UK equity funds managed by Nick Train, Paul Mumford and Colin Morton are among those that have made some of the highest returns of their peers while levying some of the lowest fees on investors, Trustnet research shows.

Fees are an important consideration for investors and a low-cost high-performing fund can be a valuable asset in any portfolio.

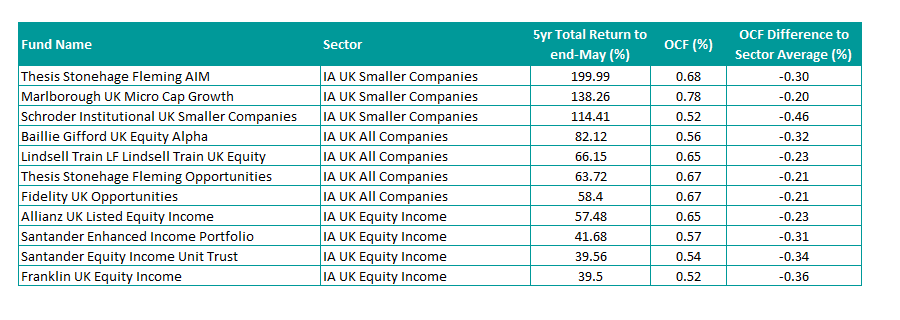

With that in mind, Trustnet looked across the IA UK All Companies, IA UK Smaller Companies and IA UK Equity Income sectors to find the active funds that have achieved both top-quartile performance over five years and are cheaper, in terms of the ongoing charges figure (OCF), relative to the average active member of the sector.

To find these funds, we narrowed it down by looking for those with a top-quartile total return over five years to the end of May and an OCF that is at least 20 basis points below that for the average active fund.

The UK active funds with low OCFs and high returns

Source: FE Analytics

At the top of the list – which is ranked by total return – is the £133.8m Thesis Stonehage Fleming AIM fund, run by Paul Mumford and Nick Burchett. It was previously known as the TM Cavendish AIM fund.

With an OCF of 0.68, it is 0.30 percentage points cheaper than the 0.98 per cent IA UK Smaller Companies sector average. It has made a total return of 199.99 per cent over five years.

Mumford is an experienced stock picker who invests in equities on the UK Alternative Investment Market (AIM) as well as in other small-cap businesses.

Interest in AIM shares has grown soundly since the start of the year and an increasing number of companies are raising capital on the stock market.

Mumford said: “Hopefully, we will participate in some of these in coming months but we will be highly selective as the poor performance of Deliveroo on the market shows how investors can be fooled into losing money.”

Mumford and Burchett also run the £118.5m Thesis Stonehage Fleming Opportunities fund, which also makes this list.

Staying within the UK Smaller Companies sector, the £1.7bn Marlborough UK Micro Cap Growth fund is second, with a top-quartile return of 138.26 per cent over five years. With an OCF of 0.78, it is 0.20 percentage points cheaper than the sector average.

Run by Guy Field and Eustace Santa Barbara, the fund was one of the most purchased funds on Hargreaves Lansdown, according to Susannah Streeter, senior investment and markets analyst for the platform.

UK smaller companies have enjoyed a strong year since the March 2020 sell-off, buoyed by a Brexit deal and strong vaccine rollout and the sector as a whole has returned 103.53 per cent in that time.

Next, the £836.6m Schroder Institutional UK Smaller Companies fund, which has the joint-lowest OCF in the list of 0.52 per cent – nearly half the sector average.

It’s been a strong long-term performer too, making 114.41 per cent over the five-year period.

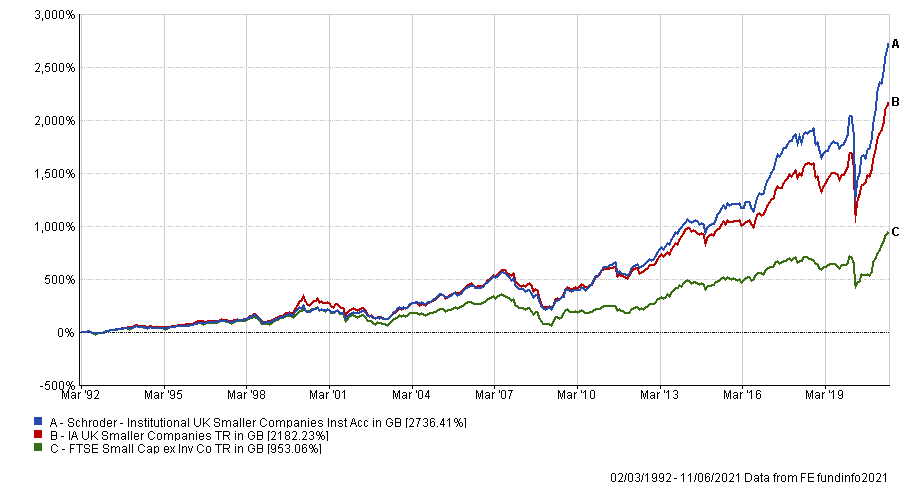

It is run by Andy Brough, who has managed the fund for over 30 years and was joined by co-manager Iain Staples in 2015.

Performance of fund over managers tenure

Source: FE Analytics

The fund has grown 2,736.41 per cent during his tenure, outstripping the 935.06 per cent return of the benchmark FTSE Small Cap (excluding investment trusts) index over the same period.

In fourth, Baillie Gifford UK Equity Alpha, run by Gerard Callahan, has made a total return of 82.12 per cent over five years, a top-quartile result in its IA UK All Companies sector.

For this sector, the average OCF is 0.88 per cent and the fund has an OCF of 0.56 per cent, 0.32 percentage points lower than the average active peer.

Running a high conviction approach, the top 10 names can account for nearly half of the fund.

According to Rayner Spencer Mills Research, Baillie Gifford’s Specialist UK Team are well informed generalists, rather than sector specialists.

Analysts said: “Baillie Gifford prefer to keep a format where the group discuss everything, as they believe this leads to better decision making, rather than just relying on one specialist on a stock within the team.

“The strength of the investment process and stock picking abilities have been demonstrated by an experienced and stable team.”

Staying with the IA UK All Companies sector and turning to one of the more famous names on this list - LF Lindsell Train UK Equity. Run by FE fundinfo Alpha Manager Nick Train, the £6.6bn fund runs a strict investment criteria with a concentrated portfolio of around 20-30 stocks.

Square Mile Investment Consulting & Research said of the manager: “In Nick Train, this fund benefits from a highly experienced, articulate and thoughtful manager who has proven to be a responsible steward of investors’ capital.

“Mr Train’s philosophy is based on the principle of investing in what he sees as strong businesses and holding them for the long term.”

Over five years, he has overseen a 66.15 per cent return, recovering well from the Covid-linked sell-off. The OCF is 0.65 per cent.

The last entry from the UK All Companies sector is the £580m Fidelity UK Opportunities fund, run by Alpha Manager Leigh Himsworth and Jac Jones.

The fund is a long-only multi-cap high conviction portfolio of around 40-60 stocks and Himsworth has over 20 years of experience managing UK equities.

The team at Rayner Spencer Mills added: “This is a dynamic fund combining both bottom up core growth holdings and a top-down thematic overlay in which the manager will tilt the sector positioning and holdings according to the market conditions.

“He will also take positions in short-term value opportunities and the fund is designed to generate superior risk adjusted returns over the cycle.”

The 0.67 per cent OCF is 0.21 percentage points cheaper than the average for the sector.

Finally, from the IA UK Equity Income sector, four funds that are less expensive than their peers. The sector average is 0.88 per cent and all fall comfortably below that.

With the highest performance amongst the IA UK Equity Income funds is the £68.6m Allianz UK Listed Equity Income fund, run by Simon Gergel and Richard Knight. The fund holds renowned dividend stocks, such as Royal Dutch Shell, BP and GlaxoSmithKline within the portfolio.

The joint-lowest OCF in the list of 0.52 per cent comes from the £872.5m Franklin UK Equity Income fund.

Speaking of manager Colin Morton, Rayner Spencer Mills Research analysts said: “We have known the manager and the team at Franklin Templeton for many years and in our opinion, they are one of the top UK equity teams.

“Over the years they have demonstrated their ability to outperform the market over varying economic cycles and over the long term the fund should increase in capital value as well as paying a healthy dividend.”