The so-called ‘Magnificent Seven’ stocks have led the markets this year, boosted by the enthusiasm for artificial intelligence (AI). Yet, Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla are now trading on high valuations and there is no guarantee all of them will be able to continue their outperformance over the long term.

For instance, Dom Rizzo, manager of the T. Rowe Price Global Technology Equity fund warned that the hype around AI has led to a bubble, which reminds him of previous bubbles during times of great innovation, such as the Railway Mania in the 19th century or the Telecommunications Bubble in the 2000s.

Below, we have asked managers which of the Magnificent Seven are the best positioned to pass the test of time.

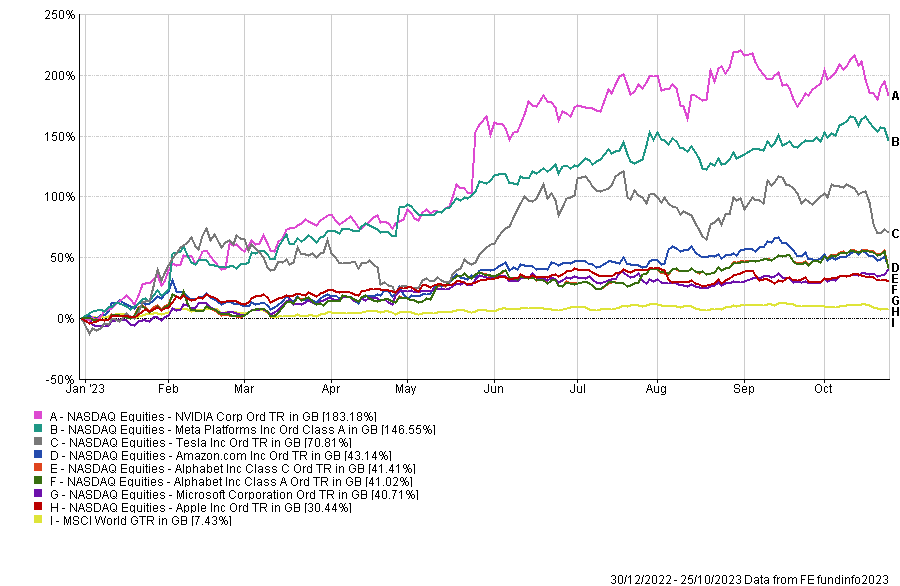

Performance of stocks vs index YTD

Source: FE Analytics

Microsoft

Abrie Pretorius, manager of Ninety One Global Quality Dividend Growth and Gerrit Smit, manager of the Stonehage Fleming Global Best Ideas Equity fund both favoured Microsoft, as it benefits from a combination of high and sustainable organic growth, high profitability and low business risk.

Smit said: “Microsoft earns a 28% return on the capital it invests and it generates a lot of cash – on which it earns income when interest rates are high – resulting in a strong balance sheet.”

It is also the only company among the seven to have a track record of evolving its business through multiple technology waves, showing its ability to adapt.

Pretorius added: “This process changed the pricing structure from a per PC basis to a per user and computer consumption. Microsoft now offers products and services focused on productivity for every organisation, every employee and across the entire IT stack.“

As a result, Microsoft has increased its target market from just being by specialist technology professionals to being used by a much broader range of people.

Smit also pointed at the diversity of business drivers over the different technologies of the “fourth industrial” digital revolution, such as cloud, security and AI technologies.

“We believe there is strong strategic merit to the recently completed Activision Blizzard transaction, possibly paving the way to also becoming a force in the metaverse,” he added.

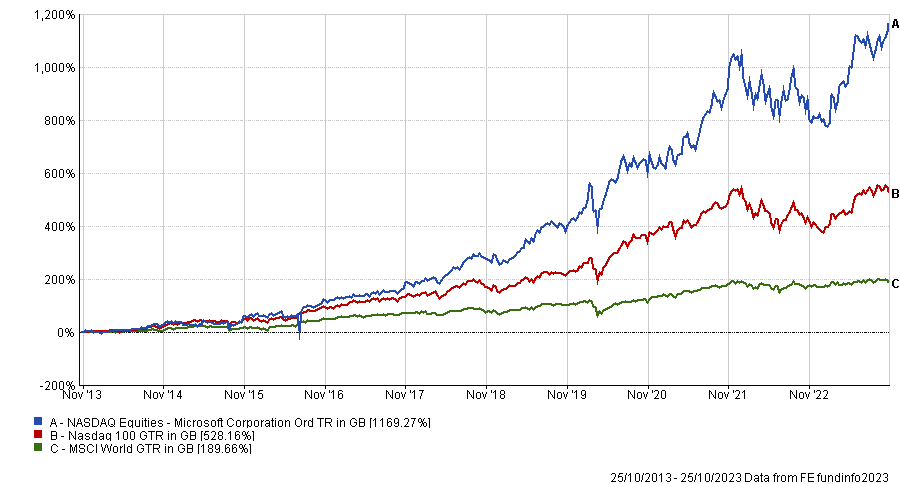

Performance of stock over 10yrs vs indices

Source: FE Analytics

Microsoft is also one of the three Magnificent Seven stocks, alongside Apple and Nvidia, to pay a dividend, but offers nearly double the yield of Apple.

Nvidia

Unlike Smit and Pretorius, T. Rowe Price’s Rizzo prefers Nvidia. To get a place in his tech portfolio, stocks have to possess four characteristics, including that they must be mission critical and innovating in secular growth markets.

He also puts an emphasis on his holding companies’ finances and requires them to have either incrementally accelerating earnings, expanding margins or improving free cash flow conversation. Finally, valuation needs to be reasonable.

Rizzo said: “Rarely do we get a company that scores well on all four metrics. Nvidia is one that actually does fit most of our requirements and would be our one pick of the stable.”

He explained that Nvidia’s graphics processing units are the “only viable options” for hyperscale generative AI applications, benefiting from a monopoly in this area with significant technological leadership in parallel processing.

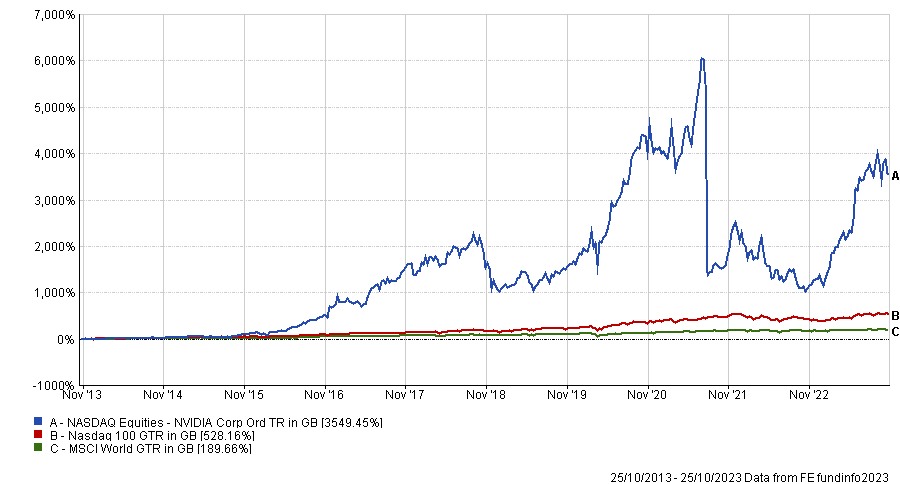

Performance of stock over 10yrs vs indices

Source: FE Analytics

Nvidia is also addressing a quickly growing market, with a shortage of chips and systems to address the demand. Earnings revisions year-to-date have also been positive.

Rizzo said: “Consensus estimates have increased from $6 per share to more than $16 per share for the full year to January 2025. Despite the impressive stock price performance year to date, the stock is actually cheaper today than it was at the start of the year.

“Why? Earnings improvements have outpaced the stock. The stock price has paused most recently, but we think we are still early in this journey and remain confident in the company’s technological leadership and growth potential.”