Calling the US market performance since the beginning of the year ‘shocking’ would probably fall short of describing how investors truly feel, but now is not the time to allow emotion to get in the way of sensible investment principals, according to Darius McDermott.

The managing director of Chelsea Financial Services said investors should, if possible, look to allocate to the beleaguered market after the extraordinary falls this year.

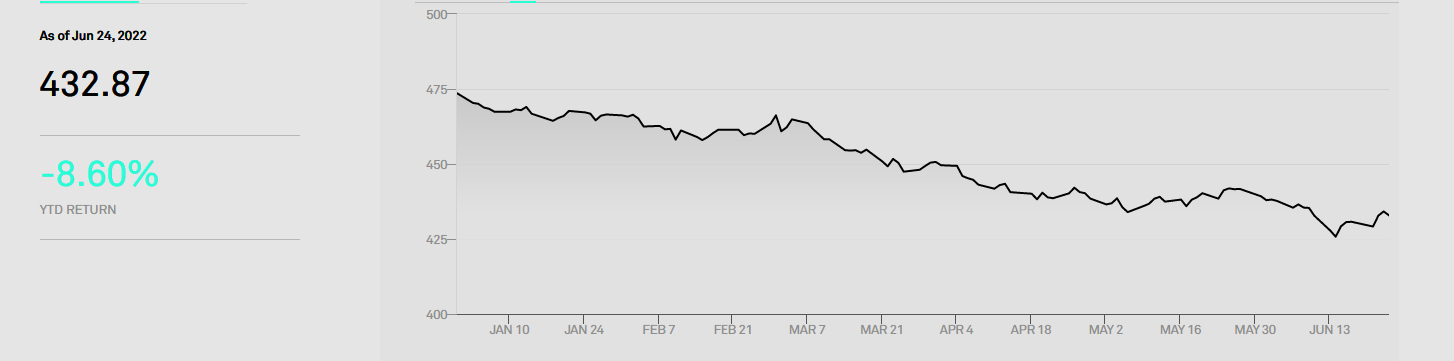

Indeed, since January 2022, the S&P 500 has plummeted 18.5%, while in the same period US treasuries have fallen by 8.4%, as shown in the charts below.

S&P 500, performance since year start

Source: Google Finance

S&P U.S. Treasury Bond Index, performance since year start

Source: S&P Dow Jones Indices

It is the fourth month in nearly 50 years that the S&P 500 fell more than 5% while US treasuries simultaneously fell around 2%.

Yet there are signs of shy optimism. After the G7 meeting that took place in Germany over the weekend, there has been an uptick in global stocks, with global indices taking a breather from their downward spiral.

Some analysts fear this confidence in the market will be short-lived, with George Lagarias, chief economist at Mazars, describing this as a relief rally.

“Far from being considered a full recovery, last week illustrates how high market volatility is and how fragile sentiment remains”, he said.

“What they are not pricing in is a full-blown global economic recession and the rising possibility of systemic events as liquidity is withdrawn and economic pressures mount. It’s not what we have seen but what we have yet to see, that keeps sentiment low.”

However, there could be more good news later this week, if the Personal Consumption Expenditures (PCE) price data points to a slowdown in inflation.

According to the consensus analyst notes, this would restore trust in the Federal Reserve’s monetary policy. But what this narration is not taking into account is that inflation lingers on.

McDermott is definitely among those who see the glass half-full. While he does expect continued market volatility due to interest rate hikes and the subsequent risk of recession, he also believes that markets move ahead of economies and much of the risk is already priced into valuations.

Hugh Sergeant, manager of ES R&M UK Recovery fund, noted that the US has suffered “the worst four-month start to the year since 1939 (and third worst on record), while for US 10-year bonds it was the worst total return since 1788, just before George Washington’s presidency”.

In the long term, McDermott said this should present opportunities for investors, as this could be a perfect entry point in a market that has historically been characterised by very high valuations.

“The US stock market is looking more attractive to me than it has done for a long time. Having led global markets for almost a decade, valuations were high, and it was difficult to justify adding to the region”, he said.

“Now the froth has come out of the market, a number of areas are looking much better value, including smaller companies and the large mega-cap tech stocks.”

He identified five investment options to take advantage of the low valuations.

For dividends, he recommended JPM US Equity Income, a dividend aristocrat which targets an above-average income by investing in a diverse range of established stocks. It has made a top-quartile return among its IA North America over one year, taking advantage of the move away from growth that has taken place in 2022 so far.

For a mix of growth and value investments in the small-cap space, he singled out T. Rowe Price US Smaller Companies Equity, which has been the best performing fund in the IA North American Smaller Companies sector over five years

He praised Schroder US Mid Cap for its “superior stock selection”, although returns have been relatively unimpressive over the long term as large-caps have dominated performance for much of the past decade.

For those that remain fans of growth, he suggested AXA Framlington American Growth for its focus on innovation and tech.It has been a top-quartile performer in the IA North America sector over five and 10 years, but is down 7.6% over the past year.

Finally, Brown Advisory US Flexible Equity has an unconstrained strategy, which provides exposure to undervalued medium-to-large improving businesses and “has enabled the fund to become of the few to consistently outperform the S&P 500 over long periods of time”, he said.