Inflation has emerged as one of the biggest market risks of 2021, moving above central bank targets across the globe and adding to pressure for rate hikes.

One of the areas in which inflation can be most keenly seen is in commodities, where many prices have spiked in 2021. In most cases this is down to supply shortages – production was held back by the pandemic – and the jump in demand that took place as economies reopened.

As the chart below shows, the broad-based S&P GSCI index – which is one of the most widely recognised commodity benchmarks – has significantly outperformed equities over 2021 so far with a return of 46.2%.

Performance of commodities vs equities over 2021 YTD

Source: FE Analytics

Of course, not every investor will have direct exposure to commodities in their portfolios. Those that do will probably have only a small amount in gold or a basket of commodities for diversification or inflation-protection purposes.

But the price of commodities has wide-reaching implications for all investors, whether that be for the profits of firms like miners or oil & gas majors, the input costs of manufacturers, the impact on commodity-heavy stock markets like the UK and Russia, or the overall rate of inflation and all its consequences.

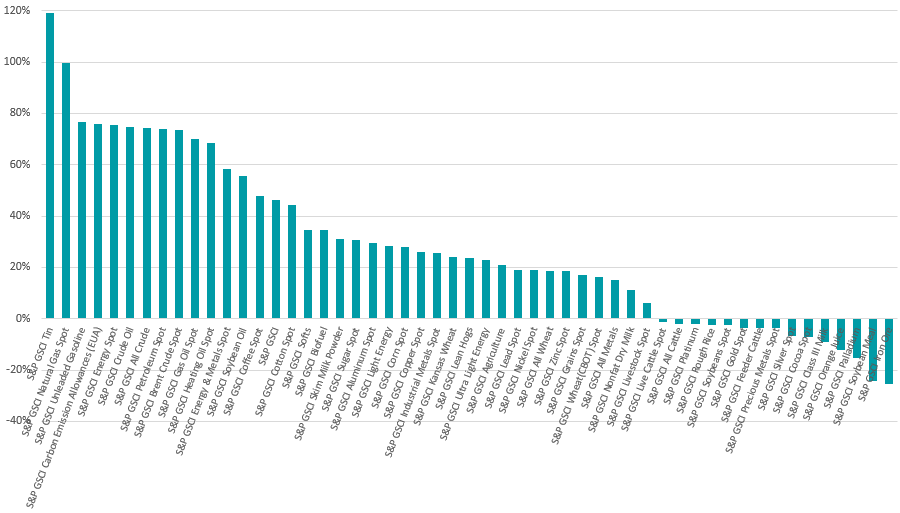

With this in mind, Trustnet ran the performance of 53 commodity indices from the S&P GSCI range to see where the biggest price rises have been witnessed over 2021 so far.

While much of the attention has been on spiralling energy prices this year, we found it was a relatively everyday metal that has jumped the most: tin.

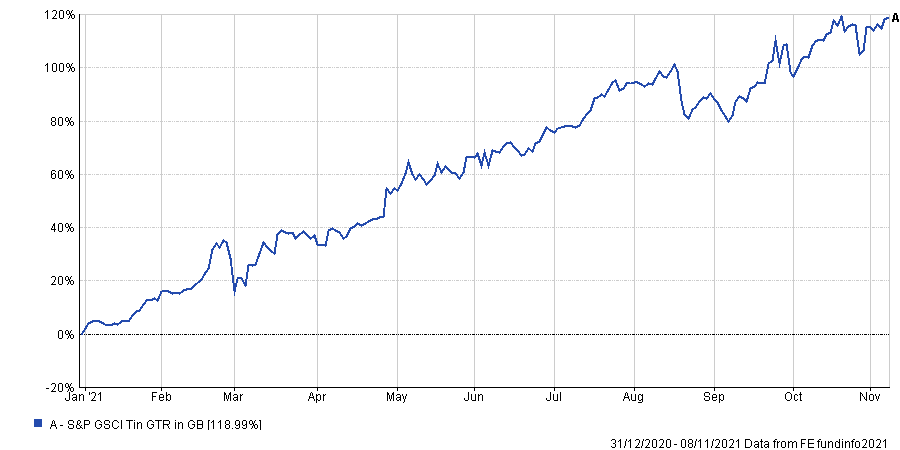

Performance of tin over 2021 YTD

Source: FE Analytics

As the chart above shows, the S&P GSCI Tin index gained 119% between the start of 2021 and 9 November. The silvery-white, malleable metal’s main application is in solder – essential for electronics manufacturing – with around half of all tin produced being used in this way.

Like many commodities, the rise in the price of tin over 2021 is largely down to supply shortages following the 2020 Covid lockdowns, combined with very strong demand in the 2021 reopening.

In the case of tin, supply was further restricted this year by fresh lockdowns in Indonesia and Malaysia, which disrupted their tin mining and smelting capacity. The two countries together accounted for about 30% of global refined tin production in 2020.

Performance of individual commodities over 2021 YTD

Source: FE Analytics

In second place is S&P GSCI Natural Gas Spot with a 99.6% rise over 2021. This should come as little surprise to investors based in the UK, after soaring gas prices led to the collapse of several small energy firms and pushed up heating bills for consumers.

Indeed, some of the biggest price rises this year have come from energy commodities. Unleaded gasoline, crude oil, petroleum, gas oil and heating oil are all up more than 60% year-to-date, according to the S&P GSCI indices’ performance.

Mark Nash, head of strategy in Jupiter’s fixed income alternatives team, said: “Energy and commodity prices are likely to remain high as we head into winter.

“Renewable sources of energy have been found wanting as droughts and a lack of wind have proven problematic, while storage issues are yet to be resolved. Meanwhile, the lack of ‘old industry’ investment has constrained fossil fuel supply and gas storage during a cold winter.

“This will feed further into oil prices and energy-intensive commodities as factories are shut down. The impact on consumers and businesses from high commodity and energy prices is a clear negative.”

Agricultural commodities have been a mixed bag over 2021 however.

There were strong price rises in soft commodities such as soybean oil (up 55.7%), coffee (47.6%), cotton (44.4%) and sugar (30.5%); however, declines have hit the likes of soybean meal (down 24.4%), orange juice (down 12.2%) and cocoa (down 7.2%).

However, strategists at WisdomTree said that prices for agricultural commodities could rise further if the La Niña phenomenon hits the Northern Hemisphere this winter.

La Niña is a complex weather pattern that is caused every few years because of variations in ocean temperatures in the equatorial band of the Pacific Ocean. It disrupts normal weather patterns, such as causing intense storms in some places and droughts in others.

“The probability of a La Niña weather pattern developing this year has been increased to 70-80%, by the US National Oceanic and Atmospheric Administration,” WisdomTree said.

“La Nina helps diminish a source of negative price pressure and given the backdrop of reduced stock levels for wheat (down by 18%), corn (down by 36%) and soybeans (down by 51%), La Nina could provide an upside price boost for these agricultural commodities.”

At the bottom of the rankings is iron, with the S&P GSCI Iron Ore index posting a 25.4% drop this year.

The price of this industrial commodity has been tumbling for months, largely on the back of moves by China to clean up its polluting industrial sector. Beijing has imposed steel production cuts as part of efforts to control pollution, but this has caused a slump in the demand for iron ore.

Performance of precious metals over 2021 YTD

Source: FE Analytics

But some of the most notable falls have come from precious metals, with the S&P GSCI Precious Metals Spot index down 3.8% this year.

Gold is the most commonly turned-to precious metal by investors, as it has traditionally been used a store of value and an inflation hedge. The yellow metal has fallen 3.4% in 2021 so far as it struggled against the twin headwinds of higher bond yields and an appreciating US dollar.

However, silver has fallen harder – down 6.9% - while palladium has lost 15.4%.

In the case of palladium (and platinum, which has held up better with a 2% decline), prices have been pushed down by both rising supply and slowing demand from the automobile industry, where production is being hampered by the global semiconductor shortage.

WisdomTree strategists said: “Investors looking beyond the ongoing challenges in the auto industry may view the recent decline in prices as creating an attractive entry point for palladium and platinum.”