Investors should look beyond the ongoing rotation into value stocks to focus on company fundamentals and a search for positive earnings surprises, according to BlackRock’s Fundamental Active Equity team.

In his outlook for the second quarter of 2021, Nigel Bolton – co-chief investment officer of BlackRock's Fundamental Equity Group – noted that, thanks to the vaccine rollout, markets have started to look beyond the coronavirus crisis to a world of post-pandemic growth.

However, against this backdrop, Bolton thinks future opportunities will be more about company specifics and the ability to deliver earnings rather than the big sector moves that investors have focused on for the past few months.

“Markets are already adjusting to the idea of post-Covid growth, and we believe the companies that can outperform now are those able to deliver on earnings,” he said.

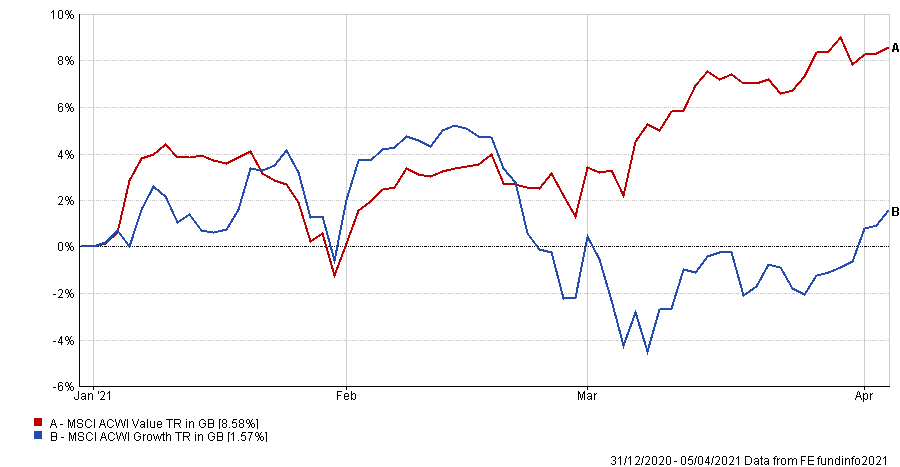

We expect global growth to surge once the Covid crisis eases and lockdowns are lifted. The cyclical value stocks closely linked with economic growth – overlooked for a decade and further beaten down by the pandemic – should continue to benefit this quarter as economies restart. But many have already notched significant gains over the past six months, making valuations less attractive.

Performance of growth and value stocks over 2021

Source: FE Analytics

“At the same time, some of the companies that grew rapidly as a result of technological innovation – a long-term trend accelerated by the pandemic – are now available at better valuations after investors rotated their portfolios towards value stocks.”

Below, Bolton highlighted three trends that BlackRock expects to become more dominant over the coming months.

Staying selective within cyclicals

BlackRock thinks that the key to outperformance in the current market will be the ability of companies to achieve a positive earnings surprise — but this could come from any sector, regardless of if it is cyclical in nature or not.

One way that this positive earnings surprise could be achieved is through companies’ pricing power allowing them to pass rising costs on to customers.

“Sellers of raw materials such as copper are in a strong position as the ‘green’ spending promised by governments boosts demand,” Bolton said. “Cement companies can raise prices as supply remains controlled and demand picks up amid broad infrastructure spending.”

Another source of positive earnings surprises could be companies that benefit from a greater-than-expected surge in consumer demand.

Bolton noted that Australia had twice as many restaurant bookings in February 2021 as for the same month in 2019 while in Singapore there are three-week waiting lists for neighbourhood restaurants that previously required no reservation. BlackRock sees this as a sign of what could soon be experienced in Europe and the US.

“Banks represent another area where we could see an earnings surprise,” he added. “The amount of money needed to cover loan losses may be less than expected, on the back of government support for businesses and consumers and a strong economic recovery into 2022.”

The winners that keep on winning

The market is undergoing a rotation out of growth stocks and into value but BlackRock said investors need to look beyond styles and sectors when assessing stocks and put a greater emphasis on company specifics.

“Valuations for many of the pre-pandemic winners that benefitted further from trends accelerated by Covid — such as tech and renewable energy companies — have retreated from lofty 2020 levels, making them more attractive for long-term investors,” Bolton said.

When it comes to information technology and cloud computing, the asset management house argued that investment will remain high as part-time remote working – or hybrid working - becomes the new normal.

In addition, companies that help other businesses with digitalisation look poised for further growth, as do fashion brands that have embraced the move to online retail.

The electric revolution

On renewable energy companies, BlackRock believes that the market is underestimating the transition to a low-carbon economy. This means companies that are integral to this process could be another source of positive earnings surprises.

Electric vehicles are one example of opportunities in this space. Consumer demand for electric vehicles is expected to soar over the coming decade and this will impact a number of other sectors, such as semiconductors, materials and robotics.

An electric vehicle can use up to 10 times as many semiconductors as a conventional mid-range car. “Semiconductors are essential for solar power, smart grid technology and electric vehicles – and makers have been able to hike prices as supply remains limited due to pandemic-related disruption,” Bolton added.

Meanwhile, the rise of electric vehicles means increased demand for the materials needed for their batteries, such as lithium, cobalt and nickel. Companies involved in the discovery and extraction of these metals could benefit, although this may come with additional ESG concerns.

Furthermore, the surging sales and profits reported by robotics companies at the end of 2020 was attributed to rising demand from electric vehicle manufacturers, especially those in China. “As car makers in the rest of the world ramp up electric vehicle production this year, we expect sales of factory automation equipment, robots and robo-machines to rise further,” Bolton finished.