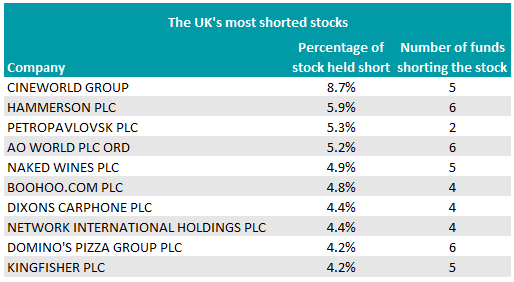

Several companies including AO World, Naked Wines, Boohoo.com and Dixons Carphone have entered the UK’s top 10 most shorted stocks in recent months as investors bet against retail businesses.

Shorting is the act of selling shares in a company that you think will decline in value and buying them back at a lower price, making a profit on its fall.

The tactic has mixed results, with some firms making huge losses on incorrect predictions, such as when wall street investors falsely predicted the downfall of GameStop last year only for the share price to skyrocket.

Bets placed against these UK companies is a clear sign that investors expect a decline in retail activity as high inflation puts a strain on consumer’s spending.

AO World

Like many online retailers, white goods retailer, AO World received massive inflows during the height of the pandemic, with the share price up over 330% in 2020. However, as lockdowns ended and Covid restrictions eased, the company has declined 69.8% over the past year.

Share price of company over five years

Source: Google Finance

Investor’s faith in the company was damaged further by poor results in Germany, which may result in the retailer removing all European operations.

Revenue for the German branch was down 24% in the third quarter compared to last year, dragging the whole group’s total loss in the period to 14%.

AO World listed market competition, increased marketing costs and persistent supply chain issues as the main anchors on performance.

These problems show no sign of easing, with the group stating that it “expects these trends will continue for the foreseeable future in the German market”.

A total of 5.2% of the company’s shares are currently on loan by short sellers, with Marshall Wace holding the largest allocation of 1.4%, followed by JPMorgan with 1.1%.

Naked Wines

Wine seller, Naked Wines is currently the sixth most shorted UK company, with 4.9% of its shares currently loaned out by five separate funds.

JP Morgan has the largest short position and earlier this month increased its size from 0.9% to 1.7% of the company’s total share register.

The company made an overall net loss last year and the share price is down 45.3% over the past year.

Boohoo.com

Shares prices for the online fashion retailer Boohoo dropped 74.7% over the past year as it suffered a fall from grace from its highs of 2020.

Valuations peaked during the pandemic, when customers used excess cash to order items online, but sales dropped as physical shops began to reopen and higher costs made consumers more frugal.

Share price of company over past year

Source: Google Finance

Additionally, in 2020 a number of campaign groups such as Labour Behind the Label, ShareAction and the Business & Human Rights Resource Centre penned a letter to the group last year to complain about poor working conditions in its Leicester facility, with many environmental, social and governance (ESG) funds culling the stock.

In order to meet high demand and make fast deliveries, Boohoo had underpaid factory workers and delivery drivers and made them work in sub-standard conditions. The company publicly apologised and made adjustments to employee relations, but the share price has not recovered since.

Furthermore, last year almost 12% of Boohoo shareholders voted against the reappointment of co-founder Carol Kane, while more than 21% voted against the management’s remuneration – although this was an improvement on the previous year.

Marshall Wace has loaned 3% of the group’s shares, with 4.8% of total shares currently shorted.

Dixons Carphone

The share price of technology retailer Dixons Carphone, which includes the high street names Currys, Carphone Warehouse and PC World, has declined 15.8% over the past year and is another popular short. However, it has been a much longer issue for the company, with shares down 68.4% over five years.

Now, investors are speculating that a lower purchasing power for the pound will lead to fewer sales, leading to 4.4% of its shares being loaned out by short sellers.

All four firms currently shorting Dixons increased their short positions this month, with GLG Partners taking the largest position of 2.1%.

Others in the top 10

Companies such as Cineworld, Hammerson, Petropavlovsk, Network International and Domino’s Pizza have kept their ranking among the top 10 most shorted UK stocks from the last time Trustnet ran these figures in October.

Cineworld continues to be the most shorted, with five investment groups loaning out 8.7% of the company’s shares, according to Sharetracker.

It has proven a profitable bet in recent months, with the share price down 39.7% over the past six months, as cinemas have struggled to draw in the same volume of customers as before the pandemic and streaming services remain rigid competition.