Next year is likely to be one of low growth, according to experts, which may prompt the more aggressive investor to dial up risk to make a good return.

Earlier this week, John Bilton, head of global multi asset strategy at JP Morgan Asset Management, suggested that global GDP would rise 1.5%, with developed markets’ growth being “modestly higher” at 3.3%.

Against this backdrop, Trustnet asked fund pickers which portfolios they would back if they were willing to take on a lot of risk to make significant returns.

Although this article is about 2022 fund picks, these types of funds are usually held over the long term, giving investors a chance to make strong gains over time, accepting that some years they might make losses.

Morgan Stanley Asia Opportunities

Rob Burgeman, investment manager at wealth manager Brewin Dolphin, said after a challenging year in Asia, with the MSCI Asia index posting a 1.5% loss in 2021, the region could be ripe for recovery in 2022.

“The Morgan Stanley Asia Opportunities fund is worthy of consideration in 2022. Kristian Heugh has a growth mindset, coupled with a high exposure to China, which has seen the fund struggle over the last year,” he said.

“However, with a lot of the bad news priced into the region, 2022 could see a better performance and we would consider this a fund that should fully participate in any broader market recovery.”

Launched in 2016, the $6.9bn (£5.1bn) fund has made the best returns among its peers over the past five years with a return 136.6%, more than double the MSCI AC Asia ex Japan index’s 59.5% gain.

Total return of fund vs sector and benchmark over 5yrs

Source: FE Analytics

“This is a growth strategy. The fund is attempting to invest the fastest-growing and highest-quality companies in the region which, in their assessment, are undervalued relative to this long-term growth potential,” Burgeman said.

Alquity Asia

Staying in Asia, Tom Sparke, investment manager at GDIM, said he had been recently impressed by the Alquity Asia fund, which he holds across a number of his portfolios including the firm’s environmental, social and governance (ESG) range.

“One of only a handful of ESG-focused Asian funds, it has performed well in finding profitable and conscientious investments since its launch in 2014 and the company as a whole has an ingrained philosophy of positive environmental impact,” he said..

“Manager Mike Sell has been at the helm since the fund’s inception and analyses companies on a number of metrics – only those that reach the fund’s exacting standards will be included. The fund has strong societal and equality considerations too and even directs a portion of the firm’s profits to its own charity.”

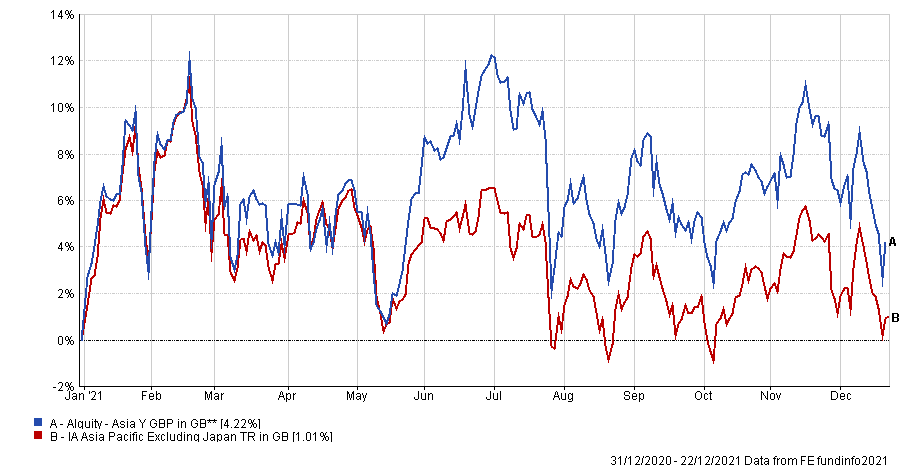

The fund has underperformed the IA Asia Pacific Excluding Japan sector since launch, returning 81.7% versus the average peer’s 110.8%. However, it enjoyed its first above-average year in 2021, returning 4.2% when the sector rose 1%.

Total return of fund vs sector and benchmark over YTD

Source: FE Analytics

Oakley Capital Investments

The performance of the listed private equity trusts sector has been good in the past couple of years but prospects remain attractive looking ahead to next year too as merger and acquisition (M&A) remains strong, according to Daniel Lockyer, senior fund manager at Hawksmoor.

“Our top pick in the sector is Oakley Capital Investments, which has a strong record of growing companies in the private sector and moving them on at significant premiums to carrying value,” he said.

Indeed, the trust has been a top-quartile performer over one, three and five years and has placed in the top three of the 16-strong IT Private Equity sector over all of these periods.

“It currently trades on an optically tight 10% discount to its net asset value last updated in June, but its recent sale of one of its top assets at a 134% premium to June’s valuation bodes well for the rest of the portfolio,” Lockyer added.

Total return of trust vs sector and benchmark over 5yrs

Source: FE Analytics

Allianz Technology Trust

Another high-risk, high-reward investment trust is the Allianz Technology Trust, which Canaccord Genuity Wealth Management investment analyst Kamal Warraich said should do well in 2022, maintaining its strong returns over the past decade.

Indeed, over 10 years the trust has made investors more than 11x their initial investment, with a total return of 1,075%.

“Technology is not one single theme. It is a diverse sector that encapsulates everything from gaming and e-commerce, to cyber security and cloud computing. And it drives innovation in old economy businesses too. It penetrates every aspect of our lives and is almost impossible to avoid,” said Warraich.

“This trust is one of the best performing technology strategies over the past decade. It is managed by a highly experienced team, some of whom have been investing in technology before the dot com era.”

JPM Natural Resources

Last up, Chris Metcalfe, investment director at IBOSS, also suggested investors should look for a thematic play, but rather than backing tech winners, he went for a comeback king: commodities.

“Commodities funds have largely been out of favour for most of the past decade. Since the lows of March 2020, which was the peak of Covid pessimism for the global economy, things have dramatically altered in this space,” he said.

Now, with surging inflation, supply chain bottlenecks, and pent-up demand, there are reasons to believe that prices are going to rise significantly in the coming year.

“Whilst it could be argued some of these tailwinds might prove more temporary than others, we feel due to years of underinvestment and newly reconstructed global supply chains, there will remain positive drivers for commodities,” he added.

“A fund we like in this space is the JPM Natural Resources fund. This investment area will always be volatile, but we feel the JPM team have the resources and the pedigree to extract the underlying value in this sector.”

| Fund | Sector | Fund size | Manager name(s) | Yield | OCF | Gearing | Discount/Premium |

| Allianz Technology Trust | IT Technology & Media | £1,477m | Walter Price | N/A | 0.80% | 0.0% | -0.5% |

| Alquity Asia | IA Asia Pacific Excluding Japan | £19m | Mike Sell | N/A | 1.55% | N/A | N/A |

| JPM Natural Resources | IA Commodity/Natural Resources | £709m | Christopher Korpan, Veronika Lysogorskaya | 2.28% | 0.82% | N/A | N/A |

| Morgan Stanley Asia Opportunity | FO Equity - Asia Pacific ex Japan | £5,184m | Kristian Heugh, Krace Zhou | 0.00% | 0.99% | N/A | N/A |

| Oakley Capital | IT Private Equity | £537m | 1.09% | 2.46% | 0.0% | -7.6% |