Over the long term, most equity investment trusts have outperformed their open-ended fund counterparts, profiting from narrowing discounts, the use of gearing and a smaller company bias.

In 2022 the tables turned and, in a falling market environment, funds’ returns surpassed trusts in both net asset value (NAV) and share price terms.

The trust sector remains “deeply unfashionable”, said Ewan Lovett-Turner, research analyst at Numis Securities, and the outlook for equities remains uncertain.

But long-term investors might still find good opportunities in equity investment companies, especially following the substantial sell-offs that took place in many areas.

Below, Numis analysts highlight their top trusts for the months to come.

The list opens with a defensively orientated trust, which were among the top-performers of the first year-half and are likely to remain popular.

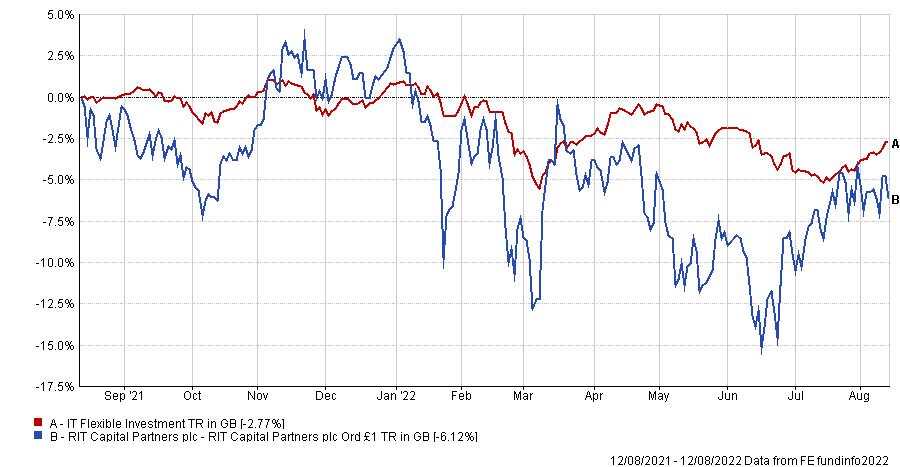

In this field, investors are “spoilt for choice” but RIT Capital Partners stood out for its capital preservation strategy, the ability to pick up on the ups and isolate the losses in a downward trending market.

Performance of trust vs sector over 1yr

Source: FE Analytics

Lovett-Turner said: “As would be expected, RIT Capital Partners experienced a large drawdown in NAV terms.

“Whilst the fund has modest quoted equity exposure (c.35% of net assets), its exposure to private investments, which are biased towards growth and venture capital, represent c.43%. Nonetheless it has demonstrated insulation from falling equity markets, and we believe it continues to represent an attractive choice for defensively-minded investors.”

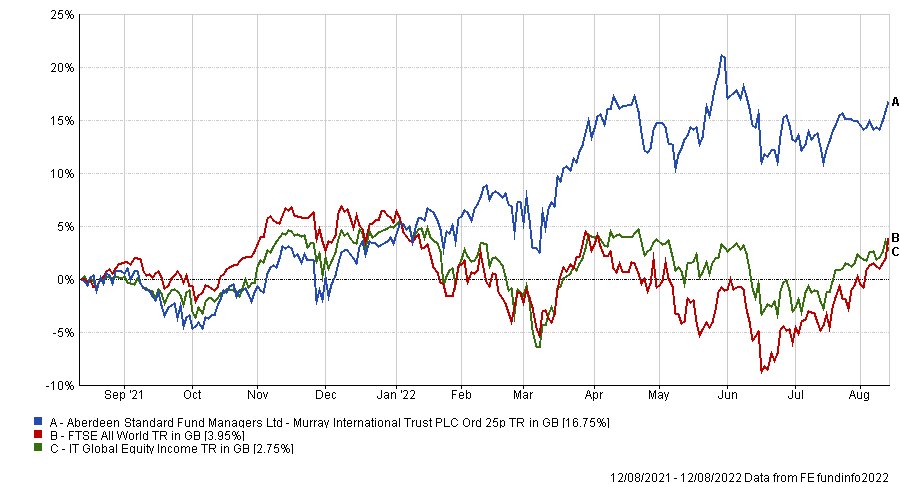

Looking at the IT Global Equity Income sector, investors who can tolerate some volatility might want to consider Murray International, which provides a “high-conviction approach with attractive dividends”.

Performance of trust vs sector and index over 1yr

Source: FE Analytics

The trust struggled in recent years, but manager Bruce Stout has stuck to his defensive positioning, focusing on cash flow generative dividend paying stocks, and shareholders will be pleased to see a period of outperformance “after a number of years in the doldrums”.

The lack of exposure in technology spurred its recent recovery, and the weightings in emerging markets, in particular real assets through the Mexican airport operator Grupo Aeroportuario, might carry it forward into the future and provide a good diversification opportunity.

In the UK equity space, Numis highlighted Troy Income & Growth, whose underweight in the energy sector generated a disappointing performance in 2022, with the NAV down 9.2% versus 2.2% for the FTSE All Share.

But its focus on strong brands and franchises with resilient pricing power and sustainable dividends should help protect margins, according to Lovett-Turner.

Another UK pick was Henderson Smaller Companies, which also went through a rough patch, losing 28.1% as small-caps fell out of favour.

Performance of trust vs sector and index over 1yr

Source: FE Analytics

But manager Neil Hermon was praised for selecting companies with strong balance sheets, many of which have been able to pay out special dividends, as Lovett-Turner, who recommended the trust for the long term, noted.

“There may be another leg down if earnings disappoint, but valuations are now depressed and investors have some margin of safety from its 15% discount,” he said.

This might be the right entry point to access the strong stock selection capabilities within this trust.

Heading east to Asia and emerging markets, Numis steered investors towards Vietnam and China.

In April, a number of investors decided to sell their positions in Vietnamese equities following a crackdown on bond market issuance by real estate companies and investigations into stock market manipulation by high-profile individuals. But according to Numis associate director Priyesh Parmar, this was exaggerated by margin calls on individual investors as well as general risk-off sentiment towards emerging markets.

“The technical setback belies the market fundamentals, which appear strong with forecast earnings growth in excess of 20% for 2022 and cheap valuations which compare favourably to regional peers,” Parmar said.

Trading at 16% discounts, VinaCapital Vietnam Opportunity and Vietnam Enterprise are attractive options, the analysts said.

Moving on to China, valuations have been depressed by Covid lockdowns and uncertainty in the property market, where buyers are withholding mortgage payments for homes that developers have yet to finish.

“That said, China is cheap, trading at a c.37% discount to developed markets, albeit narrower than its peak of c.46% in March, compared with an average of c.28% over the past five years.”

For exposure to the country, Numis’s ‘Core Buy’ is Fidelity China Special Situations, but abrdn China is also noted.

Among the biggest losers in the market rotation of 2022, the technology sector now trades at an average 13% discount. Here, Lovett-Turner retained his preference for Polar Capital Technology.

Performance of trust vs sector over 1yr

-3.png)

Source: FE Analytics

“We believe the trust is an attractive way to gain diversified exposure to global technology stocks. Ben Rogoff runs the portfolio with an active approach focused on key growth themes, and it is positive to see the manager demonstrating conviction through adding to growth companies that he believes have been sold-off too aggressively,” he said.

The trust has an active approach but is benchmark-aware, whilst risk is also managed in absolute terms with index heavyweights, such as Alphabet and Microsoft being significant underweights, despite the manager believing they have attractive prospects.

Lastly, in the stock-driven biotechnology arena, Numis favoured the active approach of the International Biotechnology trust.

Performance of trust vs sector and index over 1yr

-2.png)

Source: FE Analytics

“Long-term innovation is here to stay, so we added the biotechnology sector despite the greater risk,” said Lovett-Turner.

With increasing M&A activity and good valuations, the sector is set out to continue its expansion and International Biotechnology is not unlikely to continue to outperform its peers.

The trust could act as a strong differentiator, given its core focus is on growing capital through a diverse portfolio of biotech companies. It also has appeal to income investors, given that it pays a dividend yield of 4.0% of NAV, 4.6% on the share price, funded from capital.

There were some performance headwinds in 2021 due to it not being able to hold vaccine stocks, notably Moderna, because of managing partner Kate Bingham’s role as chair of the UK Vaccine taskforce.

“However, we are encouraged at the managers’ proactive approach, reducing small-cap exposure in 2021 and subsequently increasing in 2022 as valuations have become more attractive. We believe it is well-placed to continue the outperformance it has delivered over the last 12 months (-0.7% NAV total returns vs - 11.1% for the Nasdaq Biotech and -26% for Biotech Growth),” Numis added.