Ardevora Asset Management will cease activity after 14 year managing assets, co-founders Jeremy Lang and William Pattisson announced yesterday on Linkedin.

The firm will be “closing its doors to external investors and returning capital to all of its clients”, the announcement read.

Its largest funds, Ardevora Global Long Only Equity and Ardevora Long Only Equity SRI will be giving back £200m (down from £280m at the end of December 2023) and £270m to investors, respectively, while the remaining funds (Global Equity, Global Growth and UK Equity) only contain £64m, £28m and £12m.

The strategies have been managed by Lang and Pattisson themselves, two stock pickers whose process centred around cognitive psychology, errors and biases, applied to financial markets.

“Cognitive psychology tells us that company managers, despite being intelligent and well informed, are especially susceptible to over-confidence bias,” their investment philosophy statement reads.

“If the environment they face allows them to, they can take on too much risk and are likely to push a business harder than is sensible.”

The founding duo have a long history of working together, having begun their careers at James Capel Fund Managers in 1986, where they dealt with North American and UK equities, then at Liontrust, where they were jointly responsible for UK equity portfolios and all investment management operations.

They have been co-managing the Ardevora portfolios with Ben Fitchew, who also joined the company from Liontrust upon its foundation in 2010.

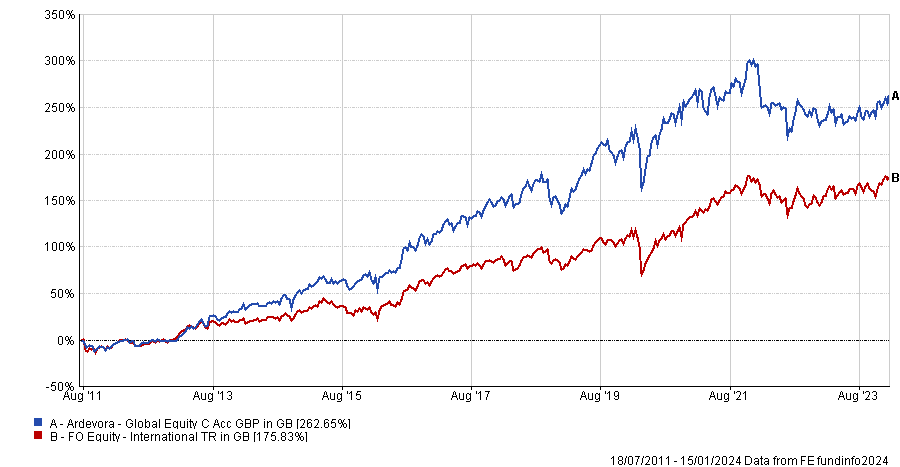

Since launch, Ardevora Global Equity has returned 262.6%, beating the FO International Equity peer group’s 175.8%.

Performance of fund vs sector since launch

Source: FE Analytics