% and underlying payments were 39.3% higher.

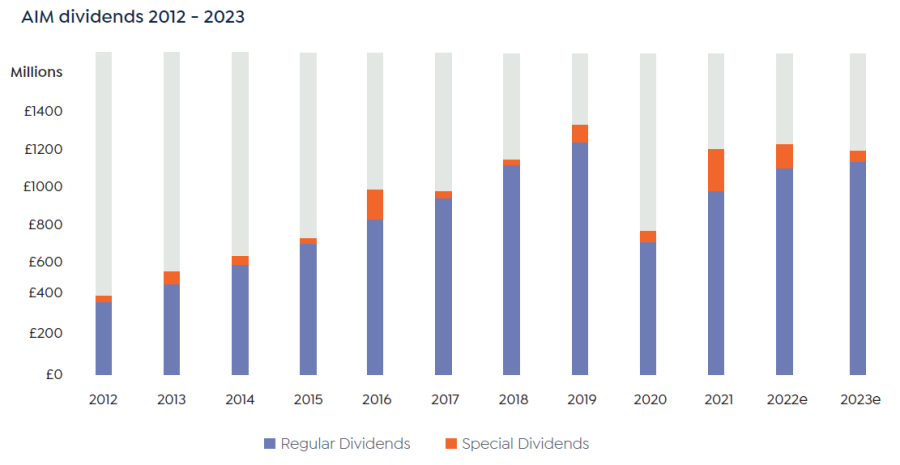

Link said that it expects 13.3% underlying growth for the full year, meaning payouts of £1.1bn, while total dividends are expected to rise 2.5%, equivalent to a total of £1.2bn.

Source: Link Dividend Monitor

Ian Stokes, managing director, corporate markets UK and Europe at Link, said: “AIM companies have really impressed with their ability to bounce back from the pandemic. This is reflected in the strength of the recovery in their dividend payments, which was better than we expected. The easy work is done, meaning that growth will now slow.”

New listings from 2021’s busy initial public offering (IPO) market, such as FMCG producer Supreme and food wholesaler Kitwave, added 1 percentage point to dividend growth in the first half of the year, the report found.

The financials, building and food & drink sectors provided the bulk of the growth. Companies in the general financials sector (comprising asset managers, corporate finance advisory firms and stockbrokers, among others) paid out the same in dividends as they had done before the pandemic. These payouts were up by a fifth on an underlying basis, slightly faster than the overall AIM total.

Meanwhile, the biggest contribution came from the building materials sector, which has benefited from a boom in construction since Covid.

The report pointed to cement, aggregates and asphalt producer Breedon as an example. The firm paid the first dividend in its history during the third quarter of 2021 and followed this up with a large final payment in May 2022.

Investors hoping to obtain a sustainable income from AIM stocks alone may struggle, as smaller firms are less likely to pay out all their profits than their main market cousins.

Even before the pandemic, just one third of AIM’s companies distributed cash to shareholders, compared with 75% on the main market.

After bottoming out at 22% in 2020, Link Group expects this to recover to 29% this year – approximately one-10th below the pre-pandemic level and some way short of the main market.

Turning to the future of AIM dividends, Stokes said that there is “less visibility on AIM payouts” but that, like the main market, growth will likely slow for the remainder of the year.

“Corporate margins are currently under pressure and a potential recession is on the cards, which will affect both the ability and willingness of AIM companies to return cash to shareholders,” he said.

“Underlying dividend growth in the 2 to 5% range is achievable if the economic squeeze is not too steep, but headline payouts are likely to fall as special divide