Holding losing positions for too long, a reluctance to make portfolio changes and failing to ‘declutter’ portfolios are three biases that investors need to get to grips with in the current market environment.

That’s the view of Emily Haisley, the behavioral finance director within BlackRock's risk and quantitative analysis team, who also believes there are several techniques investors can use to mitigate such biases.

“Investors are strapped in for a market rollercoaster in a new regime of increased volatility. Views on central bank rates are shuffling fast, as last week’s market reaction to the Fed’s rate hike showed,” Haisley said.

“We think this warrants careful thought about portfolio changes. But change is hard. Behavioral biases subconsciously influence investment decisions.”

Below, the BlackRock Investment Institute highlights the three biases likely to trouble investors in this volatile market and how they can be overcome.

Disposition bias

The first pitfall that the investment house is warning about is disposition bias, or the tendency to hold losing positions too long and sell winning ones too soon.

BlackRock said this bias is often most prevalent in times when investors are taking heavy losses, such as during recent months when the market sold off because of interest rate hikes and slowing growth.

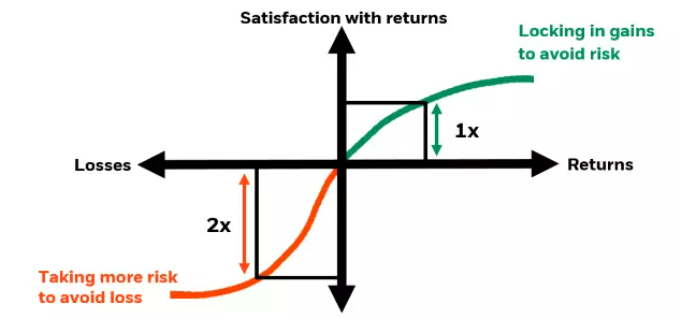

Satisfaction with gains and losses in behavioral finance prospect theory

Sources: BlackRock Investment Institute, adapted from Daniel Kahneman and Amos Tversky, Econometrica 12 (1980)

“Behavioral finance finds that people feel the pain of loss twice as strongly as they experience an equivalent gain as pleasurable [the red versus green arrow in the chart]. As a result, people may hold on to losing positions to avoid the pain of a loss [bottom left in chart],” Haisley said.

“Meanwhile, it’s tempting to lock in gains too soon on winning positions because of a reluctance to take more risk for only marginal benefits [top right].”

Inertia bias

Haisley added that the second highlighted bias – inertia bias – “should really be Public Enemy No. 1 today for professional investor”. Essentially, this is a reluctance to make any changes or only making small changes that have no real effect on performance.

BlackRock sees this as being especially problematic now as it believes the ‘Great Moderation’ – or the period of steady growth and inflation that started in the mid-1980s – has come to an end.

Instead, the investment house expects a new regime of increased macro volatility but central banks, on the other hand, still think they have the ability to slow raging inflation with just a mild economic slowdown (the so-called ‘soft landing’).

“We see more volatility ahead as markets have rallied on hopes the Fed is about to change course and relax policy. That optimism is misplaced, in our view,” Haisley added.

“All of this calls for professional investors to change their portfolios more quickly. It will be costly, in our view, to just follow playbooks such as ‘buying the dip’ or make slow and minimal changes.”

The endowment effect

The final bias that BlackRock is warning investors to guard against is ‘endowment’.

“Think of it as excessively deliberating over whether you may one day need something that sat collecting dust for years – whereas you clearly should be decluttering,” Haisley explained.

Investors suffering from endowment bias tend to overvalue their assets and the longer they hold them, the higher the price they demand to sell them.

This can lead them to cling onto positions after the investment base case has played out, hampering investors’ performance. The BlackRock Investment Institute added that it has noticed positions tend to generate more returns in their early days.

How to avoid these biases

Over the course of 2022, BlackRock has been shifting its portfolios in response to the changing market backdrop, for example by reducing portfolio risk levels. In its latest move, the group carried out an “up-in-quality portfolio shift” by downgrading developed market stocks and upgrading investment grade credit.

In order to do this, behavioral biases have to be kept under control and Haisley gave three tips on how this can be done:

- “First, do a blank-slate exercise – imagine you have realised all your gains and losses. Then construct the ideal portfolio for the most likely market and macro environment over your time horizon. That doesn’t mean abandoning long-standing investment processes. Instead, consider portfolio changes without basing it on your historical portfolio holdings and performance.”

- “Second, think of future market events or performance thresholds that would signal when to take profit or cut losses. Making a plan can help determine how to react amid volatile markets and high emotions. This is the reason we give signposts for changing our views in our 2022 mid-year outlook.”

- “Third, encourage open conversations about biases and the changes required to overcome them. Discuss your emotions after losses, examine mistakes even when performance is good, and weigh input from colleagues with an alternative point of view.”