The ‘dramatic wholesaling’ of small-caps due to the coronavirus crisis has created a lot of opportunities for the next phase of recovery, says Trevor Gurwich, portfolio manager at American Century Investments.

“You had the supply shock from China and the demand shock from a global slowing of real demand from people in quarantine, as well as the oil shock that hit all these markets, creating quite a big underlying vacuum in the global markets, depressing significantly a lot of valuations,” he said.

As a result, the manager – who runs the American Century Global Small Cap Equity fund – is seeing a lot more opportunities emerging in the asset class: “A lot of these companies are still going to be around and they are still pretty strong franchises.

“We’ve gone through quite a dramatic systemic shock in the global universe and investors dump small-caps first because they consider them to be the most risky.”

However, he said many have sold off without incidental earnings impacts and that small-caps are looking “pretty cheap” relative to large-caps, which is “an opportunity that investors don’t get very often”.

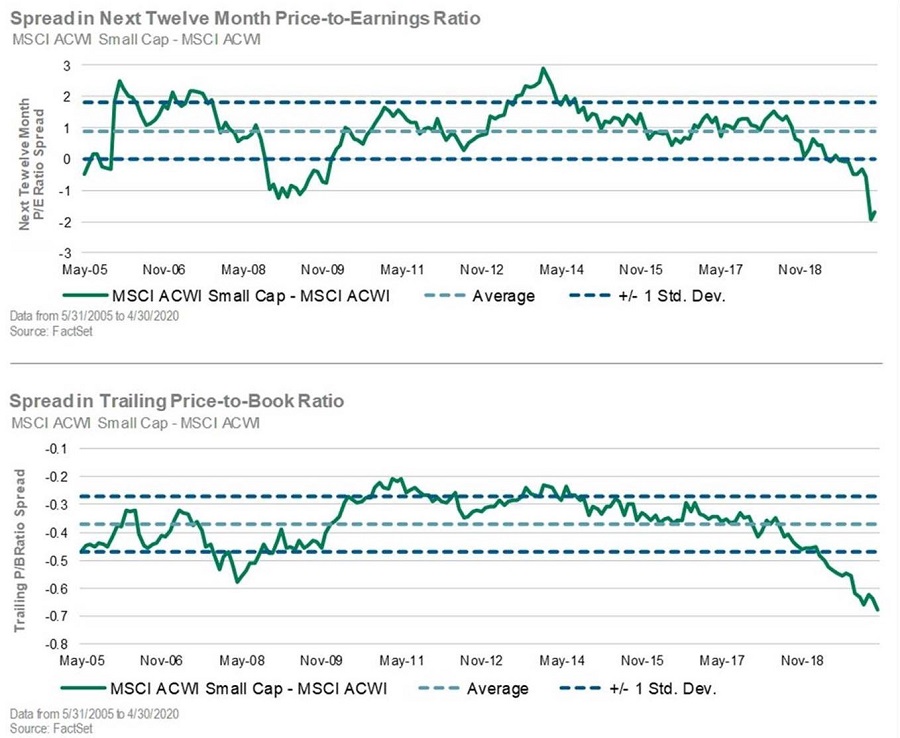

MSCI ACWI Small Cap valuations v MSCI ACWI

Source: American Century Investments

“What we’ve found is that over time that if you look at small-cap behaviour, they typically get sold off first into recessions but then they start to accelerate and they usually lead out of recessions,” he added.

Gurwich said this was partly valuation driven and partly earnings growth driven.

From a valuation perspective, he highlighted the roughly two standard deviation spread and de-rating for the 12-month forward P/E (price-to-earnings) ratios between large-caps and small-caps.

“Similarly you are seeing quite a big spread if you look at other valuation metrics like price-to-book, where historically small-caps should be priced at a slight premium to large-caps because they grow faster,” he added.

Many de-ratings that occurred during the Covid-19 sell-off are starting to re-rate, which is why the manager is seeing pretty strong performance in the small-cap space.

From an earnings growth perspective, there is faster forecasted growth in the small-cap universe and faster acceleration of that growth in 2021 versus the large-caps, he said.

Gurwich pointed to the fact that the 2020 earnings growth for small-caps globally is projected to grow roughly 9 per cent and large-caps about 3 per cent. In 2021 small-cap projected growth is 20 per cent compared with 16 per cent for large-caps.

“Looking at past crises, you do see that small-caps historically lead the market during recovery periods,” the manager said.

During the financial crisis in 2008, the drawdown in the small-cap universe was about 61 per cent while the large-cap universe was down about 58 per cent. Gurwich said that the recovery one year past that saw the MSCI small-cap index up 106 per cent and the large-cap up 78 per cent.

“When you look at the dot com crisis the drawdown on small-caps was 42 per cent, the large-caps 47 per cent, and in this case the large underperformed on the downside too and they rebounded less, rebounding 39 per cent while the small-caps were up 59 per cent.”

Gurwich believes that after the initial drawdown which saw the small cap index fall by 32 per cent, there will be a similar faster rebound in the small-cap space.

MSCI World vs MSCI World Small cap year to date total return

-2.png)

Source: FE Analytics

“One of the things we noticed that when these cases started decelerating, the markets started buying into a lot of the recovery stories,” he said.

“We were able to identify names that had a significant tailwind in all global regions. For example, we saw some very interesting companies like Teladoc, which offers telemedicine in the US.”

Teladoc is a likely beneficiary of rising demand for remote clinical diagnosis. Gurwich believes this industry is in the early stages of its growth cycle and Teladoc is a dominant player.

American Century Global Small Cap Equity is overweight in technology and healthcare, which Gurwich said are not only benefiting from long-term secular growth drivers but are also less exposed to demand destruction caused by Covid-19.

On the healthcare side, the fund is invested in Seegene, a Korean-listed molecular diagnostic reagents manufacturer that was approved to supply Covid-19 test kits.

Gurwich said that this was a rapid accelerator of revenue and earnings growth for the company because it supplied not only South Korea, but China, Italy and parts of Europe, which caused its stock price to double in the first quarter.

Another stock specific story that was true beneficiaries of the Covid-19 crisis he pointed to was German-listed food delivery company Hello Fresh.

“This is the type of business that definitely sees a huge rush of new orders, a lot of new customers trying out the product, experimenting and actually providing an incredibly perfect environment for this company to flourish,” he said.

“At the end of the day, they might not see the same acceleration that it has in the last few months, but they do get a lot more sticky customers.”

The fund has since reduced its position: “It had a huge re-rating and it got to be quite a big market cap company for us. What we’re trying to find is a lot of the smaller gems out there.”

This is really down to the fund’s investment philosophy, which is based around the belief that the market is inefficient in the global small-cap space at identifying inflection points

“If we focus on inflection points, we can identify companies as they begin to accelerate their growth phase and we can take advantage of both that earnings growth surprise and pe re-rating,” Gurwich explained.

“We believe earnings drive stock prices, and that the direction of earnings growth is far more powerful a predictor of stock price performance rather than the absolute level of growth.”

Gurwich co-manages the $52m Nomura American Century Global Small Cap Equity fund, which has returned 12.73 per cent versus a loss of 3.5 per cent from the MSCI World Small Cap index since its launch in July 2019. It has an ongoing charges figure of 0.45 per cent.

Performance of fund vs index since inception

.png)

Source: FE Analytics

The relatively new fund mirrors the strategy of the $481m American Century International Opportunities fund which is domiciled in the US.

It has a longer track record having launched in 2001. It has delivered 9.55 per cent average annualized total returns for the past 10 years, compared to 6.77 per cent of the MSCI AC World ex-U.S. Small Cap Growth index.