The post-coronavirus world could see the return of a “proper” corporate bond market, according to BMO Global Asset Management’s Kelly Prior, following a decade of “distortion” by central banks.

In a previous Trustnet article, BMO co-head of multi-manager Rob Burdett argued that events such as the coronavirus crisis often lead to “some form of regime change” that can have an impact on economic conditions, politics, fund management styles, consumer attitudes or corporate behaviours.

Kelly Prior, a member of BMO’s multi-manager people team, believes that one area where this regime change will be seen is the corporate bond market.

As central banks lowered interest rates in response to 2008’s global financial crisis, business took advantage of this by raising money in the bond market to fund aggressive balance sheet management, such as carrying out share buy-backs.

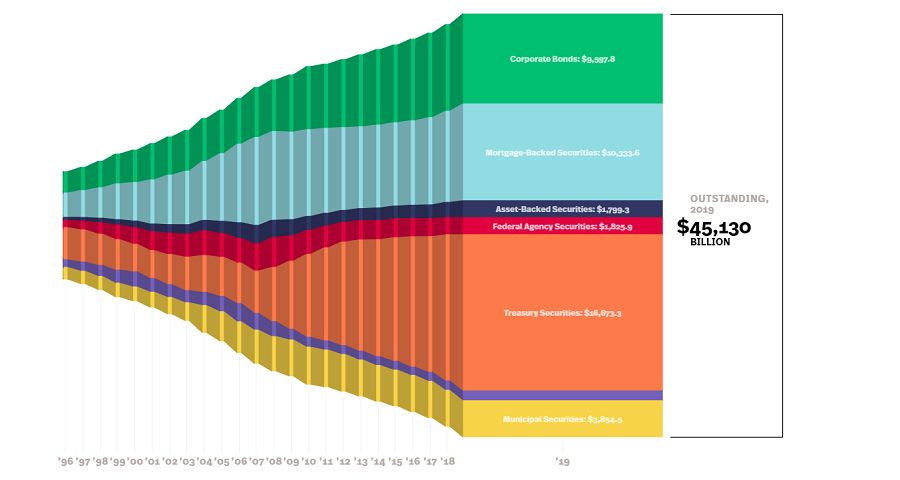

Data from the Securities Industry and Financial Markets Association shows the US corporate bond market was $5.3trn in size in 2008 but had grown to $9.6trn by the end of 2019.

US outstanding fixed income

Source: Securities Industry and Financial Markets Association

However, this period has also seen an increase in the number of businesses that are unable to service their debt, or so-called 'zombie companies'. Prior said that 4 per cent of US companies were ‘zombies’ in 2007-8 but this is now “terrifyingly” closer to 20 per cent.

“It just shows you the sort of the things that have actually been happening through this distorted period we've been through this for the last 10 or 12 years. And now this is going to come home to roost,” she said.

“Everybody has sort of forgotten about the structure of how companies and how they are actually run. Equity is worth nothing if you can't service your debt.”

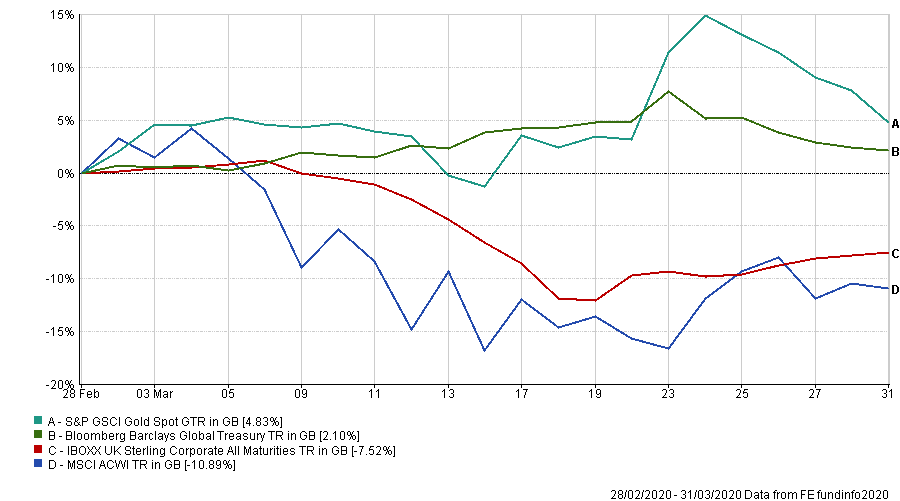

Corporate bonds were hit hard by the coronavirus sell-off in the first quarter of 2020. In March, the iBoxx Sterling Corporate index lost 7.52 per cent – beating the 10.89 per cent drop in global equities (represented by the MSCI AC World index) but far behind the rally in safe havens like government bonds and gold.

Performance of indices in Mar 2020

Source: FE Analytics

“Now things are really going to change because if you've chosen to have more debt, you're likely to be charged more for that because ultimately you're going to be a risky company,” Prior added.

“There are many facets to this but essentially companies now are going to be run more for the benefit of bond holders than equity holders. There is going to be this want to be able to service your debt.”

The BMO multi-manager added that the distortion of the past decade means many investors have forgotten that companies which show capital discipline and make prudent use of the money they’ve borrowed should be rewarded for this over the longer term.

On the flipside, companies that are over-leveraged and have poor management should be made to pay for that, in a functioning corporate bond market.

“It's almost a proper market now. I think the corporate bond world is going to become, hopefully, a proper market. Good companies that are conservative are going to be OK but we are going to see defaults pick up. It might be painful, but that’s normal” she said.

“It’s going to change corporate behaviour for sure and that can only be a good thing.”

Against this backdrop and amid the improving yields on offer, Rob Burdett and Gary Potter’s team has been increasing the corporate bond exposure of its multi-manager funds.

At the end of March, the team started a position in Jonathan Golan’s £916.5m Schroder Sterling Corporate Bond fund. The fund is the eighth highest returner of the 99 funds in the IA Sterling Corporate Bond sector, as well as being a top-quartile performer over one, three and five years.

Prior said: “It's something that we've been watching for a while: just a lovely vanilla corporate bond fund. [Golan] was able to take advantage of this real shift in markets and buy some great credits. He really extended the spread duration of that product through that time. And has managed to lock in some fabulous credits.”

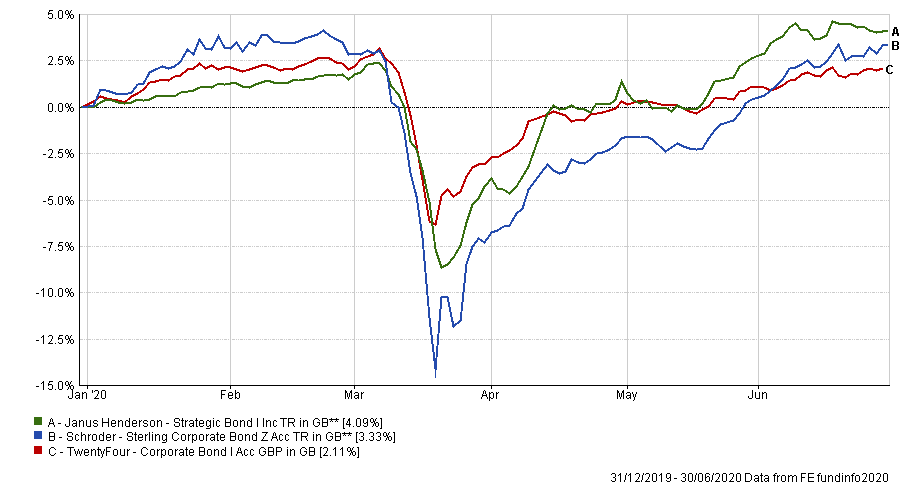

Performance of funds in 2020

Source: FE Analytics

The team also recently bought Chris Bowie’s £1.4bn TwentyFour Corporate Bond fund. It is fourth quartile in the IA Sterling Corporate Bond sector over three months but has beaten its average peer over three and five years.

“We've known Chris for a very long time; we used to own him when he was at Britannic [Asset Management],” Prior said. “He has a very intellectual way of thinking about risk and return. But again, nothing rock'n'roll. It's just looking at good quality credits and it paid for the risk that you're actually taking.”

The BMO multi-manager team also has a longstanding position in Janus Henderson Strategic Bond, which is managed by John Pattullo and Jenna Barnard. The £3bn fund has made a second-quartile 9.49 per cent total return over the past three months and is in the IA Sterling Strategic Bond sector’s first quartile over one, three and five years.

“It made a fabulous shift into US investment grade through this period and it benefited from taking advantage of the moves in terms of available credits,” Prior finished.

“This is a true strategic fund and it’s been interesting to see how they've adapted their strategy. They did incredibly well last year through their duration. This year, it's been about US investment grade. They are really shifting where they're taking their risk, which is exactly what you want to see.”