Weakness seen in the US dollar could signal the start of a new longer-term trend that sees it lose its dominance in currency markets, according to multi-asset analysts at asset manager Rathbones.

Over the past two decades, the US dollar has performed strongly against most other currencies, supported by strong economy and supportive monetary policy.

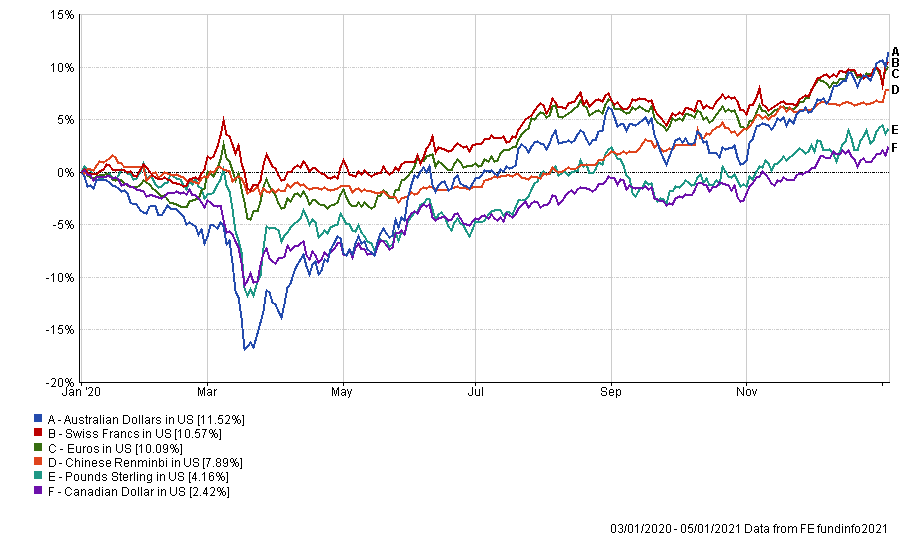

However, over the past year, all the other International Monetary Fund reserve currencies – sterling, euro, Japanese yen, Chinese yuan, Swiss francs, Australian dollar and Canadian dollar – have risen against the US dollar, as the below chart shows.

Performance of non-US reserve currencies in US dollar over 1yr

Source: FE Analytics

“From a number of perspectives, the dollar looks like it may be flying too high against most major currencies on a longer-term basis and vulnerable to a more sustained fall," noted Rathbones analysts.

“Over the next few years, large fiscal deficits, large current account deficits and low savings rates could push the dollar down, stimulating demand for foreign investors to fund these deficits.”

Should US real rates remain in negative territory, as Rathbones expects, over the long term and the current account deficit continues to widen, the dollar could weaken further.

Nevertheless, there are a number of tailwinds that could work against the asset manager’s longer-term forecast for a weaker dollar in the coming months.

“First, there are a large number of speculative short-term positions against the dollar relative to history, particularly versus the euro,” the Rathbones analysts said.

“At a time when US real yields are rising more than German real yields – as Europe battles against Covid with more stringent lockdowns – this could lead to a lot of dollar buying if these shorts are unwound.

“Second, while the US Federal Reserve is likely to keep monetary policy very loose for the next two to three years, the minutes from the Fed’s November meeting discussed the prospect of tapering bond purchases at some point — a slightly hawkish surprise, even though tapering is likely many months away.”

As such, further asset purchases by central banks in Europe, Japan and UK could be positive for the US dollar relative to their respective currencies.

However, the dollar also faces some potential headwinds.

For example, there has been a fall in the hedging of investment in dollar-denominated assets in recent years, with the asset manager warning that any change in mindset could “add fuel” to any dollar weakening.

In addition, if Covid-19 vaccinations are successful, rising global GDP growth prospects relative to the US could erase any growth advantage that has supported the dollar in 2020.

“This could be especially dollar negative if emerging market and commodity-backed currencies responded positively too,” the Rathbones analysts noted.

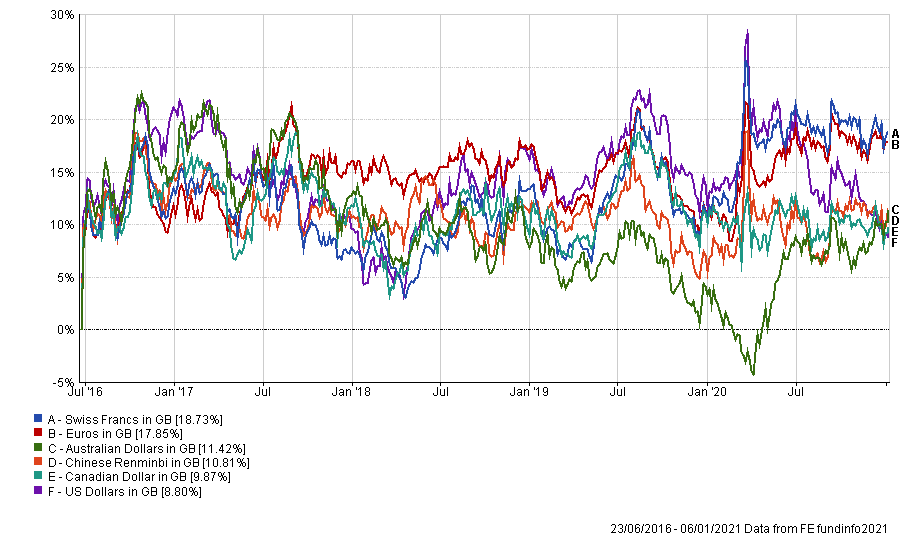

Closer to home, Rathbones analysts said that sterling could be due for a rebound given its poor performance since the 2016 EU membership referendum, as the below chart shows.

Performance of non-UK IMF reserve currencies in sterling since EU referendum

Source: FE Analytics

Source: FE Analytics

They said: “The crucial question is whether the UK’s already rather poor economic performance becomes so much worse relative to the rest of the world that its exchange rate actually looks overvalued? Our analysis suggests not.”

The Rathbone analysts noted that over a three-to-five year view there is greater scope for sterling to appreciate than there is to fall.

They concluded: “If these forecasts for a weaker dollar and stronger pound come to fruition, they could subtract from returns for global investors based in the UK when translated back to their home currency. However, these are long-term assessments.

“It’s best not to try to predict where these volatile beasts are heading in the short term.”