The global biotech sector benefits from several fundamental tailwinds that look capable of driving structural growth for many years, if not decades. The growing but ageing population and the emergence of a higher income middle class in many rapidly developing economies, are likely to drive rising demand for healthcare services.

Meanwhile, scientific and technological advances fuel an unprecedented wave of innovation, offering new investment opportunities in biotech companies with novel products that can meet the evolving needs of patients globally.

These consistent and reliable trends underpin a secular growth in biotech and supports the sector’s reputation as a source of dependable long-term growth. However, while less exposed to macroeconomic shifts than many other industries, biotech is not completely immune from cyclicality.

Cyclical valuation shifts

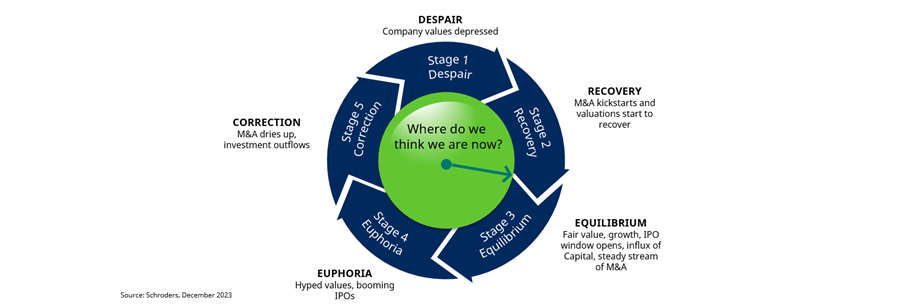

The biotech sector, though generally stable, experiences investment cycles affected by investor sentiment and risk tolerance. Some investors are fully committed to biotech, but many others tend to move in and out of the sector, creating volatility in observed valuations, and leading to significant dispersions of price from fundamental value, in both directions. This drives an investment cycle illustrated below, which we have seen repeatedly during our long time investing in the sector.

The cycle starts with stage one, marked by undervalued biotech companies whose potential is often overlooked by the market. This stage sees biotech firms trading below their cash value, reflecting a lack of investor confidence in their products and service, and a rarity in initial public offerings (IPOs). Sentiment-driven investors exit, putting further pressure on valuations.

The cycle then transitions into stage two, a recovery phase initiated by attractive low valuations drawing in, ‘cash-rich’ pharma and big biotech companies for bargain priced assets. This uptick in merger and acquisition (M&A) activity, often at premiums to share prices, signals the market undervaluation and spurs a rise in valuations.

Stage three brings stability and growth, with regular M&A activity and a steady flow of reasonably valued IPOs. This phase attracts risk-tolerant investors supporting valuations and facilitating easier re-financing.

As investor confidence grows, stage four emerges characterised by heightened investment activity and inflated valuations. IPOs become more frequent, often at values exceeding the assets’ potential.

However, this boom phase is short-lived, leading to the corrective stage five. Here, M&A deals dry up, perceived risks increase, and investors, facing declining prices and disappointment exit the sector, resetting the cycle to its initial phase.

Inverse dynamics

Another important driver of cyclicality is the relationship between biotech valuations and interest rates. The sector has witnessed long periods of declining rates followed by a decade of ultra-low rates.

However, this trend has changed in 2022, due to inflation prompting central banks to raise interest rates to levels not seen since before the global financial crisis of 2007-09.

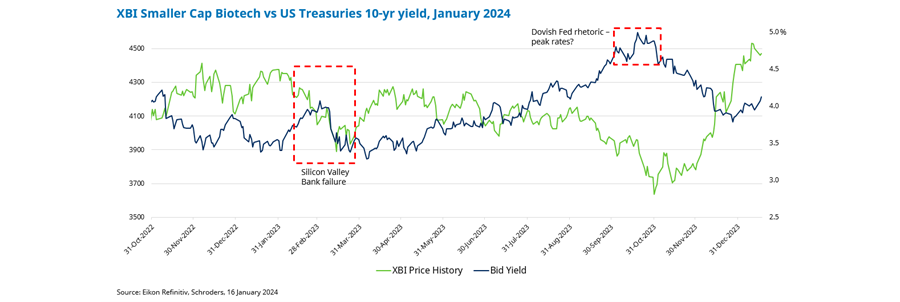

This change underscored the biotech sector’s vulnerability to higher interest rates, as evidenced by the inverse relationship by the sector’s performance and the US 10-year Treasury yield, demonstrated below.

This relationship was briefly disrupted in March 2023 by the collapse of SV Bank – a key financier for small-cap biotech companies – but has since realigned. The sector’s dependence on financing for asset development makes its sensitivity to interest rate changes understandable.

With the rise in interest rates, both debt and equity finance have become more costly impacting the sector’s financial dynamics. As interest rates peaked and started to retract in the fourth quarter of 2023, so too the smaller cap biotech sector staged a rally.

While definitive conclusions about the battle against inflation are premature, there are indications that the current interest rate cycle may be reaching its peak. The Federal Reserve, European Central Bank and Bank of England have recently held interest rates, reflecting a meaningful decrease in inflation on both sides of the Atlantic.

The uncertainty surrounding future inflation and interest rates underscores the importance of evaluating financial strength and funding requirements in the biotech sector, which is highlighted by the sector’s relationship with long-term bond yields.

Key to preserving capital, is knowing where the sector currently sits in this investment cycle. Recent trends, such as increased M&A activity, suggest that the biotech sector is progressing through stage two and is in the cusp of entering stage three.

Here, dedicated biotech investors can find well-financed businesses with innovative technology at attractive valuations. They can shift between less risky, cash flow-generating, large biotech stocks, and higher beta development-stage biotech businesses, depending on where they believe they are in the cycle.

Moreover, closed-ended trusts can borrow money to invest in further investments, known as gearing, to take advantage of rising markets, and retract it when a correction is expected.

Despite a significant rally in indices like the S&P Biotechnology Select Industry Index (XBI), which tracks development-stage companies, market valuations still remain below their peak levels of 2021.

This presents a landscape ripe for rebound, particularly in the small and mid-cap segments where reduced valuations offer enticing opportunities. With $6bn of deals announced in the first three weeks of 2024, M&A activity shows encouraging signs of recovery, driven by big pharma acquiring undervalued biotech innovators to fill clinical pipelines ahead of looming patent expiries.

Supported by long-term growth prospects and current market dynamics, we may be entering an opportune phase for the biotech sector. The overall fundamentals of the sector remain robust, suggesting a favourable environment for sustained growth and investment potential this year.

Ailsa Craig and Marek Poszepczynski are co-managers of the International Biotechnology Trust. The views expressed above should not be taken as investment advice.