A powerful economic rebound and greater willingness from central banks to tolerate higher inflation are “two key dynamics” why BlackRock is maintaining a pro-risk stance in its portfolios.

One year ago, markets were coming out of a brutal sell-off sparked by the onset of the coronavirus crisis. While massive amounts of stimulus meant financial markets started to recover relatively quickly, much of 2020 was spent with countries moving in and out of lockdown, with GDP taking an unprecedented hit.

This year, however, has started on a much more optimistic footing, with several effective Covid vaccines being rolled out across the globe and many countries easing the restrictions used to curb the pandemic.

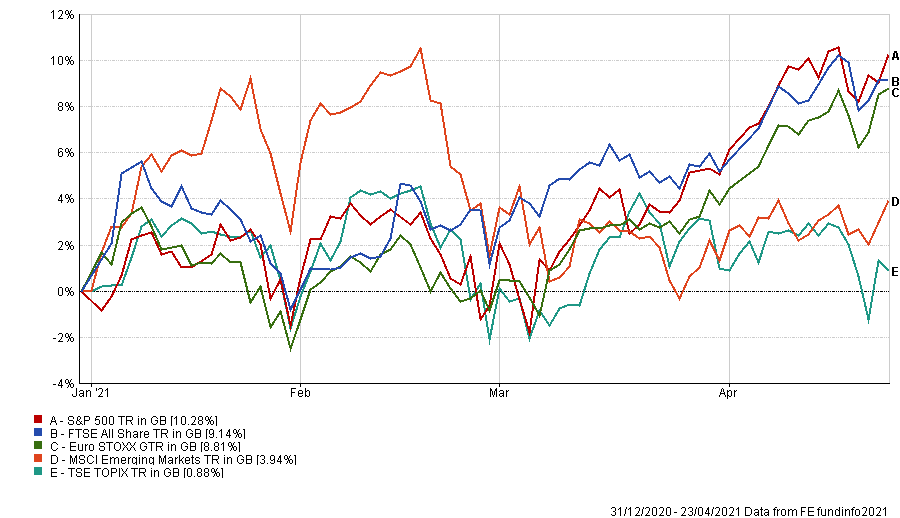

Performance of regional indices over 2021

Source: FE Analytics

The vaccine rollout and the eventual end of coronavirus restrictions appears to promise a period of strong economic growth but there has been some nervousness over the risk that inflation could take off, forcing central banks to tighten policy.

In its latest market update, the BlackRock Investment Institute – which offers insights into the global economy, markets, geopolitics and long-term asset allocation, said: “We are at an uncertain juncture in markets. Investors are grappling with how to interpret unusual growth dynamics and new central bank frameworks.”

On the first issue of ‘unusual growth dynamics’, the firm noted that US economic activity looks set to jump strongly in 2021 – powered by pent-up demand following a year of coronavirus restrictions and “sky-high” excess savings.

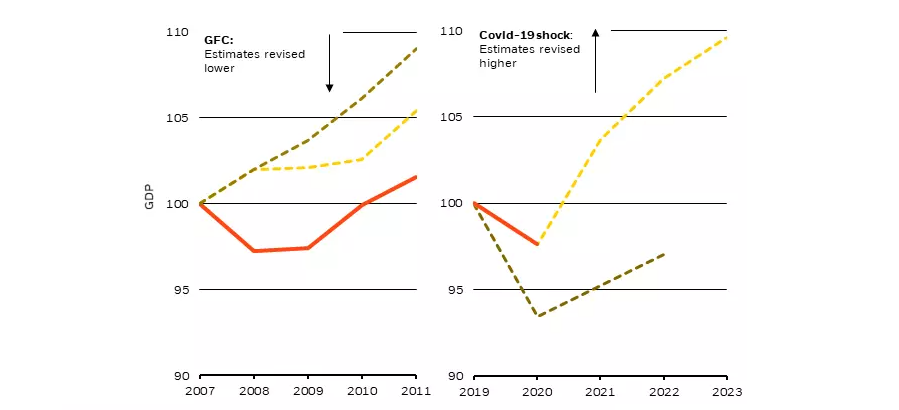

US GDP estimates: Global financial crisis (GFC) and Covid-19 shock

Sources: BlackRock Investment Institute, Federal Reserve and Reuters News, with data from Haver Analytics ,as at Apr 2021

“Growth forecasts have been catching up, but the magnitude of the restart may still be underappreciated,” the BlackRock Investment Institute said. “This is in stark contrast to the repeat growth disappointments seen after the global financial crisis – and reflects the different nature of this shock.”

BlackRock’s strategists are viewing the coronavirus rebound as more like a natural disaster followed by a rapid ‘restart’, as opposed to a traditional business cycle recession followed by a ‘recovery’.

“This is why a year ago we warned against extrapolating too much from the steep decline in activity. Now the same is true – but in reverse,” they added.

“US growth will likely peak over the summer but the eye-popping data will be transient: the more activity is restarted now, the less there will be to restart later. We see the rest of the world following the US and reopening as vaccine rollouts pick up pace.”

The second issue that markets are dealing with at the moment is ‘new central bank frameworks’. Last year, the US Federal Reserve made a change to its inflation policy: having previously targeted inflation of around 2 per cent, the central bank is now following a policy of ‘average inflation targeting’.

This is a significant change. Over much of the Fed’s history, it has quickly tightened monetary policy when it looked like inflation would rise, in order to avoid the risk of runaway inflation if the economy were to start overheating.

However, under the new framework, the Fed will allow inflation to move past 2 per cent if it follows a period when inflation has been running below target – as it has been for much of the recent past.

The BlackRock Investment Institute noted that this shift means investors could expect inflation to be higher in the years ahead, without expecting the bank to start hiking interest rates.

“The Federal Reserve is building credibility in its new framework and has set a high bar to change its easy policy stance, even in face of higher realised inflation. This has yet to be fully digested by markets, in our view,” it explained.

“We see markets still underestimating the potential for the Fed to achieve above-target inflation in the medium term as it looks to make up for persistent undershoots in the past. This is why we think the direction of travel for yields is higher. But we believe the overall adjustment will be much more muted than one would have expected in the past based on growth dynamics – and much adjustment has already taken place.”

As a result of these two key dynamics – economic activity likely to be higher than the market expects while monetary policy will allow higher inflation – BlackRock said it is maintaining its pro-risk tactical view.

This being expressed through an overweight to equities, with the group taking a pro-cyclical stance in stocks. It is overweight emerging market equities and US small-caps, as they are seen as likely beneficiaries of the vaccine-led restart.

In fixed income, BlackRock is neutral credit and underweight government bonds on a tactical basis. It likes emerging market local currency debt thanks to attractive valuations and the prospect of a stable dollar, while preferring high yield bonds over investment grade.

Some of the government bond allocations have been tweaked in light of recent market moves, however. The underweight to conventional government bonds has been trimmed and the overweight to US inflation-linked bonds has been closed.

BlackRock Investment Institute strategists finished: “The broadening restart – coupled with our belief that this will not translate into significantly higher rates – underpins our pro-risk stance.

“Risks remain, however, on the tactical horizon. One is a market overreaction to exceptional growth data in the months ahead. We may see bouts of volatility as markets test the Fed’s resolve to stay ‘behind the curve’ on inflation.

“Any temporary spikes in rates may challenge emerging market assets in particular, but we advocate staying invested and looking through any turbulence.”