Traditional asset managers, cryptocurrency stocks, oil minnows and sausage roll makers were among the top-performing UK stocks outside of the FTSE 100 in 2021.

Last year the UK market rallied following a disappointing 2020, with the value recovery boosting the largest companies on the market. Construction company Ashtead led the large-caps, up 68%, while others also shot higher, such as miner Glencore with its 67% gain.

However, there were even bigger profit to be made further down the market cap spectrum, as investors turned their attention towards unloved stocks that would thrive once the pandemic is over.

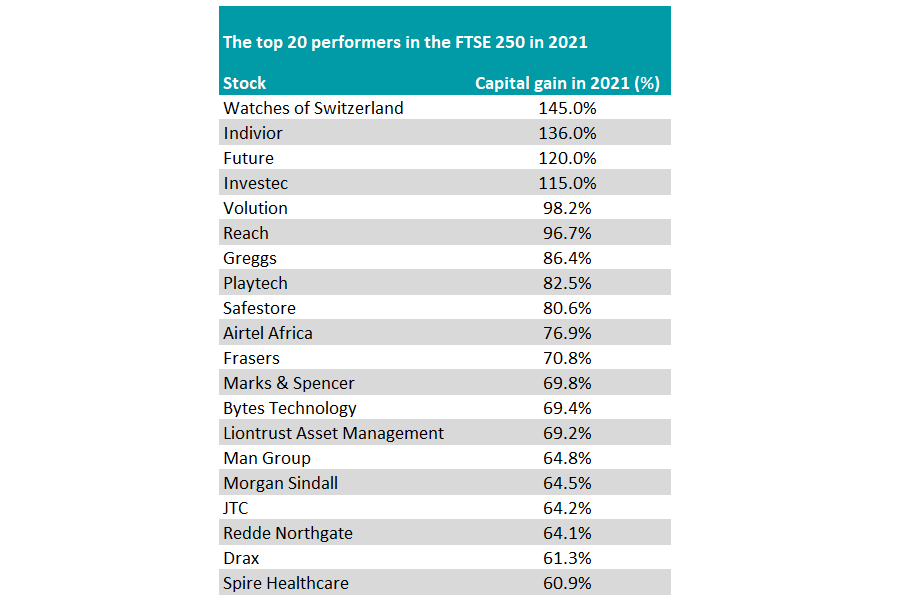

In the FTSE 250 – the index of the 250 next-largest companies after the FTSE 100 – it was a mixed bag. Among these mid-caps, retailers were big winners, with Watches of Switzerland making a 145% return, according to data from AJ Bell.

Marks & Spencer and a seemingly rejuvenated Frasers Group were also among the top 20 biggest gainers in the index, with shares up 69.8% and 70.8% respectively.

Stock in sausage roll maker Greggs – another staple of the high street – rose 86.4% as investors forecast a Covid-free future with people popping to the shops without restriction.

Source: AJ Bell, Sharepad

Outside of the retailers, print media had a resurgence last year, according to AJ Bell investment director Russ Mould, who pointed out that acquisitive publisher Future made big gains as its “aggressive roll-up strategy continued to win plaudits” while newspaper publisher Reach jumped “as digital began to offset print’s ongoing decline”.

The final hotbed of activity was in sectors where there had been a takeover. For example, Playtech’s shares rose 82.5% for the year as the gambling sector was rife with mergers and acquisitions, including the high-profile deal between William Hill and 888 Holdings.

Among those in the FTSE Small Cap index – or the companies that are smaller than those in the two indices above – there were similar trends.

Mould said: “Leading gainers included recruitment specialists Robert Walters and SThree, aerospace firm Senior, chilled goods company Bakkavor and car retailer Pendragon – all beneficiaries of an economic upturn as lockdowns eased, vaccination programmes went into overdrive and markets looked for a return to the office, or the high street, to boost demand.

“Bathroom fit-out firm Norcros benefited from the ongoing DIY boom as consumers spent on home improvements rather than holidays.”

Source: AJ Bell, Sharepad

Oil minnows EnQuest and Tullow rode the wave of higher oil prices, which were fuelled by both improved economic growth and also supply constraints.

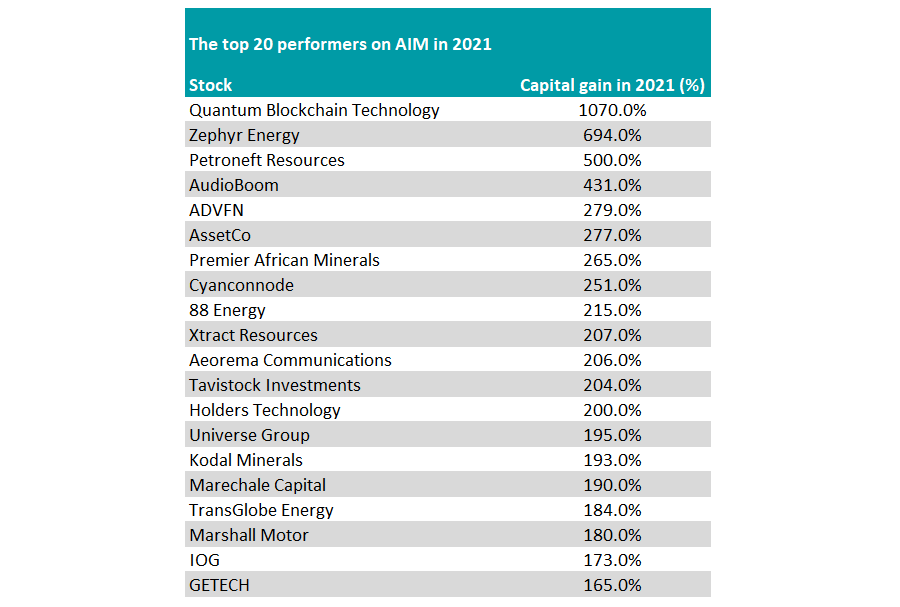

On AIM, Zephyr Energy overcame many investors’ prejudice against firms that change their name and was another beneficiary of rising energy prices.

Once known as Rose Petroleum, Zephyr operates an oil and gas field in Utah and has non-operating stakes in fields in Colorado and North Dakota. Shares were up almost eight times in 2021 (694%).

“Petroneft Resources was another beneficiary of surging oil and gas prices, even if its own output remains relatively modest. The firm owns stakes in drilling licences in the Tomsk Oblast region of the Russian Federation and its fracking operations are showing potential after a refinancing of the company,” said Mould.

However, the best performer was Quantum Blockchain Technologies. The blockchain specialist was a hot stock in 2021, making investors more than 11 times their money. Overall shares rose 1,070% as investors bought into its themes of blockchain technology, cryptocurrencies and artificial intelligence.

Elsewhere, investors latched on to miners last year as metal prices rose thanks to increased economic activity from the reopening as well as increased demand for specific commodities due to the drive for renewable energy.

Mould said: “Premier African Minerals is looking to develop a range of projects, including a lithium mine in Zimbabwe – the metal is important to batteries for electric vehicles – and a potash project in Ethiopia. Rising food and gas prices mean fertiliser prices are soaring too and farmers will be looking for further supplies.”

Source: AJ Bell, Sharepad

Meanwhile, Kodal Minerals is looking to develop its Bougouni lithium project in Mali, while Xtract Resources rode higher copper prices, he added.

“Note that Premier African Minerals and Kodal are yet to produce any materials or generate revenue as they are still in the development phase, while Xtract generated modest sales from gold mining and nothing from copper in the first half. Their potential may be considerable but it is very early days for all three and they remain highly speculative counters,” he said.