The majority of biotechnology companies could disappear through mergers and acquisitions (M&A) or bankruptcy over the coming years, according to International Biotechnology Trust manager Marek Poszepczynski.

Billions of fresh capital entered the sector in the Covid boom of 2020 that financed the rise of many companied that “shouldn’t really be there”.

There were 669 initial public offerings (IPOs) in the healthcare sector in 2020 and 2021 worth a total of $101.3bn (£83.2bn) but new launches have slowed significantly after biotechnology disappointed in the following years.

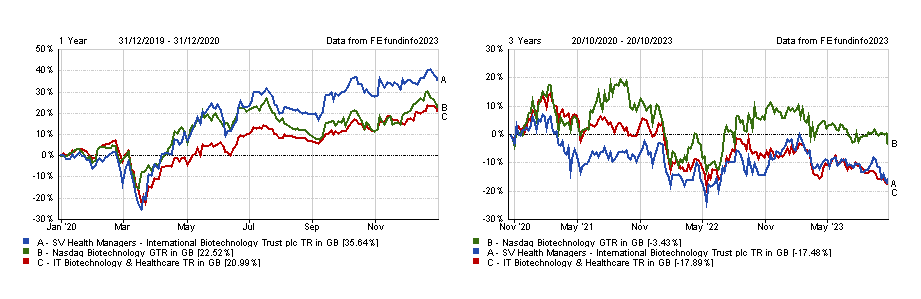

Indeed, the International Biotechnology Trust soared 35.6% in the roaring markets of 2020, but has dropped 17.5% over the past three years as the sector was rattled by rising interest rates. After failing to live up to the excitement of 2020, Poszepczynski said: “At this stage, it is very difficult I would say – it’s a tough market out there.”

Total return of trust vs benchmark and sector in 2020 and over the past three years

Source: FE Analytics

Part of his concern is that there are a number of companies all trying to do the same thing, which causes a lot of volatility in the market – if several companies are all competing to be the first to develop a new drug, only one can be the winner.

“It all goes back to duplication – they all go for the same targets and the same patient groups. They are crowding in certain areas, so you can't just win everything. Half of the companies, even the ones with successful trials, will not succeed in the market because they don't have any unique selling points,” he said.

As such, eventually businesses either get acquired, merge or go bankrupt – but it can be challenging to know which outcome it will be, particularly as many are now well-funded.

Marshall Gordon, senior research analyst for healthcare at ClearBridge Investments, voiced similar concerns earlier this year.

“There were a lot of companies that should not have gotten the funding that they did to run their clinical trials and you may see a trend towards an increasing number of trial failures,” he said.

“Because it was so easy to get funding, I think some projects that should not have been funded were, so clinical trials may be even weaker than historical averages for the next couple of years.”

Of the many new biotechnology companies that materialised during the pandemic, very few of them succeeded and many more that have not lived up to the high expectations set in 2020 could continue to vanish, according to Poszepczynski.

“We saw 150 new companies developing drugs but only one of them succeeded. That was a good test, because it showed we may have one that succeeds, but we never talked about all the ones that failed,” he said.

However, a less crowded sector would be much more beneficial for the surviving companies, Poszepczynski added, as they hoover up market share.

M&A could make amends for over-funding in 2020, but an improving monetary outlook could also act as a tailwind for the sector moving forward, according to Poszepczynski.

He explained that biotech companies are particularly vulnerable to interest rate hikes, which have hindered performance in recent years but could paint a better outlook now that central banks are reaching the end of their cycles.

The sector could undergo further deratings in the coming months as the macro environment continues to present a challenge, but biotechnology companies should return to growth once monetary policy begins to loosen.

Poszepczynski said: “This is what probably will happen if we have a massive recession because they are very interest rates sensitive, but that is also one of the reasons why they tend to perform relatively okay when there’s the outlook for recession and interest rates come down.”